Best Growth Stocks to Buy for November 10th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, November 10th:

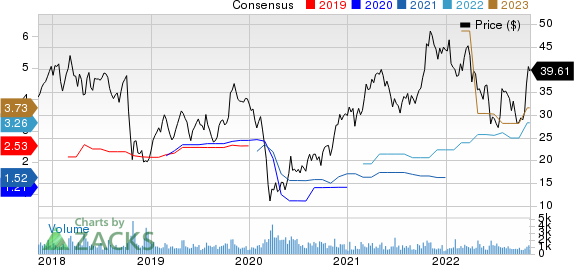

H&E Equipment Services HEES: This company which is one of the largest integrated equipment services companies in the United States with full-service facilities throughout the Intermountain, Southwest, Gulf Coast & Southeast regions of the United States, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 17.3% over the last 60 days.

H&E Equipment Services, Inc. Price and Consensus

H&E Equipment Services, Inc. price-consensus-chart | H&E Equipment Services, Inc. Quote

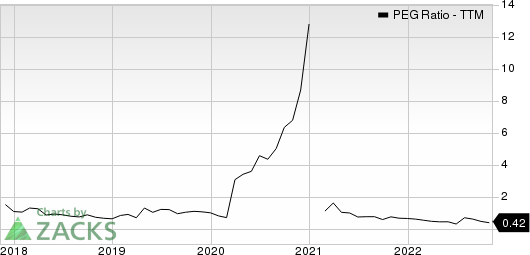

H&E Equipment Services has a PEG ratio of 0.40 compared with 0.90 for the industry. The company possesses a Growth Score of A.

H&E Equipment Services, Inc. PEG Ratio (TTM)

H&E Equipment Services, Inc. peg-ratio-ttm | H&E Equipment Services, Inc. Quote

Lamb Weston LW: This company which is a leading global manufacturer, marketer and distributor of value-added frozen potato products, particularly French fries, and also provides a range of appetizers, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.6% over the last 60 days.

Lamb Weston Price and Consensus

Lamb Weston price-consensus-chart | Lamb Weston Quote

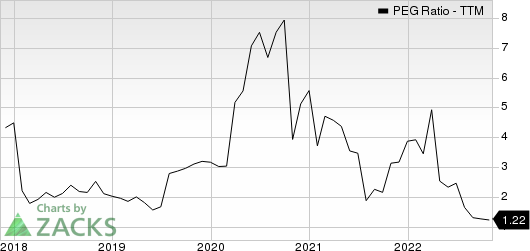

Lamb Weston has a PEG ratio of 1.04 compared with 2.22 for the industry. The company possesses a Growth Score of A.

Lamb Weston PEG Ratio (TTM)

Lamb Weston peg-ratio-ttm | Lamb Weston Quote

Grupo Financiero Santander Mexico BSMX: This banking services company withproducts and services consist of securities brokerage, financial advice services, as well as other related investment activities and operations aimed at individuals and small and medium enterprises, carries a Zacks Rank #1 and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.8% over the last 60 days.

Grupo Financiero Santander Mexico S.A. B. de C.V. Price and Consensus

Grupo Financiero Santander Mexico S.A. B. de C.V. price-consensus-chart | Grupo Financiero Santander Mexico S.A. B. de C.V. Quote

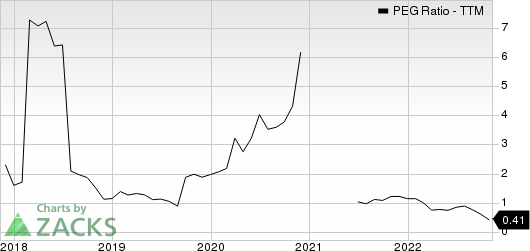

Grupo Financiero Santander Mexico has a PEG ratio of 0.42 compared with 0.72 for the industry. The company possesses a Growth Score of B.

Grupo Financiero Santander Mexico S.A. B. de C.V. PEG Ratio (TTM)

Grupo Financiero Santander Mexico S.A. B. de C.V. peg-ratio-ttm | Grupo Financiero Santander Mexico S.A. B. de C.V. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

Grupo Financiero Santander Mexico S.A. B. de C.V. (BSMX) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research