Community Health (CYH) & Cost Plus Drugs Expand Collaboration

Community Health Systems, Inc. CYH recently announced an expansion of its partnership with Mark Cuban Cost Plus Drugs Company (Cost Plus Drugs). Under this extended partnership, CYH will source more medications at lower costs for use at its affiliated hospitals.

This move bodes well for CYH as it will be able to source medications from Cost Plus Drugs Marketplace, which provides hundreds of medications at deep discounts. This is a time-opportune move for Community Health as all the companies in the Medical space are grappling with the high cost of drugs amid inflation.

The Cost Plus Drugs Marketplace aims to provide transparent pricing and make drugs cheaper. Hence, it charges only a 15% markup on the actual cost of drugs. CYH is expected to save hundreds or thousands of dollars while purchasing drugs at this lower cost.

CYH is expected to start by purchasing 12 drugs like antibiotics, pharmaceuticals for the treatment of acid reflux, hyponatremia, and glaucoma, and medicines to prevent nausea for patients in chemotherapy. Moreover, under this partnership Cost Plus Drugs might source medicines directly from its manufacturers depending on the needs of CYH. CYH is also expected to benefit from lesser pharmaceutical waste and better safety in medication administration.

In March 2024, CYH announced a partnership with Cost Plus Drugs in a bid to reduce potential drug shortages. CYH became the first national healthcare system to buy select drugs from Cost Plus Drugs. Such partnerships in the healthcare segment are expected to benefit hospitals and patients alike.

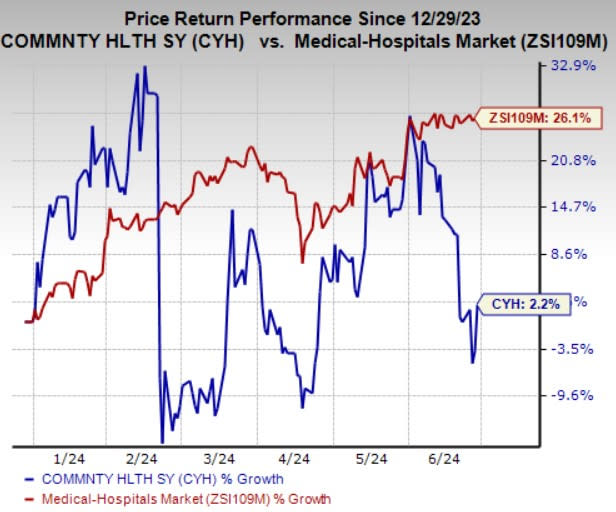

Shares of Community Health have gained 2.2% in the year-to-date period compared with the industry’s 26.1% growth. CYH currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the Medical space are Tenet Healthcare Corporation THC, Medpace Holdings, Inc. MEDP, and Universal Health Services, Inc. UHS. While Tenet Healthcare sports a Zacks Rank #1 (Strong Buy), Medpace Holdings and Universal Health carry a Zacks Rank #2 (Buy) at present.You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenet Healthcare’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 56.5%. The Zacks Consensus Estimate for THC’s 2024 earnings suggests an improvement of 22.5% from the year-ago reported figure.

The consensus estimate for THC’s 2024 earnings has moved 4.5% north in the past 30 days.

Medpace’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.8%. The Zacks Consensus Estimate for MEDP’s 2024 earnings and revenues suggests an improvement of 27.1% and 14.9% from the respective year-ago reported figures.

The consensus estimate for Medpace’s 2024 earnings has moved 0.5% north in the past 60 days.

Universal Health’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 8.1%. The consensus estimate for UHS’s 2024 earnings and revenues suggests an improvement of 30.6% and 8.5% from the respective year-ago reported figures.

The consensus estimate for Universal Health’s 2024 earnings has moved 0.9% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS): Free Stock Analysis Report

Tenet Healthcare Corporation (THC): Free Stock Analysis Report

Community Health Systems, Inc. (CYH): Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP): Free Stock Analysis Report