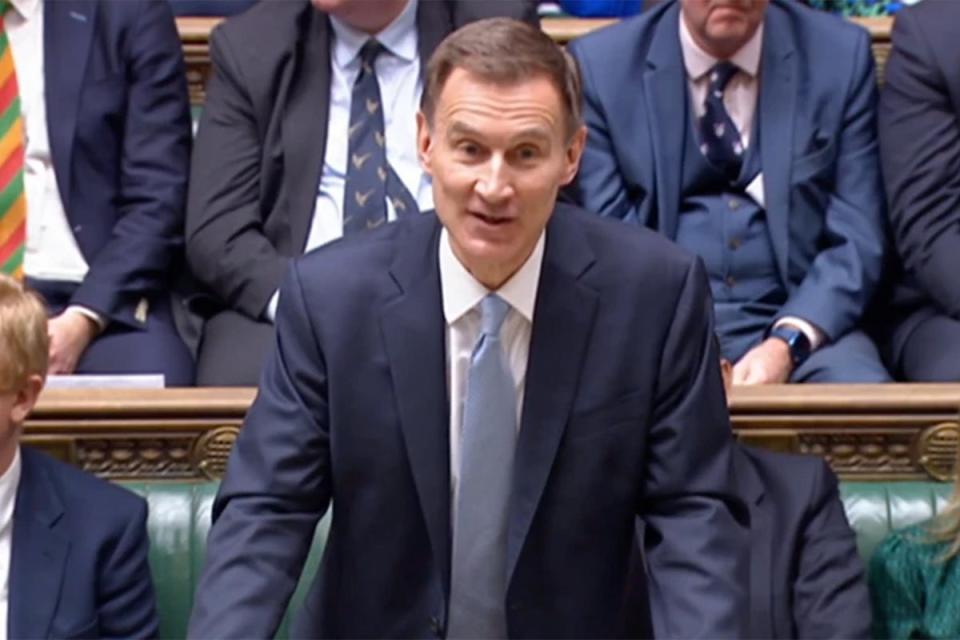

Budget 2024: Jeremy Hunt unveils £10bn national insurance cut – but average worker still £400 worse off

Jeremy Hunt has attempted to shore up support for his languishing party by unveiling a £10bn cut to national insurance – but the Budget watchdog has warned the average worker will still be hundreds of pounds worse off overall.

The chancellor announced a further two percentage point slash to national insurance among a series of tax cuts in his spring Budget ahead of this year’s general election, as support for the Conservative Party drops to a 45-year low.

By repeating his previous cut to the tax in his autumn statement, Mr Hunt said the two reductions would together save workers an average of £900 a year, with Wednesday’s cut expected to cost the Treasury £10.4bn. Taken together he claimed the tax cuts would lead an extra 200,000 people to join the workforce.

But a report from the Office for Budget Responsibility (OBR) calculated the typical worker on a £35,000 salary will be £383 worse off over this year and the next due to stealth tax rises – wiping out any potential gains from the national insurance announcement – with living standards set to remain below 2019 levels for the next two years.

The Budget watchdog went on to warn of “significant risks” posed by the package of measures, pointing to the Budget’s reliance on Britain’s tax-to-GDP ratio increasing close to a post-Second World War high, mostly from freezes to personal tax allowances and an eventual raising of fuel duty, which Mr Hunt froze for a 14th consecutive year. It also expressed concern over a “lack of detailed department-by-department spending plans beyond the current spending review period”, which ends in 2024-25.

The changes also come against a backdrop of frozen thresholds, which will see more people dragged into tax or higher brackets as their earnings rise. The OBR said that would result in more than three million more taxpayers, more than two million more higher rate and half a million more additional rate taxpayers by 2028.

The Institute for Fiscal Studies warned the cuts would not be enough to prevent taxes as a share of GDP rising to record levels within five years.

The chancellor also announced plans to raise nearly £3 billion a year through a crackdown on tax breaks for ‘non-doms’, two years after The Independent revealed the prime minister’s wife held the controversial status.

Child benefit will also be reformed to end the “unfairness” that penalises many parents for earning just over £50,000, helping half a million families next year.

With recent polling putting their party’s popularity at a 45-year low, Mr Hunt and prime minister Rishi Sunak had been determined to offer a tax giveaway to the electorate, and are reported to have targeted national insurance over income tax after deciding the latter could be too inflationary.

Londoners are set to benefit the most from the latest two per cent cut, by an average of £608, while those in the northeast will keep an average of £342 more of their pay, equating to less than £1 per day, according to analysis by the IPPR think-tank.

Almost half of the £10.4bn give-away will “end up in the pockets of the richest fifth of households, while a meagre three per cent” will benefit the poorest fifth, the think-tank said.

With the UK in the grips of a technical recession, Britain’s sluggish economy and consequent reduction in predicted tax revenues hit Mr Hunt’s plans.

While the Office for Budget Responsibility said in November that Mr Hunt had £13bn of fiscal headroom, economists believe this may have increased to around £18bn due to recent falls in inflation. But this is less than predicted a few weeks ago when interest rate cuts appeared more imminent.

Unveiling his plans, the chancellor told MPs “countries with lower taxes generally have higher growth”.

Mr Hunt has previously talked of moving towards a “lower tax economy”, although he has stressed the need to do so in a “responsible” way. He said the Conservatives would aim to abolish national insurance contributions completely over time but did not set out a timeline for doing so.

Tom Pollard, of the New Economics Foundation think-tank, warned that cutting national insurance would benefit high earners the most “while doing nothing for those really struggling to make ends meet”, and calculated that investing the same money in Universal Credit benefits “could lift 384,000 people out of poverty”.

Labour welcomed the cut but suggested Mr Sunak had broken a promise to cut income tax.

In his response, party leader Sir Keir Starmer described the Budget as a “Tory con” and accused the chancellor of giving with “one hand” and taking “even more with” the other.

He told the Commons: “The story of this parliament is devastatingly simple: a Conservative Party stubbornly clinging to the failed ideas of the past, completely unable to generate the growth working people need, and forced by that failure to ask them to pay more and more, for less and less.

“And as the desperation grows they torch not only their reputation for fiscal responsibility but any notion that they can serve the county, not themselves.

“Party first, country second while working people pay the price.”

He went on to accuse the Tories of losing control of the economy and making “working people pay” with the tax burden to remain at a record high.

“They should be under no illusion,” he said. “That record is how the British people will judge today’s cuts, because the whole country can see exactly what is happening here.”

According to an Office for Budget Responsibility forecast published on Wednesday, there will be 2.7m more higher-rate taxpayers and 600,000 more additional rate taxpayers by 2028-29 as a result of ‘fiscal drag’.