Cognizant (CTSH) Expands Clientele With Cengage Partnership

Cognizant Technology Solutions CTSH recently announced the expansion of its partnership with Cengage Group, a prominent global edtech company catering to students from middle school through graduate studies and skills education.

The seven-year agreement enhances Cognizant’s role in delivering advanced technology services, aimed at improving operational efficiency and supporting Cengage Group’s ongoing digital transformation efforts.

Building on the successful collaboration in developing Cengage Unlimited, an all-access digital subscription service for higher education course materials, Cognizant will extend its support to include operational services for global functions like Finance and Human Resources.

The partnership also leverages CTSH’s expertise in education and advanced technologies, including genAI, to drive operational excellence and innovation in educational solutions, aligning with Cengage’s mission to empower learners and educators worldwide.

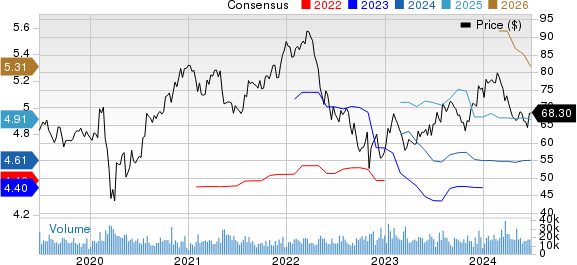

Cognizant Technology Solutions Corporation Price and Consensus

Cognizant Technology Solutions Corporation price-consensus-chart | Cognizant Technology Solutions Corporation Quote

Cognizant’s Prospects Driven by Strong Partner Base

Cognizant is benefiting from an expanding clientele and strong partner base with a robust pipeline, which includes a favorable mix of business renewals and expansions of new opportunities.

CTSH’s continued improvement of large deal momentum, evidenced by winning several deals exceeding $100 million each in first-quarter 2024.

The company’s robust partner base, which includes the likes of Gentherm THRM, Alphabet’s GOOGL cloud business, Google Cloud and Microsoft MSFT, is a critical catalyst.

Cognizant recently collaborated with Gentherm to provide engineering services, including systems engineering, validation, and model-based development, aiming to enhance agility and scalability in product development through cloud-native technologies and virtualization.

Cognizant’s partnership with Google Cloud and Microsoft bolstered its presence within the healthcare sector.

Cognizant, in collaboration with Alphabet’s Google Cloud’s genAI technology, launched healthcare LLM solutions aiming to redesign administrative processes and improve healthcare experiences.

CTSH also partnered with Microsoft to incorporate gen AI into healthcare administration through TriZetto Assistant on Facets, leveraging Azure Open AI Services and Semantic Kernel to boost productivity, efficiency and patient care while maintaining regulatory compliance and data security.

CTSH Q2 Performance Not So Rosy

Despite an expanding clientele and strong partner base, a challenging macroeconomic environment, along with weakness in the Financial Services segment, is a concern for CTSH’s prospects.

In first-quarter 2024, Financial Services revenues declined 6.2% year over year to $1.38 billion.

Cognizant’s shares have declined 9.6% against the Zacks Computer & Technology sector’s growth of 24.6% year to date.

This Zacks Rank #3 (Hold) company expects second-quarter 2024 revenues to be between $4.75 billion and $4.82 billion, indicating a decline of 2.9% to 1.4% (a decline of 2.5-1% at constant currency). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the second quarter is pegged at $4.81 billion, indicating a decline of 1.63% from year-ago levels.

The consensus mark for earnings is pegged at $1.12 per share, unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

Gentherm Inc (THRM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report