Bull of the Day: Duolingo (DUOL)

Duolingo, Inc. DUOL is expected to see its earnings jump in 2024 as more people take to its app to learn a new language. This Zacks Rank #1 (Strong Buy) is forecast to grow sales by the double digits this year.

Duolingo is an education app which is popular with those trying to learn a new language. It offers over 100 courses across 42 distinct languages, from Spanish, French, German and Japanese to Navajo and Yiddish.

However, in 2023, it also launched Music and Math courses on its flagship app, adding to its offerings.

Another Earnings Beat in the Third Quarter

On Nov 8, 2023, Duolingo reported its third quarter results and easily beat the Zacks Consensus. It reported earnings of $0.06 versus the Zacks Consensus of a loss of $0.06. That's a $0.12 beat.

Paid subscribers rose 60% to 5.8 million from 3.7 million in the third quarter of 2022.

Total bookings rose 49% to $153.6 million year-over-year led by subscription bookings which also rose 54% to $121.3 million.

Monthly active users (MAUs) were 83.1 million, up 47% from the prior year quarter. Daily active users (DAUs) jumped 63% to 24.2 million.

Total revenue also surge 43% to $137.6 million.

Raised Full Year Guidance

For the second quarter in a row, Duolingo raised its full year revenue guidance. It expects to be in a range of $525 million to $528 million, up from its second quarter guidance of $510 million to $516 million.

The Zacks Consensus is at the high end of the range at $527.07 million. Analysts are also bullish on 2024 with sales expected to jump 29.3% to $681.5 million.

Analysts are also bullish on earnings for 2024. 1 estimate has been revised higher in the last 30 days. This has pushed the Zacks Consensus up to $0.81 from $0.79 in the last month.

That's earnings growth of 210.8% as the company is expected to make just $0.26 in 2023. It will report fourth quarter and full year results at the end of Feb 2024.

Image Source: Zacks Investment Research

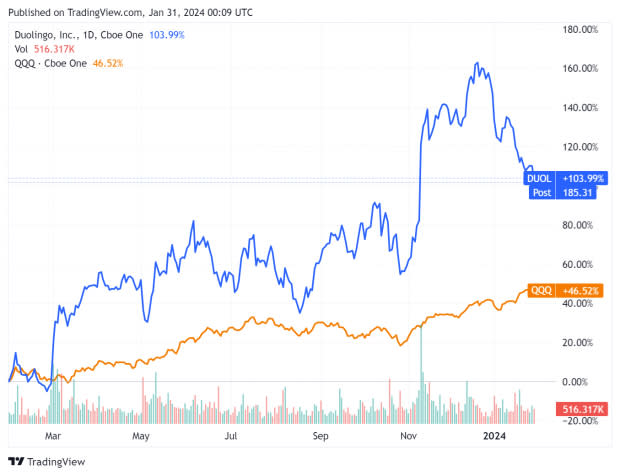

Shares Soar in the Last Year

Duolingo has been on a ride since its July 2021 IPO. The shares sold off in the 2022 growth stock sell-off but have rebounded in the last year, gaining 104% versus the 46.5% gain in the Invesco QQQ ETF during that same time.

Image Source: Zacks Investment Research

If you're looking for a growth stock, Duolingo is for you. Analysts expect big growth in sales and earnings in 2024. However, it's not cheap. It trades with a forward P/E of 238.

For investors looking for a top ranked growth stock, Duolingo should be on your short list.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report