Cadence (CDNS) Expands Portfolio Through Invecas Acquisition

Cadence Design Systems CDNS recently acquired California-based embedded software and system-level solutions provider Invecas, Inc. Financial terms of the deal were not disclosed. Moreover, the company does not expect the acquisition to materially contribute to total revenues and earnings this year.

Cadence highlighted that generational trends reinforced by AI advancements are driving a strong design activity. With the slowing down of Moore’s Law there has been rapid development of technologies like advanced 2.5D/3D packaging and chiplets, leading the way for achieving higher performance and manufacturing efficiencies

This is driving customer demand for a comprehensive engineering expertise in enabling their custom silicon and system development endeavors.

Invecas buyout adds a skilled engineering team (based in Hyderabad, India) which will aid Cadence in offering its customers with custom solutions across chip design, advanced packaging, product engineering and embedded software.

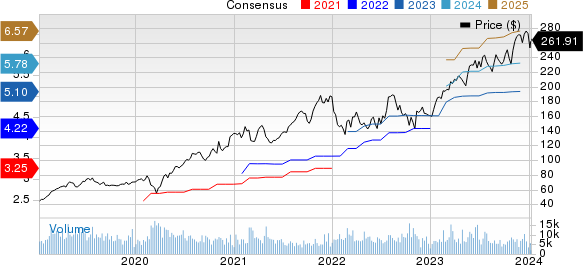

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Invecas also boasts alliances with important players and top foundry and assembly, and test partners in the design ecosystem. It has a strong customer base across various verticals including mobile, networking, hyperscaler and automotive, added CDNS.

Strategic acquisitions have played a pivotal role in driving Cadence’s performance. In October 2023, the company acquired Intrinsix Corporation from CEVA. Intrinsix is a leading provider of design engineering solutions for the U.S. aerospace and defense industry. This acquisition aims to expand Cadence’s footprint in the advanced nodes, radio frequency, mixed signal and security algorithms’ space. Intrinsix will aid Cadence to boost its system and IC design services portfolio, and help customers to achieve design excellence, especially in key verticals like aerospace and defense.

Apart from Intrinsix, it also acquired Rambus SerDes and memory interface PHY IP business from Rambus. This buyout will help it to extend its reach across geographies and key vertical markets.

Prior to that it had acquired OpenEye Scientific Software to augment its reach in the pharmaceutical and biotechnology market. In July 2022, Cadence purchased Future Facilities, a simulation software company. This addition will help it to improve its Fidelity CFD solution with digital twin offerings including electronics cooling and energy management solutions.

The buyouts of Pointwise and NUMECA were also aimed at increasing the system analysis portfolio with more CFD solutions. Other significant acquisitions made by the company include Integrand Software, AWR Corporation, Tensilica and InspectAR Augmented Interfaces.

However, higher research & development costs, stiff competition and weakness prevailing over global macroeconomic conditions remain concerns for this Zacks Rank #4 (Sell) stock.

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Watts Water Technologies WTS, NETGEAR NTGR and Blackbaud BLKB. While NETGEAR currently sports a Zacks Rank #1 (Strong Buy), Watts Water and Blackbaud carries a Zacks Rank of 2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved by 2% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 28.8% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days. NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR were down 28.1% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS has improved by 1% in the past 60 days to $3.86.

BLKB’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have jumped 34.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report