Britain officially entered record recession in second quarter

The economy plunged into the deepest recession on record in the second quarter of 2020 as Britain suffered a bigger blow from its Covid lockdown than almost every other major country.

GDP collapsed by 20.4pc between April and June, the worst three-month fall ever recorded according to the Office for National Statistics (ONS), as almost every industry was crushed by the response to the pandemic.

The contraction followed a 2.2pc dip in the first quarter, sending the country hurtling into a technical recession defined as two straight quarters of contraction.

Overall, this blow was more severe than any large nation apart from Spain – and twice as big as the damage done to the US. It means Britain has both one of the world's highest death tolls and hardest-hit economies.

But recovery has already begun. The fall bottomed out in April, followed by modest growth in May and then an unprecedented 8.7pc monthly increase in June as the country got back to work in the first signs of a possible rapid "V-shaped" recovery. The start of the quarter was so bad that overall, the economy still finished the period more than a fifth smaller.

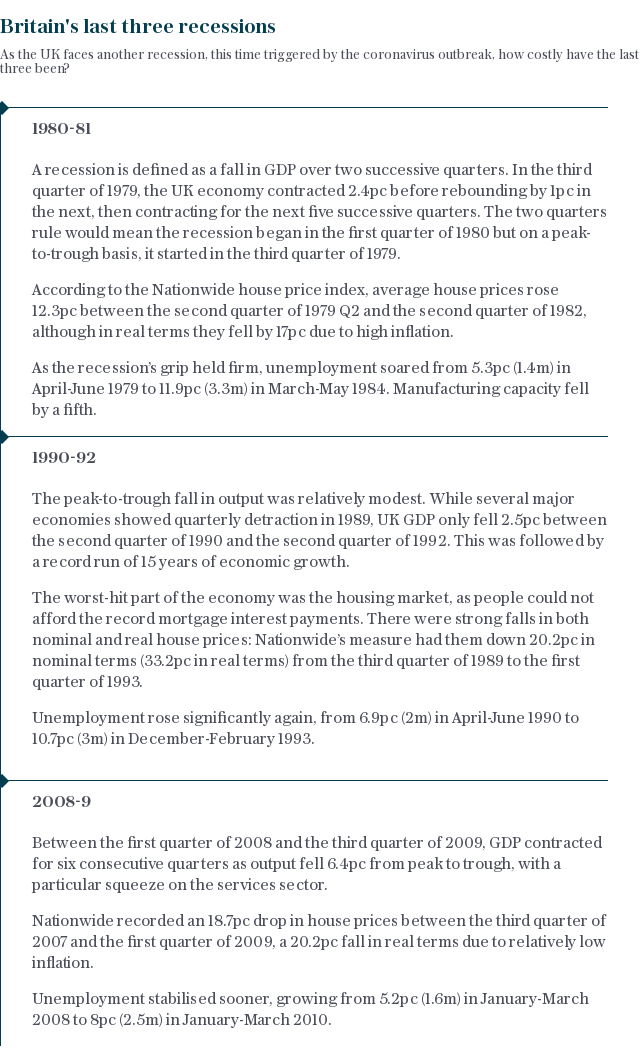

The peak-to-trough contraction was six times faster and four times deeper than during the financial crisis. It comes a day after separate ONS figures showed employment fell by the most for over a decade during the quarter, with many more cuts expected in coming months as the taxpayer-funded furlough scheme ends.

Chancellor Rishi Sunak said: "Hundreds of thousands of people have already lost their jobs, and sadly in the coming months many more will.

"But while there are difficult choices to be made ahead, we will get through this, and I can assure people that nobody will be left without hope or opportunity."

Samuel Tombs, of Pantheon Macroeconomics, said poor performance was driven by the length of the lockdown in the second quarter. Some experts believe Britain could have been shut for a shorter time if action had been taken earlier, lessening the economic impact.

Mr Tombs added that the fall in GDP could also be attributed partly to the country's reliance on services, which include many jobs such as in retail and hospitality that cannot be done from home.

The labour market also depends heavily on working parents who had to stay home to look after children, another long-term disadvantage that could hold back the recovery in the third and fourth quarters.

Former Treasury minister Lord O’Neill said that Britain's relatively large service sector is is no excuse for policymakers not “thinking more carefully before deploying the blunt tool of a mass shutdown”.

He said: “It’s not as though our system-wide shutdown resulted in better health outcomes."

The UK's official Covid death toll stands at more than 41,000, the highest in Europe and fifth-biggest worldwide.

The hospitality industry was only allowed to reopen in July, so was particularly devastated between April and June with almost all outlets closed. Output in accommodation and food services was almost completely wiped out, falling 86.7pc.

Education was down more than a third, with almost as large a blow in several other major industries including administrative and support services, and transport and storage. Even human health and social activities shrank by more than one-quarter, despite a clamour for more health and care home staff to avoid disaster.

The high street was trashed with wholesale, retail and motor trades down by a fifth, although there was a recovery as the quarter ended and with more shops being allowed to open.

In June, retail output had recovered to just 6.3pc below its February level from a peak-to-trough fall of more than a third.

Manufacturing tumbled by just over a fifth, with almost every industry affected. The crash in car sales meaning output of transport equipment fell fastest, down by almost half.

In construction, output collapsed by a record 35pc in the quarter as building sites shut down to halt the spread of the virus. New private housing was hardest hit with output cut by more than half.

However, the industry is also recording a rapid bounceback. Monthly output in June surged by 23.5pc, a record, which leaves output down by just under one-quarter compared with February's level.

Despite the brutal collapse, there was a rapid pick-up as restrictions lifted.

Services experienced widespread growth at the end of the quarter driven by the wholesale and retail trade and vehicle repairs as lockdown restrictions eased, while the manufacturing and construction sectors revived as pent-up demand was unleashed and work recommenced under social-distancing rules.

James Smith, research director at the Resolution Foundation think-tank, said: “The rapid growth rates seen for some sectors... tell us more about the extent to which the lockdown damaged economic activity than it does about prospects for a rapid recovery in the coming months and years.”

ING’s James Smith said he expected a significant bounce in GDP in July when a wider range of service businesses reopened, but that it could take up to three years for the economy to regain its lost ground. The Bank of England assumes a full recovery by the end of next year.

Mr Smith also warned that the end of the Brexit transition period will create a new wave of costs for businesses – even if the Government reaches a trade deal with the EU – and that these are likely to hit industries that have not necessarily been the worst affected by Covid-19, spreading the pain further.