Business insolvencies shot up by more than 41% last year, as pandemic debts mount

Business insolvencies jumped by more than 41 per cent in 2023, according to data released Friday by Canada's top financial regulator.

The report from the Office of the Superintendent of Bankruptcy showed that the total number of insolvencies — meaning those filed by both businesses and consumers — was up by 23.6 per cent last year.

The high insolvency rates for businesses are "telling a story that we've been a little concerned about, and that is essentially that we're seeing a very tough economic climate for a lot of businesses" amid low economic activity, said Pedro Antunes, chief economist at the Conference Board of Canada.

"Profits have plummeted and we've seen the stresses of CEBA loan repayments due, and perhaps other stresses coming into play," he said, adding there might be more job losses in the coming months.

He said that if things start to unravel, there's still room for the Bank of Canada to lower interest rates, which would help businesses repay their loans and reduce the need for job cuts.

"But we're at that crux. We're at that moment where everybody's kind of holding their breath to see what's going to come of this," he noted.

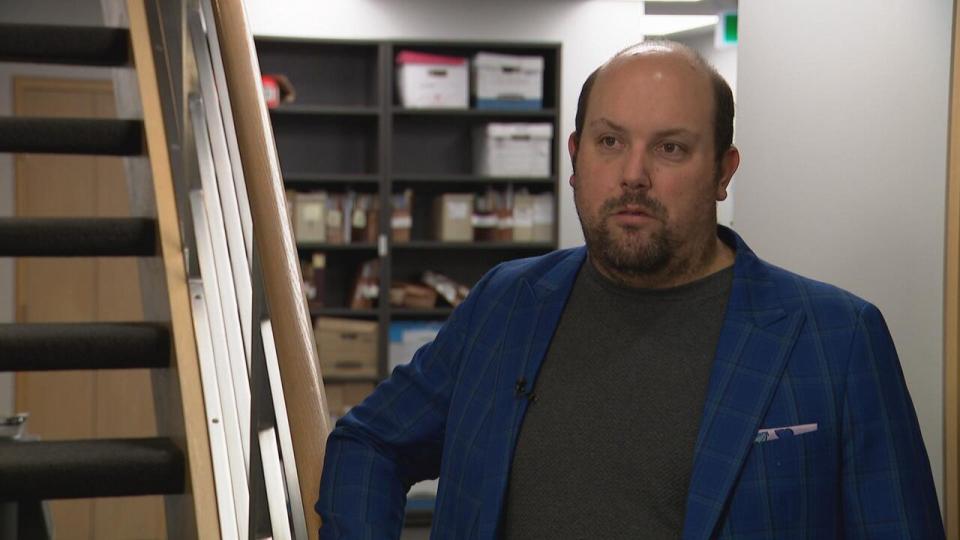

Richard Goldhar, a licensed insolvency trustee, says phones are ringing off the hook at his Toronto-based bankruptcy firm. (CBC)

The Canadian Association of Insolvency and Restructuring Professionals (CAIRP) said in a statement that Friday's numbers marked the sharpest increase in business insolvencies in 36 years of records. Analysts were expecting businesses to be hit hard in 2023, with many having fallen behind on their pandemic loan repayments.

Finance Minister Chrystia Freeland said on Jan. 23 that a quarter of small businesses that took out a Canadian emergency business account (CEBA) loan had missed the repayment-with-partial-forgiveness deadline of Jan. 18.

"Many businesses are already on a razor's edge. The additional costs to service their debts due to higher interest rates will mean even less room to cover increasing costs of business going into 2024," said CAIRP chair André Bolduc.

Cost of living a major factor

The insolvency numbers take bankruptcies and creditor proposals into account. The latter is when a person in debt offers a formal proposal to their creditors asking for a different arrangement to pay back the money they owe. They might pay a percentage of their original debt or negotiate the repayment deadline, or a combination of both.

Richard Goldhar, a licensed insolvency trustee who assists clients with such arrangements, says things are busy at his Toronto-based firm.

"Our staff are always talking to clients now, the phones are ringing all the time," said Goldhar. His firm files bankruptcy or bankruptcy proposals on behalf of individuals and businesses, then helps them restructure their debts.

LISTEN | Why more bankruptcies could lead to a credit crunch:

Consumer insolvencies alone rose by 23 per cent last year, according to Friday's report. Goldhar said that the cost of living is the highest contributing factor to personal bankruptcy among his clients.

"Food costs, car costs, gas costs, just the daily cost of life," he said.

Between these expenses, plus mounting credit card debts and skyrocketing payday loans (short-term loans that have expensive fees), as well as elevated interest rates for those refinancing their mortgages, Goldhar said his clients are dealing with many layers of financial stress.

Credit card debt is an especially significant factor, with total balances reaching an all-time high of $11.34 billion in the fall, a 16 per cent rise from the same period last year, according to a December report by credit bureau Equifax. (That figure doesn't include mortgage debt.)

And while wages have been on the rise, they aren't keeping pace with inflation, in turn forcing people to borrow money while interest rates are still high, at five per cent.

Goldhar said that wages are also playing into the uptick of business insolvencies among his clients, as employees ask for better salaries and businesses struggle to balance those increases.

Canadian bank notes are seen in Ottawa on Sept. 6, 2017. A Toronto licensed insolvency trustee says that the high cost of living, mounting credit card debts, skyrocketing payday loans and elevated interest rates are contributing to financial stress among his clients. (Adrian Wyld/The Canadian Press)

Numbers back up after pandemic lows

Consumer bankruptcies plunged to a record low at the start of the pandemic, with only 6,700 people filing for insolvency or filing a creditor proposal in April 2020, down 43 per cent from a year before. The government had introduced financial supports, while mortgage payments were deferred.

Anna Lund, an associate professor in the faculty of law at the University of Alberta, said that the insolvency numbers reported on Friday are more or less in line with 2019 levels, given the drop-off that began in 2020.

"So we're coming back up to where we were before the pandemic."

The low bankruptcy levels that began during the pandemic have "stayed that way for households up until very recently," said Antunes. Now, those numbers are starting to come up, especially for consumer-filed creditor proposals, which were up by 28.3 per cent last year.

"That means that, essentially, households have gotten themselves into too much trouble, and they're trying to bargain their way out of a tough situation," said Antunes.

Lund offered a different explanation for the rise in proposals.

"One of the things that people worry about with bankruptcy is that if you make it too easy for people to get rid of their debts, they are going to file for bankruptcy when they could pay back some of their taxes."

As a result, Lund said, "the federal government has expressed sort of a preference for consumer proposals and has put a number of things into the Bankruptcy and Insolvency Act that encourage people towards consumer proposals."