Celanese's (CE) Earnings and Sales Surpass Estimates in Q3

Celanese Corporation CE logged earnings from continuing operations of $1.76 per share in third-quarter 2020, down from $2.17 in the year-ago quarter.

Barring one-time items, adjusted earnings were $1.95 per share, down from $2.53 in the year-ago quarter. However, the figure surpassed the Zacks Consensus Estimate of $1.70.

Revenues of $1,411 million fell 11% year over year, but beat the Zacks Consensus Estimate of $1,362.2 million.

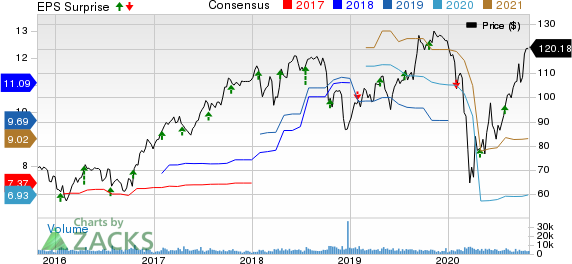

Celanese Corporation Price, Consensus and EPS Surprise

Celanese Corporation price-consensus-eps-surprise-chart | Celanese Corporation Quote

Segment Review

Net sales in the Engineered Materials unit were $526 million in the quarter, down 11% year over year. The segment witnessed sequentially higher volumes on the back of strong demand recovery for durable goods across all regions.

The Acetyl Chain segment posted net sales of $776 million, down 10.5% year over year. Per the company, pricing for VAM and acetic acid remained depressed in the quarter as the benefits of demand recovery on industry utilization was largely offset by considerably improved industry supply.

Net sales in the Acetate Tow segment were $129 million, down 18.4% year over year.

Financials

Celanese ended the quarter with cash and cash equivalents of $615 million, up 23.7% year over year. Long-term debt fell 6.5% year over year to $3,140 million.

Celanese generated operating cash flow of $431 million and free cash flow of $351 million in the quarter. Capital expenditures amounted to $72 million in the quarter.

Outlook

Celanese stated that the global demand during the third quarter progressed toward recovery across most of its end markets. The company is assessing the impact of the resurgence of COVID-19 across various regions on its businesses. It expects the momentum witnessed in the third quarter to continue in the fourth quarter, which is expected to partly offset various headwinds including a major turnaround at its Frankfurt POM facility and normal seasonality in December.

For 2020, the company expects adjusted earnings of around $7-$7.10 per share. Celanese is focused on controllable actions to drive strong growth next year amid uncertainties. This includes production planning, productivity and disciplined capital deployment.

Price Performance

Celanese’s shares have lost 1.2% in the past year compared with the industry’s 0.6% decline.

Zacks Rank & Key Picks

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Agnico Eagle Mines Limited AEM, Equinox Gold Corp. EQX and Barrick Gold Corporation GOLD. While Agnico Eagle sports a Zacks Rank #1 (Strong Buy), Barrick and Equinox carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle has an expected earnings growth rate of 107.2% for 2020. Its shares have returned 35.4% in the past year.

Barrick has an expected earnings growth rate of 100% for 2020. The company’s shares have gained 60.9% in the past year.

Equinox has an expected earnings growth rate of 155.2% for 2020. The company’s shares have surged 92.3% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research