Breaking Out: 3 Software Stocks Showing Relative Strength

A Wall Street paradox is that some of the best and brightest minds outside of the stock market often don’t translate to stock market success. Often, doctors, engineers, or lawyers may overthink and overanalyze the practice of investing. In turn, overthinking leads to overcomplicated, indecisive, emotional trading.

Leonardo Da Vinci was one of the most famous painters’ engineers, and scientists of the Renaissance. How was Da Vinci able to find success in so many different arenas? Da Vinci once famously said, “Simplicity is the Ultimate Sophistication.”

Employing Simplicity in Investing

The easiest way to employ the simplicity mindset in the stock market is to monitor relative strength. Relative strength compares the performance of a stock or group of stocks versus the general market.

Example:If the S&P 500 Index is down by 1%, and XYZ stock is flat or up by 1%, XYZ exhibits relative strength.

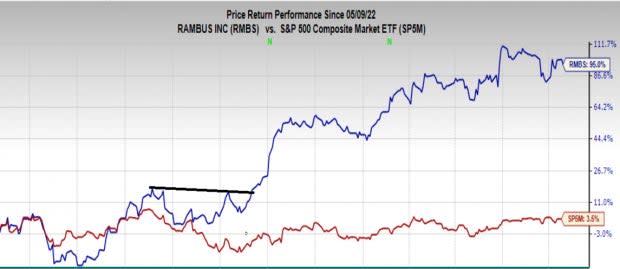

While the idea is simple, the results can be powerful. Rambus (RMBS) is a great example of relative strength. In late 2022, the stock minted fresh 52-week highs while the S&P 500 Index flushed to new lows. Sure enough, as soon as the S&P 500 Index bottomed on October 13th, Rambus was off to the races and never looked back.

Image Source: Zacks Investment Research

Current Examples

Early Monday, the Nasdaq 100 ETF (QQQ) fell by more than a percent. However, several stocks from the Internet – Software trend bucked the trend signaling relative strength.

Monday.com (MNDY)

Zacks Rank #1 (Strong Buy) stock Monday.com (MNDY) helps companies to build software applications and work management tools. MNDY has beat analyst expectations every quarter since going public in the middle of 2021.

Image Source: Zacks Investment Research

Datadog (DDOG)

Zacks Rank #2 (Buy) stock Datadog (DDOG) is another highly ranked software stock setting up for higher prices. DDOG provides a monitoring and analytics platform for developers, IT operations teams, and business users in the cloud age. The company sports impressive growth – growing each year sequentially since going public. Last quarter, revenue jumped 33% while earnings bolted 17% year-over-year.

Image Source: Zacks Investment Research

Datadog benefits when enterprises install their software and services across a wide range of computing platforms. Because monitoring the performance of all those applications can be tedious, time-consuming, and lead to errors, more and more companies are turning to DDOG.

Early Monday, shares of DDOG attempted to break out of a multi-week consolidation after pulling back for the first time since breaking out. The zone provides an attractive area from a reward-to-risk perspective.

Image Source: TradingView

MongoDB (MDB)

MongoDB’s (MDB) Atlas Platform helps to streamline the process of creating AI-powered Apps. Because AI is so revolutionary, it is almost guaranteed that more AI-based applications will come to the market. During MDB’s recent shareholder meeting, the company announced it would partner with Alphabet’s (GOOGL) Google Cloud to launch an AI initiative. Beyond Google, MongoDB is riding the AI wave by helping customers such as General Electric (GE), Toyota (TM), and Verizon (VZ) develop AI-related products.

Blow Out Earnings

MongoDB’s earnings call in early June was a game-changer for the company. Earnings per share jumped 180% while revenue shot higher by 29% year-over-year. MDB shares shot higher by 28% on daily volume quadrupling the norm – a sign of institutional accumulation. The stock is set up for a post-earnings drift trade because of the many fundamental catalysts and the fact that investors with significant gains are in no rush to sell shares.

Image Source: TradingView

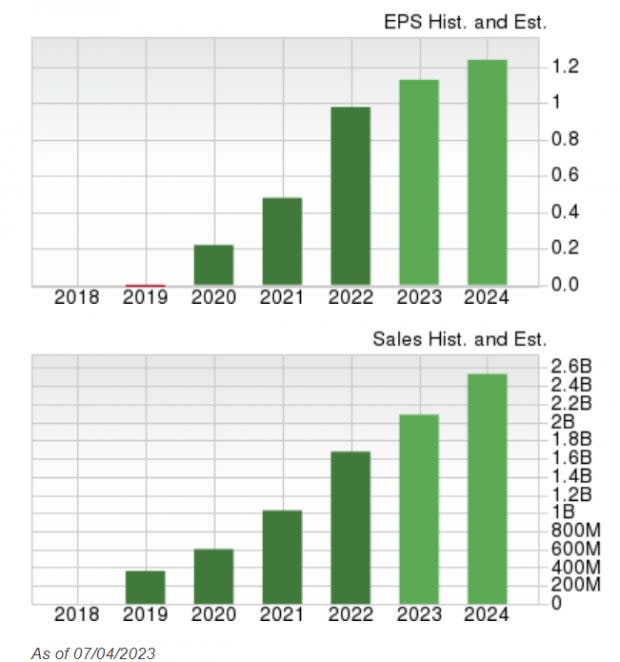

MDB has robust growth numbers, and the company has outpaced Zacks Consensus Estimates by a long shot. In the past three quarters, MDB has delivered triple-digit earnings surprises.

Image Source: Zacks Investment Research

Takeaway

Investors gain an edge when they pay attention to the simple, subtle clues equity markets provide on down days. What stocks are green? Which industry has multiple charts setting up? The plethora of fundamentally strong software stocks breaking out amidst a weak tape Monday should raise investor antennas. The Zacks Internet – Software Industry is ranked in the top 27% of all groups. Remember, our studies show that the top 50% groups tend to outperform by a factor of 2 to 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report