Is a Beat in Store for Glaxo (GSK) This Earnings Season?

We expect GlaxoSmithKline plc GSK to beat expectations when it reports third-quarter 2020 results on Oct 28. In the last reported quarter, the company delivered a negative earnings surprise of 2.04%.

Shares of Glaxo have underperformed the industry so far this year. The stock has declined 25.3% compared with the industry’s decrease of 3.6%.

Glaxo’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, delivering beat of 7.33%, on average.

Reopening of major economies is likely to have helped the company to recover from some of the disruption caused by COVID-19.

Factors to Consider

During the third quarter, growth in Glaxo’s revenues is likely to have been driven by Pharmaceutical and Consumer Healthcare segment, partially offset by weaker vaccine sales. On its second-quarter earnings call, the company had stated that it expects limited impact from COVID-19-related stocking patterns on its Pharmaceutical and Consumer Healthcare segment in the second half. However, notable risks for the Vaccine segment remain. Meanwhile, the impact of Advair generics and rising competition in the HIV segment, especially for three-drug regimens, might have hurt sales.

The growth trend in sales of the Respiratory category might have continued in the third quarter on the back of strong demand for Trelegy Ellipta and Nucala despite the pandemic. At-home administration of these drugs have helped them remain in the positive territory. We expect the strong momentum to have continued in the soon-to-be reported quarter. However, older respiratory drugs — Advair and Relvar/Breo Ellipta — facing competitive and pricing pressure are likely to have unfavorably impacted Glaxo’s sales.

Demand for Glaxo’s key vaccine, Shingrix, as well as other vaccines in its portfolio was significantly hampered in the second quarter due to stay-at-home directives in the United States, which led to lower vaccination rates. The company is likely to have witnessed some recovery in vaccination rates in the third quarter, which might have benefited sales of Shingrix and other vaccines. However, negative impact divestment of certain vaccines may have hurt revenues from the portfolio.

Sales of meningitis vaccines, Bexsero, acquired from Novartis AG NVS, and Menveo were significantly hurt in the second quarter by lower demand across all regions following de-prioritization of vaccination during the COVID-19 pandemic. Decline in sales of these two vaccines is likely to have continued in the third quarter.

Sales of Glaxo’s lupus drug, Benlysta, showed impressive growth in the previous quarter despite COVID-19 related disruption. We expect the momentum to have continued in the soon-to-be reported quarter.

Oncology sales, solely from Zejula, are also likely to have witnessed growth. Moreover, the label expansion of Zejula as first-line maintenance treatment of ovarian cancer patients regardless of biomarker status in April boosted its share in first-line maintenance in the second quarter. A likely continuation of the trend is likely to have boosted sales.

Meanwhile, the competitive environment and the shift in portfolio toward two-drug regimens may have hurt sales of three-drug regimens — Tivicay and Triumeq — and older HIV drugs. However, the strong growth trend witnessed in two-drug regimens, Juluca and Dovato, might have helped the company to partially offset some of the losses in sales of three-drug regimens.

Third-quarter sales of consumer healthcare business are likely to have been primarily driven by Pfizer’s PFE legacy brands. Glaxo formed a joint venture with Pfizer in August 2019 to create the world’s largest consumer healthcare business. Moreover, re-opening of economies is likely to have boosted sales of the segment in the third quarter.

We expect the company to provide an update on the anticipated impact of this global crisis on its future business on the call.

Recent Key Developments

Glaxo has several programs ongoing for combating coronavirus pandemic. The company has signed supply deals with several countries for its adjuvant vaccine candidate being developed in collaboration with Sanofi. Glaxo is also developing an antibody candidate for the treatment of severe pulmonary COVID-related disease, individually.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Glaxo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate (84 cents per ADS) and the Zacks Consensus Estimate (78 cents per ADS) is +7.23%.

Zacks Rank: Glaxo currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

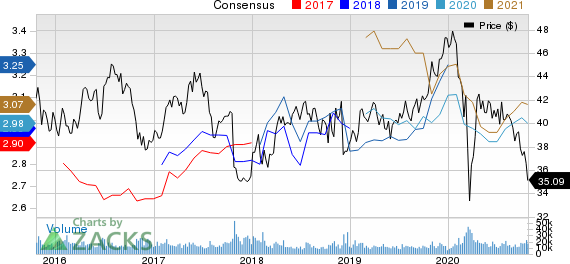

GlaxoSmithKline plc Price and Consensus

GlaxoSmithKline plc price-consensus-chart | GlaxoSmithKline plc Quote

Another Stock to Consider

Here is a large biotech stock that you may also want to consider, as our model shows that it has the right combination of elements to post an earnings beat this season.

Merck MRK has an Earnings ESP of +2.6% and a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck Co., Inc. (MRK) : Free Stock Analysis Report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research