Cadence (CDNS) Completes Intrinsix Buyout, Terms Undisclosed

Cadence Design Systems CDNS announced that it has completed the acquisition of Intrinsix Corporation from CEVA. Intrinsix is a leading provider of design engineering solutions for the U.S. aerospace and defense industry.

CDNS had entered into a definite agreement with CEVA to acquire its subsidiary in September 2023. The company, however, did not disclose the financial terms of the deal.

This acquisition aims to expand Cadence’s footprint in the advanced nodes, radio frequency, mixed-signal, and security algorithms’ space. Intrinsix will aid Cadence to boost its system and IC design services portfolio and help customers to achieve design excellence, especially in key verticals like aerospace and defense. However, management had noted earlier that the impact of this acquisition on its current-year revenues and earnings is expected to be insignificant.

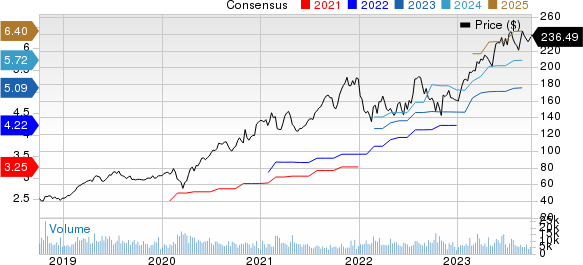

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Strategic acquisitions have aided CDNS’ top-line growth. Apart from Intrinsix, it also acquired Rambus SerDes and memory interface PHY IP business from Rambus. The acquisition will help it to extend its reach across geographies and key vertical markets.

Prior to that it had acquired OpenEye Scientific Software to augment its reach in the pharmaceutical and biotechnology market. In July 2022, Cadence purchased Future Facilities, a simulation software company. This addition will help it to improve its Fidelity CFD solution with digital twin offerings including electronics cooling and energy management solutions.

The buyouts of Pointwise and NUMECA were also aimed at increasing the system analysis portfolio with more CFD solutions. The other significant acquisitions made by the company include Integrand Software, AWR Corporation, Tensilica and InspectAR Augmented Interfaces.

Based in San Jose, CA, Cadence is focused on providing end-to-end solutions, which rapidly reduces the time required to introduce a semiconductor product in the market. It is experiencing strong demand for its software – particularly verification and digital design products – from customers providing datacenter servers, networking products and smartphones that continues to invest in new design concepts and projects.

Apart from strategic buyouts, frequent product launches are expected to help the company to sustain top-line growth. In 2022, it introduced nine new products including LPDDR5X memory interface IP, Certus Closure Solution, Cadence Joint Enterprise Data and AI Platform, Verisium AI-Driven Verification Platform and more.

The company recently rolled out next-generation Artificial Intelligence (AI)-powered OrCAD X platform, which is also enabled with Cadence OnCloud Platform. With cloud scalability and AI-powered placement automation technology, the platform is capable of reducing design turnaround time by 5X, per Cadence.

Among existing products, its Palladium and Protium platform is gaining traction among clients in the AI, hyperscale computing and automotive segments.

However, higher costs related to research and development are likely to dent margins in the near term. Stiff competition and volatile macroeconomic conditions continue to be concerns.

CDNS currently carries a Zacks Rank #2 (Buy).

In the past year, the stock has gained 38% compared with the Zacks sub-industry’s growth of 31.7%.

Image Source: Zacks Investment Research

Other Key Picks

Some other top-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS, and VMware VMW. All stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 676.4%. Shares of ASUR have surged 68.5% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have gained 44.2% in the past year.

The Zacks Consensus Estimate for VMware’s fiscal 2024 EPS has improved 5.9% in the past 60 days to $7.23.

VMware’s earnings outpaced the Zacks Consensus Estimate in two of the last four quarters, while missing it in the remaining quarters. The average earnings surprise stands at 1.2%. Shares of VMW have jumped 47.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report