Cheesecake Factory (CAKE) Q3 Earnings Lag Estimates, Fall Y/Y

The Cheesecake Factory Incorporated CAKE reported third-quarter fiscal 2022 results, with earnings and revenues missing the Zacks Consensus Estimate. The top line rose year over year, while the bottom line declined from the prior-year quarter's figure. Following the announcement, shares of the company declined 7.4% during the after-hours trading session on Nov 1.

David Overton, chairman and CEO of Cheesecake Factory, stated, “While our operational performance has been solid and core cost inputs have become more stable and predictable, we continue to face a dynamic and challenging inflationary environment in some areas. As a result, our profit margins in the quarter reflected higher than anticipated operating expenses particularly in utilities and building maintenance.”

Earnings & Revenue Discussion

In the quarter under review, the company reported an adjusted loss per share of 3 cents missing the Zacks Consensus Estimate of earnings of 28 cents. In the prior-year quarter, the company reported adjusted earnings per share (EPS) of 65 cents.

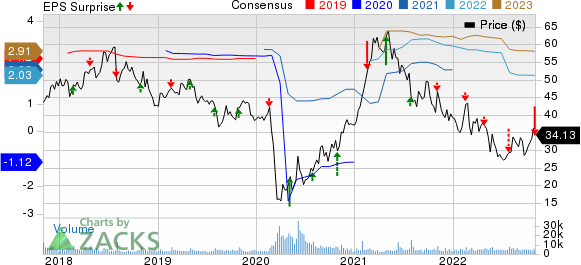

The Cheesecake Factory Incorporated Price, Consensus and EPS Surprise

The Cheesecake Factory Incorporated price-consensus-eps-surprise-chart | The Cheesecake Factory Incorporated Quote

During the fiscal third quarter, total revenues of $784 million missed the Zacks Consensus Estimate of $799 million by 1.9%. The top line increased 3.9% on a year-over-year basis.

During the reported quarter, comps at Cheesecake Factory restaurants increased 1.1% year over year compared with a 41.1% increase reported in the prior-year quarter. Also, comps had increased 9.5% from 2019 levels. From the start of the fiscal third quarter to Oct 25, 2022, comps at Cheesecake Factory (across all operating models) increased approximately 2.8% year over year and 14% from fiscal 2019 levels.

Costs in Detail

Cost of sales, as a percentage of revenues, increased 270 basis points (bps) year over year to 25.2% in the fiscal third quarter. Labor expenses, as a percentage of total revenues, amounted to 37.4%, up 30 bps from the year-ago quarter’s levels. Other operating costs (as a percentage of total revenues) came in at 27.7%, up 100 bps from the prior-year quarter’s levels.

General and administrative (G&A) expenses accounted for 6.4% of revenues compared with 6.1% in the prior-year quarter. In the fiscal third quarter, pre-opening expenses accounted for 0.6% of revenues, up 20 bps year over year.

Balance Sheet

As of Sep 27, 2022, Cheesecake Factory’s cash and cash equivalents totaled $133.2 million compared with $194.9 million reported in the previous quarter. During the fiscal third quarter, long-term debt (net of issuance costs) came in at $467.5 million compared with $467 million as of Jun 28, 2022.

The company declared a quarterly cash dividend of 27 cents per share. The dividend will be payable Nov 28, 2022, to its shareholders of record as of Nov 15, 2022.

Store Developments

During the fiscal third quarter, the company opened The Cheesecake Factory in Katy, TX, a North Italia in Dunwoody, GA, and a Fly Bye in Phoenix, AZ.

In fiscal 2022, the company anticipates opening as many as 13 new restaurants comprising three Cheesecake Factory restaurants, four North Italia restaurants and six FRC restaurants (including three Flower Child locations). Subsequent to the end of fiscal third quarter, the company intends to open The Cheesecake Factory Opry Mills in Nashville, TN, a North Italia in The Woodlands, TX, and a Flower Child in Austin, TX. Internationally, it intends to open one Cheesecake Factory restaurant under a licensing agreement.

Zacks Rank & Key Picks

Cheesecake Factory currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Retail – Restaurants industry are Potbelly Corporation PBPB, Wingstop Inc. WING and Chipotle Mexican Grill, Inc. CMG.

Potbelly sports a Zacks Rank #1. PBPB has a trailing four-quarter earnings surprise of 22.2%, on average. Shares of PBPB have declined 16.6% in the past year.

The Zacks Consensus Estimate for Potbelly’s 2022 sales and EPS suggests growth of 17.9% and 101.9%, respectively, from the corresponding year-ago period’s levels.

Wingstop sports a Zacks Rank #1. WING has a long-term earnings growth rate of 11%. Shares of WING have declined 8% in the past year.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.1% and 17.1%, respectively, from the comparable year-ago period’s levels.

Chipotle currently carries a Zacks Rank #2 (Buy). CMG has a trailing four-quarter earnings surprise of 4.1%, on average. The stock has declined 17.9% in the past year.

The Zacks Consensus Estimate for Chipotle’s 2022 sales and EPS suggests growth of 15.2% and 30.7%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research