Boyd Gaming (BYD) Q3 Earnings Beat Estimates, Decline Y/Y

Boyd Gaming Corporation BYD reported third-quarter 2020 results, wherein the top and the bottom line beat the Zacks Consensus Estimate. However, both the metrics declined on a year-over-year basis.

Nonetheless, the company stated that it is making significant progress in terms of operating performances. Moreover, the company along with FanDuel Group rolled out mobile sports betting platforms in Illinois and Iowa, thereby expanding its reach to more than 30 million users nationwide. Notably, the company intends to capitalize on the growth opportunity with interactive gaming and mobile sports betting. Following the announcements, the company’s shares rose 2.8% during after-hour trading session on Oct 26.

Q3 Earnings and Revenues

In the quarter under review, adjusted earnings per share came in at 38 cents, topping the Zacks Consensus Estimate of 17 cents by 123.5%. However, the metric declined 2.6% from prior-year earnings of 39 cents per share.

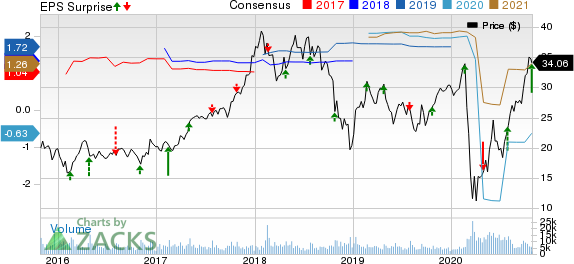

Boyd Gaming Corporation Price, Consensus and EPS Surprise

Boyd Gaming Corporation price-consensus-eps-surprise-chart | Boyd Gaming Corporation Quote

Total revenues of $652.2 million beat the consensus mark of $610 million by 43%. However, the top line declined 20.4% on a year-over-year basis.

Total adjusted EBITDAR during the reported quarter came in at $238.8 million, increasing 12% year over year.

Segmental Details

Las Vegas Locals

During the third quarter of 2020, revenues at this segment amounted to $171.1 million, down 19.8% year over year. However, the segment’s adjusted EBITDAR came in at $78.9 million compared with $64.1 million in the year-ago quarter. During the quarter under review, operating margin rose more than 1,600 basis points (bps) year over year to 46.1%.

Downtown Las Vegas

During the third quarter, revenues at the segment declined 71.1% from the prior-year quarter’s figure to $17.5 million. Adjusted EBITDAR came in at ($1.5) million against $11.9 million reported in the year-ago quarter. The decline can primarily be attributed to travel restrictions in Hawaii along with reduced visitation to Las Vegas.

Midwest and South Segment

During the third quarter, revenues at this segment fell 15% year over year to $463.6 million. However, adjusted EBITDAR came in at $182.5 million, compared with $156.2 million in the year-ago quarter. Meanwhile, operating margin during the quarter rose approximately 1,100 bps year over year to 39.4% on solid operating performance, partially offset by the impact of property closures at Hurricanes Laura and Sally.

Other Financial Details

As of Sep 30, 2020, the company had cash on hand of $506 million, compared with $1.31 billion as on Jun 30, 2020. Meanwhile, total debt during the third quarter amounted to $4.04 billion, compared with $4.98 billion as reported in second-quarter 2020.

Zacks Rank & Key Picks

Boyd Gaming currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Consumer Discretionary sector are YETI Holdings, Inc. YETI, Monarch Casino & Resort, Inc. MCRI and Red Rock Resorts, Inc. RRR, each carrying a Zacks Rank #2 (Buy).

YETI Holdings has a three-five-year earnings per share growth rate of 14.3%.

Earnings for Monarch Casino and Red Rock in 2021 are expected to surge 531% and 112.4%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Monarch Casino Resort, Inc. (MCRI) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research