Boeing (BA) Set to Deliver 5 878 Dreamliners to LATAM Group

The Boeing Company BA recently clinched an order from LATAM Group to deliver five of its 787 Dreamliner jets, in addition to the 41 of these aircraft that have already been scheduled for deliveries in the upcoming years. This contract should bolster Boeing’s footprint in Latin America’s commercial aerospace market.

Boeing’s Take in 787 Dreamliner

The Boeing 787 Dreamliner family has an unparalleled fuel efficiency and range flexibility. It uses 25% less fuel and creates 25% fewer emissions than the airplanes they replace. The jet offer passengers a matchless experience with comfort, spacious cabin, adjustable LED lighting, the largest windows and improved air quality.

The Boeing 787-9 aircraft can fly 300 passengers, 7,565 nautical miles (14,010km), with 25% better fuel per seat than the airplanes it will replace. Since its beginning in 2011, the 787 aircraft family has serviced more than 2,000 routes around the world.

Such remarkable features must have bolstered the demand for this jet family that translates into solid order growth for this aircraft. Currently, the company has 744 unfulfilled orders for 787 Dreamliner airplanes across the world. During November 2023, it received orders for 11 787 jets from Ethiopian Airlines, two jets from Royal Air Maroc and four from Royal Jordanian. Revenues earned from the delivery of these jets, including the latest deal for five jets, will significantly bolster Boeing’s commercial unit’s top line, which witnessed a solid 25% year-over-year improvement in the last reported quarter.

Prospects in the Latin America Market

As we continue to witness recovery of air traffic over the past few months, the Latin America region has emerged as a forerunner, with Brazil dominating this region.

To this end, a report by the Mordor Intelligence firm estimates that the Latin American commercial aircraft market will witness a CAGR of more than 10% during 2022-2027. Undoubtedly, such a solid market growth prospect offers strong expansion opportunities for Boeing, one of the largest commercial jet makers in the world.

With 668 commercial aircraft in service, Boeing expects demand for 2,530 new airplanes from Latin America and the Caribbean over the next two decades. This further reflects Boeing’s dominance in the Latin American commercial jet market.

Peer Prospects

A couple of other aerospace players that can gain from the expanding aviation market in the Latin America region are Airbus SE EADSY and Embraer SA ERJ.

Airbus has a long-standing presence in Brazil, Mexico and Chile. It has developed long-term collaborations with local entities such as LATAM Airlines Group, Azul Airlines etc. On Oct 2, 2023, LATAM Airlines took delivery of its first A321neo leased from AerCap and placed an order for 13 additional A321neo aircraft. On Dec 15, 2023, Azul Linhas Aereas disclosed order for four additional A330-900 from a purchase agreement signed in June 2023.

EADSY boasts a long-term (three to five-years) earnings growth rate of 12.4%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 12.9% from that reported in 2022.

Embraer’s E2 family of jets is operated by several airlines globally, including Azul airlines in Brazil. On Jun 27, 2023, Embraer concluded the sale of E190-E2 jet to Brazil’s financial institution, Crefisa, that will use the jet to provide charter operations to top football teams.

ERJ boasts a long-term earnings growth rate of 17%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 21.3% from that reported in 2022.

Price Performance

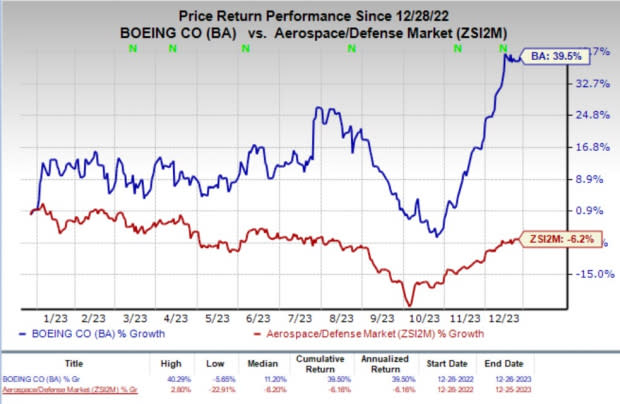

In the past year, shares of BA have rallied 39.5% against the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Pick

Boeing currently has a Zacks Rank #3 (Hold).

A better ranked stock in the same industry is Virgin Galactic Holdings Inc. SPCE, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SPCE boasts a long-term earnings growth rate of 40.3%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 192.1% from that reported in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Virgin Galactic Holdings, Inc. (SPCE) : Free Stock Analysis Report