The Complete Guide To MRTA, MLTA, MRTT, And MLTT In Malaysia

The words ‘MRTA’, ‘MLTA’, ‘MRTT’, and ‘MLTT’ might sound like rival K-pop groups, but they’re actually essential types of life insurance cover for your mortgage!

These products are designed to cover the financial burden of your home loan in the event of death and/or total permanent disability.

That means if something tragic happens to you, your loved ones have financial certainty at the moment they need it most.

These four covers all represent a financial safety net for your home loan. But what’s the difference between the four, and which one might be the best one for you?

FAQs About MRTA

1) What Is MRTA?

Mortgage Reducing Term Assurance (MRTA) is a type of home loan insurance where the sum insured is designed to reduce over the term of your home loan.

As you pay off your home loan, the value of your outstanding debt will fall. MRTA is designed so that the amount that would pay out, at the point of a claim, covers the total value of your outstanding home loan at that time.

It’s important to make sure that when you take out MRTA, you correctly include the terms and value of your home loan.

If the amount insured in MRTA is less than your home loan at the point of claim, there could be a gap between what you owe on the home loan, and what is paid out.

Equally, if you’re insured for more money than is owed on the home loan, only the amount owed will be paid out to the home loan provider, with no additional benefit.

2) Is MRTA Compulsory?

MRTA is not compulsory in Malaysia, but it can be mandatory in the terms and conditions of an individual home loan provider.

That means, while you don’t legally require this cover, the bank offering you a home loan may insist you take it out to cover the value of the loan.

3) How Much Does MRTA Cost?

The cost of MRTA depends on a number of factors such as your age, the value of your home loan, and the length of your home loan. The cover is paid for with a single lump sum at the beginning of the policy.

Insurance is all about assessing risk. The older you are, the riskier you are (sorry). The higher the value of your home loan, the higher the financial risk. You get the idea!

If you’re uncertain about whether a policy is good value, the best choice is to compare different quotes from different providers. If in doubt — speak to a financial professional.

4) Is MRTA refundable?

No. In the event of a payout, the money is paid to the bank. That means the MRTA will cover the total value of the home loan, with no financial refund or benefit to any third party.

It’s a cover designed to pay for a home loan, and that’s exactly what it’ll do!

FAQs About MLTA

1) What is MLTA?

Mortgage Level Term Assurance (MLTA) is a type of home loan insurance where the sum insured remains level throughout the term of the plan. That means it will pay out the same amount in year 10 as it would in year 25.

MLTA provides a defined benefit amount during the entire period of the policy. Unlike MRTA, any additional amount is paid to the beneficiary.

Take the scenario where your MLTA cover is for RM500,000, and the outstanding amount on your home loan is RM300,000.

A successful claim would pay RM300,000 to the bank to cover the outstanding home loan, with RM200,000 paid out to the beneficiary of the policy.

2) Is MLTA Compulsory?

MLTA is not compulsory in Malaysia, but home loan providers could make it a condition of receiving a home loan.

That means while it’s not legally compulsory, you might struggle to find a home loan that doesn’t insist you have some form of life insurance cover for your home loan.

3) How much does MLTA cost?

Like MRTA, MLTA is assessed based on factors such as your age, the value of the insured amount, and the term of your policy. Insurance premium payments for MLTA are made in instalments throughout the term of a policy.

Since the amount insured in MLTA doesn’t decrease over time, the financial risk to the provider is far greater than a reducing term cover like MRTA.

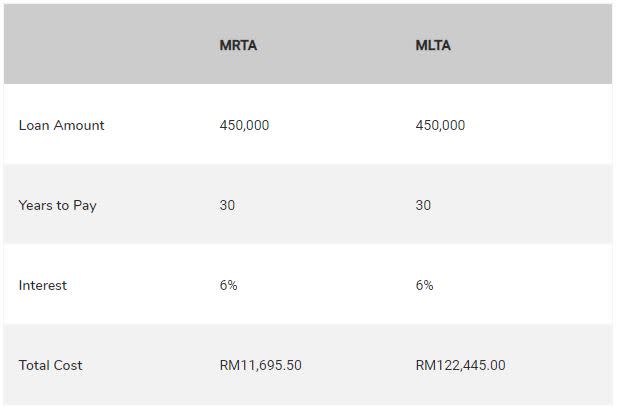

That means MLTA premiums (for a similar insured amount) are likely to be significantly higher, compared to the MRTA. Let’s take one simple example comparing the cost of MRTA vs MLTA:

Age – 28

Home loan value – RM450,000

Interest – 6%

Insurance term – 30 years

As you can see in the table above, that’s a big difference between the cost of these covers!

4) Is MLTA refundable?

Any additional insured amount, above the value of the home loan, is paid to the beneficiary at the point of claim.

That means if your outstanding home loan is RM300,000, and your insured amount under MLTA is RM500,000, your beneficiary will receive RM200,000, while the RM300,000 directly goes to the bank to cover the home loan.

That’s an extra level of financial support and certainty in the event that the insured individuals die, or suffer total permanent disability.

FAQs About MRTT

1) What is MRTT?

Mortgage Reduction Term Takaful (MRTT) is a reducing term life insurance product that follows the takaful principles of Islamic finance.

It’s basically an insurance plan to cover the cost of a home loan, in the event of death or total permanent disability.

Like MRTA covers, the sum assured for an MRTT is designed to reduce as the total value of your outstanding home loan also reduces.

As you pay your home loan, the amount owed falls, and an appropriately arranged MRTT is designed to fall, in line with that figure.

It’s important to make sure the term and sum assured are set up properly at the start of this insurance.

That way, you can be confident that the outstanding loan and sum assured match during the term of the policy.

2) Is MRTT compulsory?

MRTT, like other similar covers, is not mandatory. Some home loans will require you to have a life insurance product in order to cover the total amount of a loan, however.

3) How much does MRTT cost?

There’s no guaranteed set cost for MRTT insurance. The cost of the policy will be based on risk, which is increased by things such as a larger amount covered, longer term on the cover, and the age of the person taking out the cover.

You should speak to a financial professional if you’re not sure which is the right cover for you. Now, MRTT will be cheaper than a similar level term policy.

This is because while the amount paid out at the point of claim for MRTT is reducing through the period of the home loan, the value assured remains the same for level covers.

The payment for an MRTT cover is made in one lump sum at the beginning of the cover.

4) Is MRTT Refundable?

Payment of a successful claim on an MRTT policy is made directly to the bank that financed the home loan. No additional money is paid out to individual beneficiaries.

That means if the outstanding value of your home loan is RM100,000, and your MRTT sum assured is RM110,000 at the point a claim is paid, only RM100,000 will be released.

This sum of money will go directly to the bank. You’ve essentially paid for higher cover that you don’t need!

FAQs About MLTT

1) What Is MLTT?

Mortgage Level Term Takaful (MLTT) is a life insurance cover designed to provide financial support in the event of death or total permanent disability.

The total sum assured in this cover remains level throughout the period of the cover. MLTT is an Islamic finance product that provides certainty as to how much will pay out throughout the course of the plan.

It sets out a guaranteed payment value, which means the sum assured that would pay out on a claim is the same in the first year as it is in the last year of the cover.

2) Is MLTT compulsory?

No, MLTT is not compulsory. However, some banks or financial institutions may require you to have life insurance to cover the home loan in the event of death or total permanent disability.

3) How much does MLTT cost?

In terms of MRTT vs MLTT, a level term assurance is likely to be more expensive than one where the amount paid out reduces over time.

This is because the financial risk for banks is far greater on a cover that will pay out the same amount at any time of the policy, as compared to one where the total sum assured reduces over time.

The cost of MLTT is based on factors such as your age, the length of the cover, and the total amount covered.

The older you are, the longer the term of the cover, or the higher the value insured, the higher the costs will be.

4) Is MLTT Refundable?

MLTT takaful insurance pays out any additional sum assured directly to the policy owner or beneficiaries in the event of a claim.

If your home loan is RM200,000, but your insurance is for RM300,000, RM200,000 would be paid to the bank to cover the home loan, with an additional RM100,000 paid out to the beneficiary.

If we’re comparing MLTT vs MRTT, the level cover would pay out additional funds to the individual, whereas the reducing term takaful pays out only up to the total value of the outstanding home loan directly to the bank.

Now that we’ve fleshed out the crucial details of each of the four policies, let’s talk a little bit about the in-demand comparison between MRTT vs MRTA.

[PropertyTip]Compare MLTT vs MRTT in our comprehensive guide — What’s The Difference Between MRTT And MLTT Insurance.[/PropertyTip]

MRTT vs MRTA/MLTT vs MLTA

Like MRTT and MLTT, both MRTT and MRTA exist to help you cover the home loan payment you owe to your providing bank in times of extreme life difficulties.

They both offer mortgage coverage sums that decrease over time as you pay off your loan to your bank. So what’s the real difference between MRTT and MRTA?

The simplest way to think about it is: MRTT is simply a Takaful version of MRTA, covering a reducing sum on a home loan through the course of the plan.

The only difference between the two is that MRTT works on Islamic finance principles (which avoid ‘riba’ or interest-based transactions).

A side-note: the same ‘Islamic vs non-Islamic’ dynamic is true of MLTT vs MLTA. MLTT is simply a Takaful (Islamic) version of the same type of level term cover that MLTA provides.

What Are The Differences Between MRTA, MLTA, MRTT, And MLTT?

| MRTA | MLTA | MRTT | MLTT |

Covers | Death and Total Permanent Disability. | Death and Total Permanent Disability. | Death and Total Permanent Disability. | Death and Total Permanent Disability. |

Sum Covered | Reducing during term of plan. | Level during term of plan. | Reducing during term of plan. | Level during term of plan. |

Policy Payments | One-off lump sum payment at start of plan. | Monthly payments throughout course of plan. | One-off lump sum payment at start of plan. | Monthly payments throughout course of plan. |

Pays To | Bank or financial institution holding the home loan. | Bank up to the value of outstanding home loan. + Additional funds to beneficiaries. | Bank or financial institution holding the home loan. | Bank up to the value of outstanding home loan. + Additional funds to beneficiaries. |

Cost | Single lump sum, can be covered in home loan. Reflects decreasing value of payout. | Relatively higher long-term cost as covering a fixed sum assured, covered by payer in installments. | Single lump sum, can be covered in home loan. Reflects decreasing value of payout. | Relatively higher long-term cost as covering a fixed sum assured, covered by payer in installments. |

Islamic Finance Principles | No | No | Yes | Yes |

Which Mortgage Life Insurance Is Best For You?

Every individual’s circumstances are unique, which means there’s no clear ‘best mortgage life insurance’ for everyone.

Finding the right cover for you is about assessing the different covers highlighted above, and identifying which policy will best meet the needs of your loved ones in the event that the worst happens.

This cover can be a valuable financial safety net in difficult times, so it’s worth considering even if it’s not a mandatory requirement of your home loan offer.

It’s better to plan for the worst and hope for the best than going the other way around. If you’re not sure which cover is for you, then speak to a financial expert.

Looking to ensure you’ve got all the right information? Check out our guide on The Complete Introduction To House Insurance.