Bull of the Day: W W Grainger Inc

Overview

Incorporated in 1928, Illinois-based Zacks Rank #1 stock (Strong Buy) W.W. Grainger GWW is a distributor of maintenance, repair, and operating (MRO) products and services. Its products include material-handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, and metalworking tools. Grainger’s largest market is North America; however, the company has expanded internationally to Asia, Europe, and South America. The company serves a broad swath of clientele, including the commercial, manufacturing, government, and transportation industries.

Q4 Earnings Summary

Grainger reported strong earnings, growing sales, and expanding margins in early February. Adjusted earnings per share (EPS) of $7.14 in Q4 2022, beating the Zacks Consensus by a margin of 2%. The bottom line improved by 31% year-over-year. Sales rose ~17% year-over-year amid solid new customer acquisition numbers.

Fundamental Highlights include:

EPS Growth: GWW’s earnings grew 33% year-over-year in Q4 2022. Grainger has benefitted from volume growth in its two primary businesses: High Tech Solutions and Endless Assortment.

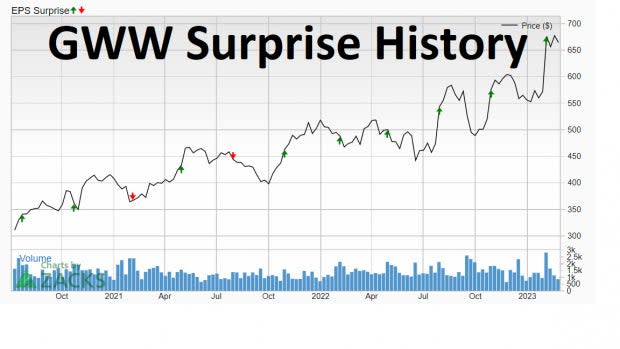

Surprise History: Grainger consistently beats consensus analyst expectations. The company has rewarded investors with positive earnings surprises for six straight quarters.

Image Source: Zacks Investment Research

On average, GWW bests consensus estimates by ~9%.

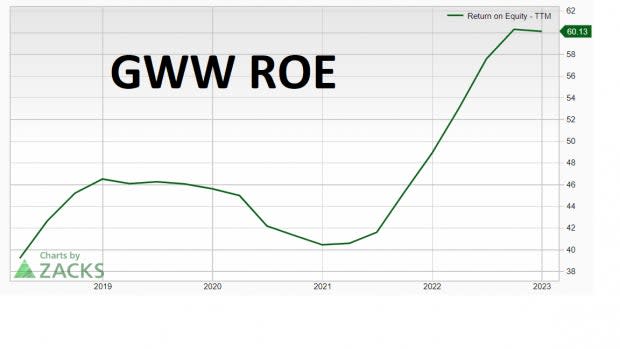

Efficient Business: Grainger is seeing larger margins due to rising profits from its pandemic-related products, lower freight costs, and its ability to navigate supply-chain challenges. From a return on equity perspective (ROE), GWW is one of the strongest companies on Wall Street. GWW boasts an ROE of 60.13 – a staggering number compared to the Industrial Services industry average of 5.53%.

Image Source: Zacks Investment Research

Past Performance: Adjusted EPS surged 49.5% year-over-year to $29.66 in 2022, surpassing the Zacks Consensus Estimate of $29.47. Including one-time items, EPS was $30.06 in 2022 compared with $19.84 in 2021. The top line beat the Zacks Consensus estimate of $15.19 billion. Sales were up 19.3% on a daily, constant currency basis.

Rosy Outlook: Consensus analyst estimates show that analysts are becoming more bullish on GWW earnings picture. Because of this, GWW earns a Zacks #1 Rank, putting it in the top 5% of stocks tracked by Zacks.

Technical Picture: Following the Q4 EPS release, GWW shares bolted higher by 13% on volume more than double the norm – a bullish sign of accumulation. Since then, shares have been consolidating in a bull flag.

Image Source: Zacks Investment Research

A break out above the recent high will present investors with an attractive reward-to-risk zone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report