Big Tech Earnings: Time to Buy Microsoft, Amazon, and Meta Stock?

Today’s episode of Full Court Finance at Zacks explores the broader earnings outlook as the results start to pour in from Tesla, Netflix, and tons of other big tech stocks. The episode then transitions to deeper dives into Microsoft, Amazon, and Meta to see if investors should consider buying these technology superstars heading into their upcoming earnings releases.

The stock market eventually closed solidly lower after Jay Powell’s speech Thursday. The Fed boss did appear to signal that the central bank won’t hike rates again, which should have pleased Wall Street. But Powell continued to say that the inflation fight isn’t over, suggesting higher for longer will remain the name of the game in the near term.

Powell, of course, was never going to come out and declare victory over inflation. Thankfully, Wall Street remains rather certain that the Fed is done tightening. This means that quarterly earnings results and guidance will likely drive the stock market in the coming weeks as long as the geopolitical fears don’t escalate.

Third quarter S&P 500 earnings are currently projected to slip by 1.1% and then grow by 5.1% in the fourth quarter and 12.5% in fiscal 2024. Peeking even further ahead, 2025 earnings are projected to surge another 11.7%, based on the most recent Zacks data. "One can expect this favorable turn in the overall earnings picture to strengthen further as companies report Q3 results and share trends in underlying business," Director of Research at Zacks Sheraz Mian wrote on Wednesday.

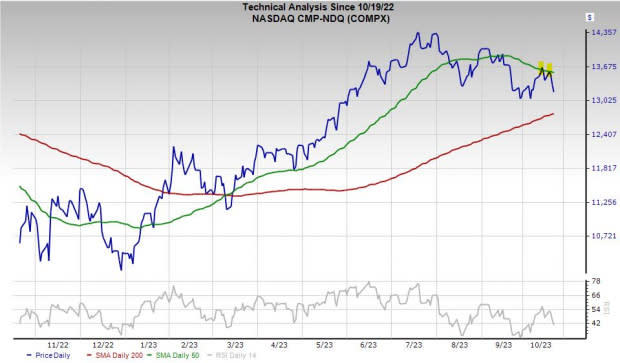

Image Source: Zacks Investment Research

Looking ahead, the 50-day moving average for both the S&P 500 and the Nasdaq should be a line in the sand the bulls can retake if the earnings results and more importantly guidance match or top expectations. The nearby chart showcases that the Nasdaq got rejected at its 50-day twice already in October following its nice rally.

Microsoft (MSFT) is set to report its first quarter FY24 results on October 24. The big news heading into its release is that MSFT finally closed its $75 billion acquisition of Activision Blizzard as a massive bet on gaming and the future of VR and the metaverse.

Microsoft is a technology titan that already recalibrated its long-term trajectory with its expansion into cloud computing. MSFT is also rolling out more AI efforts, while Office, Windows, and more remain staples of the economy.

Image Source: Zacks Investment Research

Current Zacks estimates call for Microsoft to post double-digit top and bottom line growth both this year and next. And its most accurate/most recent EPS estimates are coming in above consensus.

MSFT shares have surged 40% YTD and currently trade 18% below their average Zacks price target. The stock is also trading above its 50-day moving average. On the valuation side of the coin, Microsoft trades around 20% below its 10-year highs at 29.1X forward 12-month earnings. On top of that, Microsoft recently announced that it raised its dividend by 10%.

Meta Platforms, Inc. (META) will release its Q3 FY23 financial results on October 25. The parent company of Facebook, Instagram, and WhatsApp reaches billions of people a day and its user base continues to expand.

META grew its daily active people by 7% last quarter to 3.07 billion, with monthly active people up to 3.88 billion. For better or worse, people are addicted to their phones, which means advertisers will keep paying to reach them where they are. This means Mark Zuckerberg’s metaverse bet doesn’t have to pay off anytime soon.

Image Source: Zacks Investment Research

Meta, like many other tech companies, is now focused on profitability and efficiency over breakneck growth. Speaking of, Meta is projected to grow its adjusted earnings by 36% in 2023 and another 26% next year on the back of 14% and 13%, respective sales expansion. Plus, its earnings outlook has continued to improve.

Meta stock has soared 160% YTD vs. the Zacks Tech sector's 35%, yet it is still trading below its peaks and 15% under its average Zacks price target. On top of that, Meta trades at a 14% discount to the Zacks tech sector and 23% below its own 10-year median at 19.7X forward 12-month earnings. On top of that, Meta is currently trading above its 50-day moving average.

The last stock we dive into today is Amazon (AMZN) before it reports on October 26. Amazon stock suffered a massive fall from grace as Wall Street punished the stock amid soaring interest rates, helping force the firm to concentrate on the bottom line. Amazon’s adjusted earnings are projected to soar by 214% in 2023 and another 39% next year on the back of 11% and 13%, respective revenue expansion.

Amazon’s upward earnings revisions help it land a Zacks Rank #2 (Buy) right now. Wall Street also remains very high on the stock, with 35 of the 40 brokerage recommendations Zacks has coming in at “Strong Buys.” The upbeat outlook makes sense considering its market-leading share of cloud computing and e-commerce.

Image Source: Zacks Investment Research

Amazon shares are up 610% in the last decade vs. the S&P 500’s 150%. More recently, Amazon has climbed 53% YTD. Yet the stock is still trading nearly 30% from its peaks and 32% below its average Zacks price target.

The stock is also trading 65% below its highs at 44X forward 12-month earnings, which is still rather rich for many investors. Yet, its peg ratio, which factors in its longer-term earnings outlook, marks a 22% discount vs. the Zacks tech sector.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report