Bruker (BRKR) Q2 Earnings Match Estimates, '22 Sales View Down

Bruker Corporation BRKR delivered adjusted earnings per share (EPS) of 45 cents in the second quarter of 2022, up 2.3% year over year. Moreover, the figure was in line with the Zacks Consensus Estimate.

Our model projected an adjusted EPS of 44 cents in Q2.

The adjustments include expenses related to purchased intangible amortization, acquisition-related costs and restructuring costs, among others.

GAAP EPS for the quarter was 33 cents a share, reflecting a 13.2% decline from the year-earlier figure.

Revenues in Detail

Bruker registered revenues of $588.4 million in the second quarter, up 3.1% year over year. However, the figure missed the Zacks Consensus Estimate by 0.4%.

The second-quarter revenue compares to our own estimate of $600.8 million.

Excluding the positive impact of 1.6% from acquisitions and another 7.3% from negative changes in foreign currency rates, the company saw organic revenue growth of 8.8%.

Solid performances by all the reporting segments driven by robust demand for the company’s solutions and products significantly drove the top line.

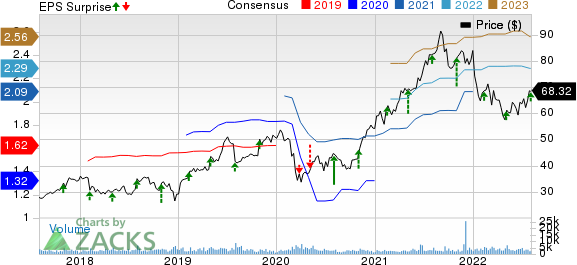

Bruker Corporation Price, Consensus and EPS Surprise

Bruker Corporation price-consensus-eps-surprise-chart | Bruker Corporation Quote

Geographically, the United States witnessed a 7.3% year-over-year rise in revenues in the reported quarter. Europe revenues fell 8.3% year over year, whereas revenues in the Asia Pacific increased 14.8%. Further, the Other category’s revenues moved up 2.4% year over year.

Segments in Detail

Bruker reports results under three segments, namely, BSI Life Science (comprising BioSpin and CALID), BSI Nano and BEST.

In the second quarter, BioSpin Group revenues rose 7.6% from the year-ago quarter to $159.8 million. BioSpin benefitted from the revenue recognition of one 1.2 gigahertz class NMR system in the reported quarter.

CALID revenues fell 1.6% year over year to $190.3 million in the second quarter, primarily due to supply chain issues. The business delivered a solid performance in the first six months of the year primarily owing to the timsTOF platform witnessing continued strong adoption in 4D proteomics, epiproteomics and multiomics.

Revenues in the Nano group climbed 3.9% to $182.2 million. Revenues for the company’s NANO advanced X-ray and NANO surfaces tools delivered strong growth in the first half of 2022. Nano's microelectronics and semiconductor metrology tools also performed well with strong bookings and backlog.

Nano organic revenue grew in the high single-digit percentage, driven by strength in NANO's industrial research and semiconductor businesses.

The BSI segment (including BSI Life Science and BSI Nano Segments) improved 2.9% year over year to $532.3, including organic revenue growth of 8.1%.

For the BSI segment, we projected $543.4 million revenues in the second quarter.

In the second quarter, the company’s BEST segment revenues were $59.2 million, up 4.6% year over year. The solid segmental performance in the first half of 2022 was driven by share gains and strong superconductor demand by MRI OEM customers. However, the segment continued to experience supply-chain and logistics challenges. Organically, BEST segment revenues improved 15.1%, net of intercompany eliminations.

This figure compares with our BEST revenue estimate of $61.1 million for Q2.

Margin Trend

In the quarter under review, Bruker’s gross profit rose 6.3% to $298.2 million. The gross margin expanded 152 basis points (bps) to 50.7%.

We projected an adjusted gross margin of 50.5% for Q2.

Meanwhile, selling, general & administrative expenses rose 12.9% to $152.2 million. Research and development expenses went up 6.8% year over year to $59.6 million. Adjusted operating expenses of $211.8 million increased 11.1% year over year.

Adjusted operating profit totaled $86.4 million, reflecting a 4% fall from the prior-year quarter. Further, the adjusted operating margin in the second quarter contracted 108 bps to 14.7%.

The adjusted operating margin, according to our model, was 16.9% for Q2.

Financial Position

Bruker exited the second quarter of 2022 with cash and cash equivalents and short-term investments of $723 million compared with $916.1 million at the end of first-quarter 2022. Total long-term debt (including the current portion) at the end of the second quarter of 2022 was $1.19 billion compared with $1.21 billion at the end of first-quarter 2022.

Cumulative net cash flow from operating activities at the end of the second quarter was $33.4 million compared with $119.9 million in the year-ago period.

2022 Guidance

Bruker updated its revenue outlook for 2022 to account for stronger foreign currency translation headwinds.

The company expects revenue growth of approximately 2.5-4.5%, down from the May-announced revenue guidance of 5-7%. The Zacks Consensus Estimate for revenues is pegged at $2.57 billion. The company has reaffirmed its organic revenue growth outlook in the band of 7-9%.

The company has also maintained full-year adjusted EPS guidance in the band of $2.29-$2.33, indicating an uptick of 9-11% from the 2021 reported figure. The Zacks Consensus Estimate for the same is pegged at $2.29.

Our Take

Bruker ended the second quarter of 2022 with earnings matching the Zacks Consensus Estimate. The top line was driven by robust performances across all geographies and the BSI and BEST businesses. The company delivered robust bookings and backlog growth in the second quarter, instilling optimism. Revenue recognition from one gigahertz class NMR system and the continued uptake of the timsTOF platform are added advantages.

However, revenues missed the consensus mark. The sales decline in CALID business does not bode well. Mounting operating costs are concerning. Contraction of adjusted operating margin is another downside. The company continues to be challenged by supply chain disruptions and logistics delays, impacting business performance.

Zacks Rank and Key Picks

Bruker currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, Molina Healthcare, Inc. MOH and Merck & Co. MRK.

Quest Diagnostics, carrying a Zacks Rank #2 (Buy), reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 7.0% compared with the industry’s 3.2%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

Molina Healthcare, having a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $ 4.55, which beat the Zacks Consensus Estimate by 4.8%. Revenues of $8.1 billion outpaced the consensus mark by 6.2%.

Molina Healthcare has a long-term estimated growth rate of 16.4%. MOH’s earnings surpassed estimates in the trailing four quarters, the average being 3.2%.

Merck reported second-quarter 2022 adjusted earnings of $1.87 per share, beating the Zacks Consensus Estimate of $1.67. Revenues of $14.6 billion surpassed the Zacks Consensus Estimate by 5.4%. It currently has a Zacks Rank #2.

Merck has a long-term estimated growth rate of 10.1%. MRK’s earnings surpassed estimates in the trailing four quarters, the average surprise being 16.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research