Best Value Stocks to Buy for March 10th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, March 10th:

Global Ship Lease GSL: This rapidly growing containership company which owns and charters out containerships under long-term, fixed rate charters to world class container liner companies, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.9% over the last 60 days.

Global Ship Lease, Inc. Price and Consensus

Global Ship Lease, Inc. price-consensus-chart | Global Ship Lease, Inc. Quote

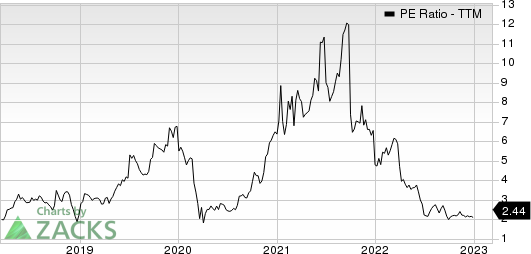

Global Ship Lease has a price-to-earnings ratio (P/E) of 2.29 compared with 6.50 for the industry. The company possesses a Value Score of A.

Global Ship Lease, Inc. PE Ratio (TTM)

Global Ship Lease, Inc. pe-ratio-ttm | Global Ship Lease, Inc. Quote

Mercedes-Benz Group AG MBGAF: This automotive company which operates principally in Germany and internationally and develops, manufactures and sells passenger cars comprising premium and luxury vehicles of the Mercedes-Benz brand, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.7% over the last 60 days.

Mercedes-Benz Group AG Price and Consensus

Mercedes-Benz Group AG price-consensus-chart | Mercedes-Benz Group AG Quote

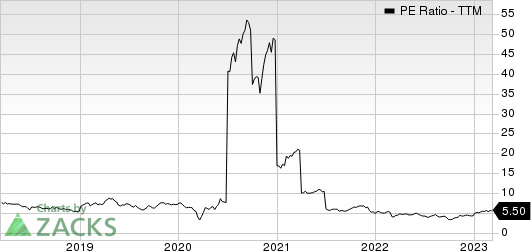

Mercedes-Benz Group AG has a price-to-earnings ratio (P/E) of 5.76 compared with 8.70 for the industry. The company possesses a Value Score of A.

Mercedes-Benz Group AG PE Ratio (TTM)

Mercedes-Benz Group AG pe-ratio-ttm | Mercedes-Benz Group AG Quote

Selective Insurance Group SIGI: This company which operates as a P&C insurer and offers insurance products and services across the United States, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.0% over the last 60 days.

Selective Insurance Group, Inc. Price and Consensus

Selective Insurance Group, Inc. price-consensus-chart | Selective Insurance Group, Inc. Quote

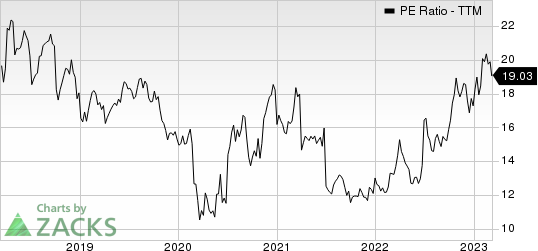

Selective Insurance Group has a price-to-earnings ratio (P/E) of 14.90 compared with 19.00 for the S&P. The company possesses a Value Score of B.

Selective Insurance Group, Inc. PE Ratio (TTM)

Selective Insurance Group, Inc. pe-ratio-ttm | Selective Insurance Group, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Selective Insurance Group, Inc. (SIGI) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report