Clarus (CLAR) Beats on Q1 Earnings & Revenues, Hikes '21 View

Clarus Corporation CLAR reported robust first-quarter fiscal 2021 results, wherein both earnings and revenues beat the Zacks Consensus Estimate. Both the metrics also surpassed the consensus mark for the third straight quarter.

Clarus president John Walbrecht said “We had another quarter of double-digit revenue growth driven by continued robust demand across all of our brands and product categories.”

The company reported adjusted earnings of 31 cents per share, which beat the Zacks Consensus Estimate of 24 cents by 29.2%. In the prior year, the company had reported adjusted earnings per share of 9 cents.

Revenues of $75.3 million surpassed the consensus mark of $70 million by 7.1%. Moreover, the top line improved 40.7% year over year. This uptick can be attributed to strong sales performance from Black Diamond and Sierra. Revenues gain in the quarter also includes revenue contribution of nearly $8.5 million from Barnes acquisition, which was completed on Oct 2, 2020.

Black Diamond sales rose 13% in first quarter, while Sierra sales soared 203% (94% excluding Barnes). The company benefited from increase in consumer demand and the recovery from the coronavirus pandemic.

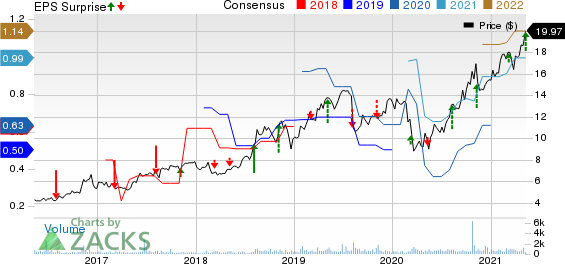

Clarus Corporation Price, Consensus and EPS Surprise

Clarus Corporation price-consensus-eps-surprise-chart | Clarus Corporation Quote

Operating Highlights

In the reported quarter, gross margin was 35.9%, up 130 basis points (bps) from the prior-year quarter’s levels. Adjusted EBITDA amounted to $10.6 million compared with $3.6 million in the prior-year quarter.

Balance Sheet

As of Mar 31, 2021, cash and cash equivalents amounted to $6.5 million compared with $17.8 million as of Dec 31, 2020. Inventory increased to $70 million from $68.4 million at 2020 end. Long-term debt as of Mar 31 amounted to $23.7 million, up from $30.6 million at the end of 2020.

2021 Outlook

The company raised its 2021 outlook. Clarus now expects fiscal 2021 sales to rise approximately 32% to $295 million from 2020 levels and also up from the prior estimate of $280 million. The company anticipates sales for Black Diamond to increase 20% to $205 million, compared with the prior estimate of $200 million. The company projects Sierra and Barnes combined sales to increase 71% to $90 million compared with 2020, up from the prior estimate of $80 million.

Adjusted EBITDA for 2021 is likely to increase approximately 70% to $38 million, compared with the prior estimate of $35 million.

Zacks Rank & Key Picks

Clarus currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks worth considering in the same space include Academy Sports and Outdoors, Inc. ASO, American Outdoor Brands, Inc. AOUT and Smith & Wesson Brands, Inc. SWBI. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Academy Sports and Outdoors has reported better-than-expected earnings in the trailing two quarters.

American Outdoor Brands has reported better-than-expected earnings in the trailing three quarters.

Smith & Wesson Brands earnings for fiscal 2021 are anticipated to grow 392.7%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clarus Corporation (CLAR) : Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO) : Free Stock Analysis Report

American Outdoor Brands, Inc. (AOUT) : Free Stock Analysis Report

Smith & Wesson Brands, Inc. (SWBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research