Bull of the Day: Coinbase (COIN)

Company Overview

Zacks Rank #1 (Strong Buy) stock Coinbase (COIN) is the largest domestic cryptocurrency exchange. Coinbase facilitates the buying, selling, and storing of various digital assets, including popular cryptocurrencies like Bitcoin and Ethereum. As a user-friendly platform, Coinbase allows individuals to create accounts, deposit funds, and trade cryptocurrencies. It provides a secure wallet for storing digital assets and offers additional features such as educational resources, price charts, and market insights. Coinbase plays a pivotal role in the mainstream adoption of crypto, serving as a bridge between traditional financial systems and the evolving world of digital currencies. Additionally, Coinbase has expanded its services to include features like staking borrowing, and a professional trading platform known as Coinbase Pro.

Bitcoin ETFs = Most Successful Launch in History

After a long and drawn-out saga, the U.S. Securities and Exchange Commission (SEC) finally approvedeleven Bitcoin ETFs that recently began trading.After over a month of being live, the Bitcoin ETF has lived up to the hype and has become the most successful ETF launch in history. For example, Fidelity’s Wise Origin Bitcoin Fund ETF (FBTC) and BlackRock’s (BLK) iShares Bitcoin Trust ETF (IBIT) have brought in more assets in the first month than any other ETF launched by the two financial giants. That’s saying something when you consider that Fidelity has 65 active ETFs and BlackRock has 426! Coinbase, which is the custodian for nearly every Bitcoin ETF, stands to benefit dramatically.

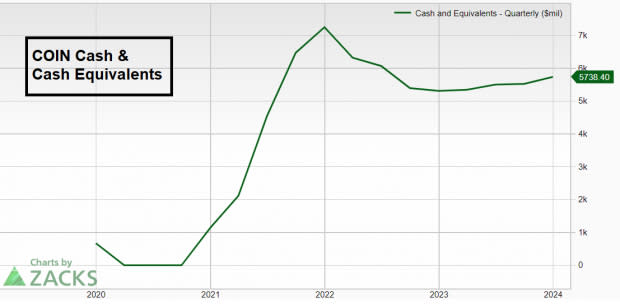

Strong Balance Sheet

Seth Klarman is a legendary value investor, billionaire, and one of the highest-earning money managers in the world. In a recent interview, Klarman stated that he avoids crypto but sees value in Coinbase, saying, “Coinbase is sitting on $5 billion in cash, has less than that in debt, and is doing some smart things.”

Image Source: Zacks Investment Research

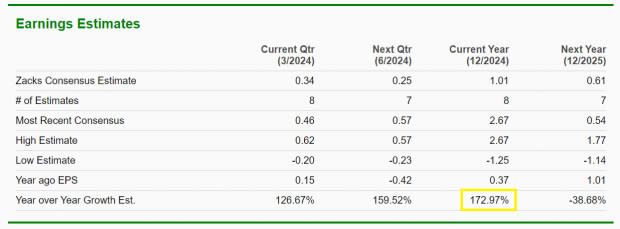

A Swing to Profitability + More Momentum Expected

2023 was Coinbase’s best year as a public company. COIN swung to its first annual profit ever as a public company and grew earnings 142% on robust revenue growth of 52% year-over-year. Based on Zacks Consensus Estimates, the earnings momentum may be just beginning. In 2024, analysts expect COIN to grow EPS by a massive 172.97%!

Image Source: Zacks Investment Research

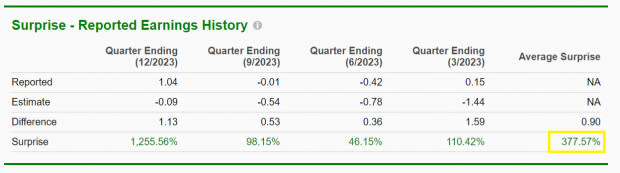

Incredible EPS Surprise History

Expectations mean little to investors if a company has trouble reaching meeting or exceeding them. Fortunately for investors, COIN does not have that problem. COIN has delivered positive EPS surprises in four straight quarters and boasts an eye-popping 377.57% average surprise in that time frame.

Image Source: Zacks Investment Research

Technical Breakout

Monday, COIN shares broke out of a picture-perfect cup-with-handle structure and simultaneously overcame more than one year old resistance.

Image Source: Zacks Investment Research

Bottom Line

Crypto is one of the hottest industries on Wall Street. Coinbase, the crypto exchange leader, stands to benefit from the successful Bitcoin ETF launch, a massive cash hoard, and a swing to profitability. Expect shares to be much higher one year from today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

iShares Bitcoin Trust (IBIT): ETF Research Reports

Fidelity Wise Origin Bitcoin Fund (FBTC): ETF Research Reports