Colgate (CL) Q3 Earnings in Line, Higher Costs Hurt Outlook

Colgate-Palmolive Company CL has reported third-quarter 2022 results, wherein earnings meet the Zacks Consensus Estimate, while sales lagged the same. Sales and earnings also missed our estimate in the third quarter. The top line increased year over year, while earnings per share declined.

The company has witnessed year-over-year increases in raw and packaging material, and logistics costs, as well as volatile currency. In the quarter, the company witnessed a stabilization in raw material inflation, resulting in 20 bps of sequential growth in the gross margin. Logistics declined sequentially as a percentage of sales but were up on a year-over-year basis. Bold pricing actions and accelerated revenue growth management plans also acted as upsides. Revenue growth management initiatives have led to double-digit pricing gains worldwide.

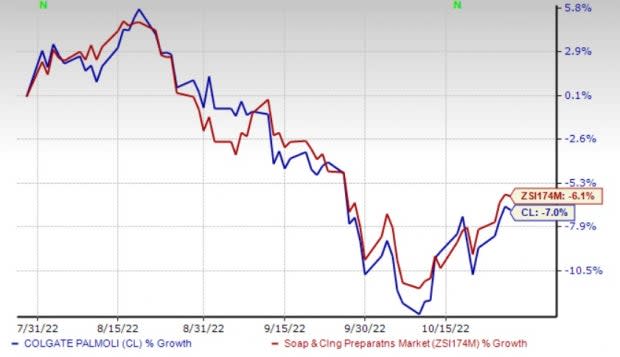

Shares of the Zacks Rank #4 (Sell) company have lost 7% in the past three months compared with the industry’s decline of 6.1%.

Image Source: Zacks Investment Research

Quarter in Detail

On a Base Business basis (adjusted non-GAAP), earnings of 74 cents per share declined 9% from the prior-year quarter. Earnings per share were in line with the Zacks Consensus Estimate but missed our estimate of 75 cents. On a GAAP basis, earnings declined 1% to 74 cents per share. The bottom line was impacted by higher raw material and logistics costs worldwide despite sales growth.

Net sales of $4,455 million increased 1% from the year-ago quarter but missed the Zacks Consensus Estimate of $4,498 million and our estimate of $4,523.4 million. On an organic basis, the company’s sales advanced 7%, with improvements in all divisions and categories. This marked the 15th successive quarter of organic sales growth at or above its long-term target of 3-5% growth. Also, innovation, brand strength and digital capabilities drove organic sales growth, with double-digit organic sales growth in oral care and pet nutrition.

Total volumes declined 4.5% on both reported and organic basis, and pricing was up 11.5%. The unfavorable currency impact in the quarter was 6%.

The gross profit of $2,548 million declined 2.9% year over year. The gross profit margin contracted 220 basis points (bps) to 57.2%, both on a GAAP and an adjusted basis.

Selling, general & administrative (SG&A) expenses dipped 0.1% year over year to $1,634 million. As a percentage of sales, SG&A expenses declined 40 bps year over year to 36.7%.

Colgate’s global market share in the manual toothbrushes category has reached 31.6% year to date. The company has continued with its leadership position in the global toothpaste market, with a market share of 39.7% year to date.

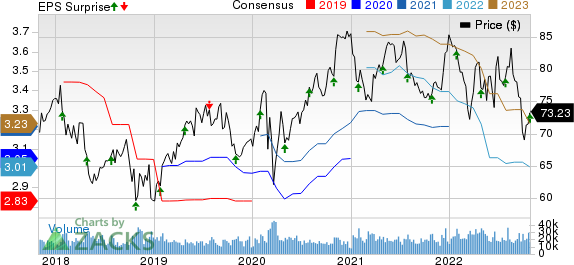

ColgatePalmolive Company Price, Consensus and EPS Surprise

ColgatePalmolive Company price-consensus-eps-surprise-chart | ColgatePalmolive Company Quote

Segmental Discussion

North America’s net sales (22% of total sales) rose 3% year over year. The segment gained from a 9% increase in pricing, offset by a 5.5% decline in volume and 0.5% currency headwinds. Organic sales grew 3.5%, driven by gains in oral care, personal care and home care. Year to date, the company’s share in the toothpaste market is 34.6% and in the manual toothbrush market is 42.3% in the United States.

Latin America’s net sales (22% of total sales) advanced 7% year over year on 20% pricing gains. Sales growth was partly offset by an 8.5% decline in volume and a 4.5% negative currency impact. On an organic basis, sales were up 11.5%, led by growth in Brazil, Mexico, Argentina and Colombia.

Europe’s net sales (14% of the total sales) declined 12% year over year on a reported basis. The segment was affected by a 2.5% decrease in volume and a 14.5% negative currency impact, offset by a 5% pricing gain. Organic sales were up 2.5%, whereas volumes were down 2.5%. Organic sales were driven by growth in the U.K., Poland and France, partially offset by a decline in the Filorga business.

The Asia Pacific segment’s net sales (16% of the total sales) dipped 3% year over year, owing to a 1% fall in volumes and an 8% impact of adverse currency, somewhat offset by a 6% increase in pricing. Volumes also declined 1% on an organic basis. Organic sales improved 5%, driven by gains in the Greater China region, Australia and the Philippines.

Africa/Eurasia’s net sales (6% of the total sales) improved 11% year over year, owing to 26.5% growth in pricing, offset by a 9% unfavorable currency impact and a 6.5% decline in volume. Organic sales for the segment grew 20%, driven by growth in Turkiye and South Africa.

Hill’s Pet Nutrition’s net sales (20% of the total sales) improved 3% from the year-ago quarter on a reported basis and 7.5% on an organic basis. Results have gained from an 11% increase in pricing, offset by a 3.5% pricing decline and a 4.5% adverse currency impact. Organic sales were aided by gains in the United States and Europe.

Other Financial Details

Colgate ended third-quarter 2022 with cash and cash equivalents of $938 million, and total debt of $8,248 million. Net cash provided by operating activities was $1,883 million as of Sep 30, 2022.

Outlook

Management has raised its organic sales guidance for 2022. It anticipates net sales growth at the middle of the previously mentioned 1-4% rise. This includes a 5% unfavorable currency impact and a modest benefit from the Red Collar acquisition. Organic sales are expected to increase 6-7% compared with 5-7% growth mentioned earlier.

Colgate expects a gross margin decline on both GAAP and adjusted basis for 2022. Advertising investments are expected to be nearly flat year over year on a dollar basis, on both GAAP and adjusted basis, in 2022. Advertising is expected to be down slightly as a percentage of net sales in 2022, driven by reductions in Europe.

Although the company expects to witness a reduced impact of headwinds from logistics, it expects logistic costs to increase year over year in the fourth quarter.

The company expects a tax rate of 23.5-24% for 2022 on a GAAP and adjusted basis.

It anticipates earnings growth in double-digits on a GAAP basis. On an adjusted basis, earnings are projected to decline 7-8%, including the incremental currency impacts due to the move in exchange rates since the second quarter.

For the fourth quarter, the company anticipates the production of pet food for Red Collar to add 200 bps to net sales, have a 100-bps negative impact on the gross margin and be neutral to earnings per share.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely e.l.f. Beauty ELF, Constellation Brands STZ and General Mills GIS.

e.l.f. Beauty currently flaunts a Zacks Rank of 1 (Strong Buy). ELF has a trailing four-quarter earnings surprise of 77%, on average. The company has rallied 28.1% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ELF’s current financial-year sales and earnings suggests growth of 17.6% and 8.3%, respectively, from the prior-year reported numbers. The consensus mark for ELF’s earnings per share has moved up by a penny in the past seven days.

Constellation Brands currently has a Zacks Rank #2 (Buy) and an expected long-term earnings growth rate of 11.1%. STZ has a trailing four-quarter earnings surprise of 10.5%, on average. The company has declined 3.2% in the past three months.

The Zacks Consensus Estimate for Constellation Brands’ current financial-year sales and earnings per share suggests growth of 8.2% and 8.7%, respectively, from the year-ago reported numbers. The consensus mark for STZ’s earnings per share has moved up 14.9% in the past 30 days.

General Mills currently carries a Zacks Rank #2. GIS has a trailing four-quarter earnings surprise of 6.1%, on average. The company has risen 6.8% in the past three months. GIS has an expected long-term earnings growth rate of 7.5%.

The Zacks Consensus Estimate for General Mills’ current financial year’s sales and earnings per share suggests growth of 2.6% and 3.6%, respectively, from the year-ago reported numbers. The consensus mark for GIS’ earnings per share has moved up by a penny in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

ColgatePalmolive Company (CL) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research