Business Restructuring Likely to Keep Aiding HSBC's Growth

HSBC Holdings plc’s HSBC strong capital position, initiatives to strengthen digital capabilities, an extensive network and improvement in operating efficiency through business restructuring will likely keep aiding growth. Exiting the U.S. and French retail banking operations is expected to help the company focus on Asia.

Over the past 30 days, the Zacks Consensus Estimate for HSBC’s current-year earnings has been revised 1.3% upward, reflecting analysts’ optimism regarding its earnings growth potential. Thus, the company currently carries a Zacks Rank #2 (Buy).

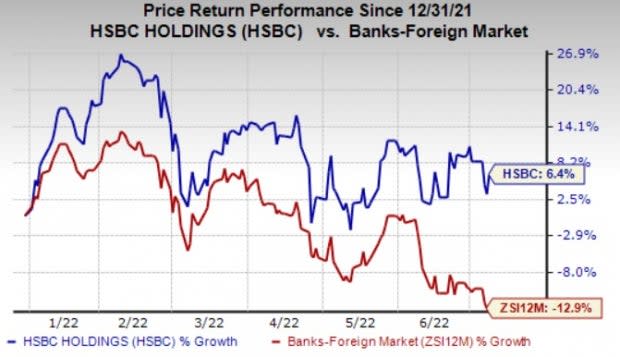

So far this year, shares of HSBC have gained 6.4% against the 12.9% decline recorded by the industry.

Image Source: Zacks Investment Research

HSBC has been undertaking measures to bolster its performance with a special focus on building operations in Asia, including Hong Kong and China. In sync with this, the company acquired 100% of the issued share capital of AXA Insurance in Singapore for $529 million this February and agreed to acquire L&T Investment Management Limited.

The bank also started an exclusive fund focused on the metaverse for its private banking clients in Hong Kong and Singapore. It also plans to re-launch its private banking business in India in a year.

Moreover, HSBC intends to position itself as a top bank for high net worth and ultra-high net worth clients in Asia. In 2020, the company initiated a digital-first, hybrid financial management platform — HSBC Pinnacle — in mainland China to bank on the increasing wealth in the region.

Further, HSBC plans to restructure its operations to improve operating efficiency. In February 2020, the bank announced its transformation plan, aimed at reshaping underperforming businesses, simplifying complex organization and reducing costs. As part of this initiative, the company expects to incur $7 billion in charges and achieve at least $5.5 billion in cost savings by 2022-end.

Despite the uncertain macro-environment, HSBC remains strong with respect to its capital position. As of Mar 31, 2022, the company’s capital ratios were strong, driven by steady capital generation. HSBC aims to continue identifying and removing “low-return” risk-weighted assets (RWAs). Management projects mid-single-digit growth in RWAs this year through a combination of business growth, acquisitions and regulatory changes, partly offset by additional RWA savings. The RWA savings are anticipated to exceed $120 billion by 2022-end.

Based on a stable capital position, HSBC has been consistently rewarding shareholders. In February 2022, the company approved a second interim dividend of 18 cents per share, marking a total of 25 cents per share as dividend for 2021. The company expects to move within its target payout ratio of 40-55% of reported earnings per share.

However, overall costs are expected to remain high in the near term, given HSBC’s focus on growing market share in the U.K. and China and strengthening digital capabilities globally. Also, the company’s reported revenues have declined at a compound annual growth rate of 6% over the last three years (2019-2021), with the downward trend continuing in first-quarter 2022. Muted performance in its mature markets (Europe, the U.K., and the United States) remains a major concern.

Other Stocks Worth Considering

A couple of other top-ranked stocks from the finance space are Axos Financial, Inc. AX and S&T Bancorp, Inc. STBA. Currently, both AX and STBA carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axos Financial’s current-year earnings estimates have been unchanged over the past 30 days. AX’s shares have lost 20.8% over the past year.

The consensus estimate for S&T Bancorp’s current-year earnings has been unchanged over the past 30 days. Over the past year, STBA’s share price has declined 9.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

S&T Bancorp, Inc. (STBA) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research