ConocoPhillips (COP) Stock Falls 12.6% in 3 Months: Hold or Fold?

Over the past three months, ConocoPhillips COP has experienced a 12.6% fall, underperforming the industry’s 3.9% decline.

Recent investor concerns primarily stem from the premium ConocoPhillips is set to pay for acquiring Marathon Oil Corporation MRO and the expected increase in debt due to this transaction.

Image Source: Zacks Investment Research

MRO Deal Seems Expensive at First Glance: Cause for Concern?

On May 29, ConocoPhillips finalized an agreement to acquire Marathon Oil in an all-stock deal valued at $22.5 billion, which also incorporates $5.4 billion in net debt. According to the terms, Marathon shareholders will receive 0.2550 shares of ConocoPhillips for each of their shares, marking a 14.7% premium over Marathon Oil's previous day's closing price.

Despite investor concerns regarding the premium ConocoPhillips is offering and the accompanying debt it will incur, the company's long-term outlook appears promising, buoyed by its history of acquiring low-cost assets. ConocoPhillips has consistently emphasized its focus on targeting acquisitions that align with the long-term goal of creating stockholder wealth.

Notably, the recent agreement to acquire Marathon Oil, anticipated to close in the fourth quarter of this year, will broaden ConocoPhillips' key Lower 48 portfolio. This acquisition will enable COP to expand its presence in prolific, low-cost U.S. basins such as Eagle Ford, Bakken, Delaware and Permian, adding more than 2 billion barrels of resources. In addition to realizing cost synergies and generating shareholder value, ConocoPhillips, a leading upstream energy company, anticipates this transaction to be immediately accretive to its earnings and cash flows.

Ultimately, while the premium and debt might initially make the deal appear expensive, the strategic alignment, resource additions and anticipated accretive effects could justify the cost.

Robust Financial Health Offers a Safety Net

Similar to the Marathon Oil deal, previous acquisitions of Concho Resources and Shell plc's SHEL Permian assets have increased ConocoPhillips' debt. However, most analysts believe that COP will maintain a stronger balance sheet compared with industry peers, thanks to its substantial size and robust earnings.

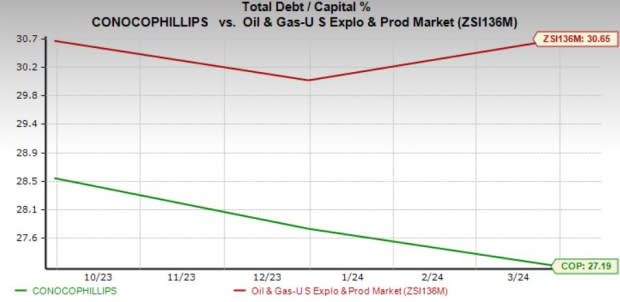

As evident in the snapshot, COP’s total debt-to-capitalization ratio of 27.2% is lower than 30.7% of the industry’s composite stocks. The company’s debt-to-capitalization ratio has consistently been lower than the composite stocks over the past few years. Thus, the robust financial position will aid the leading oil producer in combating periods of low crude prices.

Image Source: Zacks Investment Research

Time to Keep an Eye on the Stock

Despite recent positive developments, investors should factor in ConocoPhillips' heightened vulnerability to oil price volatility, given its exclusive focus on exploration and production activities. While a strong balance sheet can provide a buffer during downturns in the energy sector, the Zacks Rank #3 (Hold) company could face more pronounced challenges during a cyclical earnings downturn compared with diversified majors like Exxon Mobil Corporation XOM and Shell. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Unlike ConocoPhillips, Shell's operations encompass Integrated Gas, Marketing, Chemicals & Products, and Renewables & Energy Solutions, providing broader exposure across different businesses. ExxonMobil similarly benefits from diversified revenue streams, including Energy Products, Chemical Products and Specialty Products, in addition to upstream operations.

However, considering ConocoPhillips’ strong business model, extensive asset base, strong financial position and lucrative shareholder returns, the company’s long-term outlook seems rosy despite its vulnerability to commodity price volatility.

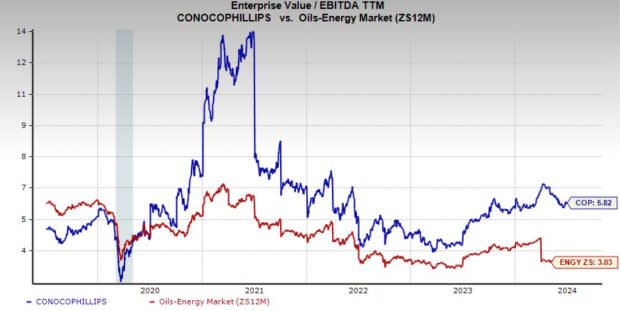

Nevertheless, investors may want to await a more favorable entry point. This is because, at this moment, shares are somewhat expensive on a relative basis, with the current 5.82X trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization staying above the 5.44X five-year median. Also, the company is trading at a premium to the broader Zacks Oil - Energy sector average of 3.03X.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report