Bull of the Day: Paycom Software (PAYC)

Paycom Software, Inc. PAYC is growing its cloud-based HR software business in 2024. This Zacks Rank #1 (Strong Buy) is expected to see double digit sales growth both in 2024 and 2025.

Paycom Software is a leading provider of cloud-based human capital management software, including for HR and payroll. It's a mid-cap company with a market cap of $8.1 billion.

Another Earnings Beat in Q1 2024

On May 1, 2024, Paycom Software reported its first quarter 2024 results and beat on the Zacks Consensus by $0.16. Earnings were $2.59 versus the consensus of $2.43.

An earnings beat shouldn't be surprising as Paycom has a perfect 5-year earnings surprise track record. That is impressive given that many companies were not able to hold onto their earnings surprise streaks during the pandemic.

Revenue was up 10.7% to $499.9 million from $451.6 million a year ago.

Zero Debt and Plenty of Cash

Paycom Software had debt of $0 as of Mar 31, 2024. But it also had cash and cash equivalents of $371.3 million as of Mar 31, 2024, up from $294 million as of Dec 31, 2023.

And that was even after Paycom paid $21.2 million cash dividends and repurchased $3.1 million in stock during the first quarter.

The dividend is yielding 1.1%.

Analysts Remain Bullish on 2024

Paycom Software gave full year sales guidance of a range of $1.86 to $1.885 billion. The Zacks Consensus is looking for $1.87 billion, which is sales growth of 10.2%.

1 estimate was revised higher for 2024 earnings in the last 30 days, pushing the Zacks Consensus up to $7.71 from $7.69. That is still a decline in earnings of 0.5% as the company made $7.75 last year.

But analysts expect earnings to jump another 11.4% in 2025, as the Zacks Consensus is looking for $8.60.

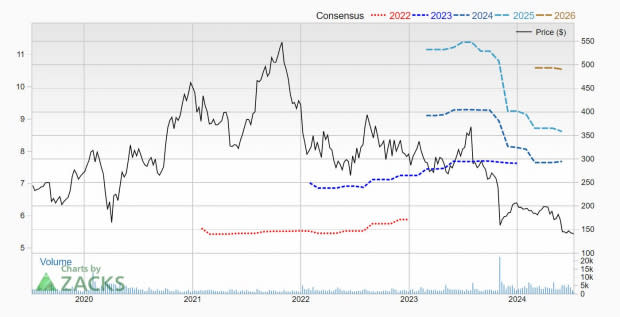

You can see on the price and consensus chart where the analysts got a little bearish about 2024's earnings but also where they are expecting the growth in 2025 and 2026.

Image Source: Zacks Investment Research

Shares at 5-Year Lows

Despite the bullish fundamentals, the Street has been negative on Paycom's stock for several years. In fact, the stock peaked in 2021 and has now slid to a new 5-year low.

Image Source: Zacks Investment Research

Because of the stock slide, it now has attractive fundamentals. Paycom trades with a forward P/E of 18.2.

For investors looking for a software stock with attractive fundamentals and no debt, Paycom Software should be on your short list.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report