Bear of the Day: Icahn Enterprises (IEP)

Company Overview

Zacks Rank #5 (Strong Sell) Icahn Enterprises (IEP) is a diversified holding company founded and controlled by billionaire Carl Icahn. Icahn Enterprises invests in investment management, metals, real estate, and home fashion companies through its subsidiaries and affiliates. Icahn Enterprises is known for its involvement in corporate governance matters and its efforts to management boards and decisions in the companies it invests in. As the company’s chairman, Carl Icahn plays a key role in setting its investment strategies and overseeing its operations.

Short-Seller Report: Hit Piece or Red Flag?

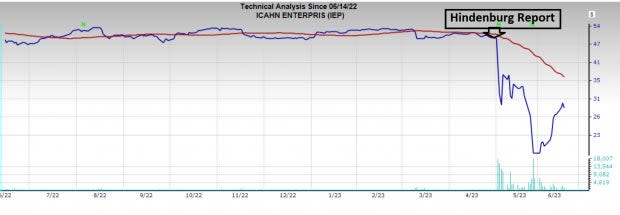

Last month, Hindenburg Research, a U.S. short-focused investment research firm, unveiled a short report thesis on Icahn Enterprises. Shares of IEP swooned immediately following the report, dropping 55% for May on massive volume turnover.

Image Source: Zacks Investment Research

In the short report, Hindenburg Research made bold accusations against IEP, claiming the company is inflating its illiquid private holdings. According to Hindenburg’s research:

· IEP assets trade at a 218% premium to its last reported Net Asset Value (NAV)

· IEP’s premium to NAV is higher than every closed-end fund and double the next highest.

· IEP uses Carl Icahn’s legendary status and a hefty dividend to attract investors. Meanwhile, institutional investors have little to no exposure in the company.

What is Hindenburg’s Track Record?

Because short-focused research shops often release “hit pieces” to manipulate stocks for short-term gains, investors need to be wary of them. However, Hindenburg Research is an exception to this rule. In late 2020, Hindenburg accused EV-maker Nikola (NKLA) of fraud. Since then, the stock has dropped from $50 to $1.

Image Source: Zacks Investment Research

Hindenburg also raised a red flag on the SPAC Clover Health (CLOV). Like NKLA, CLOV dove and hasn’t looked back since. Most recently, Hindenburg pointed out accounting inconsistencies in Adani – India’s largest company. Since then, certain banks have stopped accepting Adani loans as collateral.

By the Numbers

Whether you agree with Hindenburg’s assessment or not, IEP’s fundamentals are unattractive at this juncture. Since 2018, IEP has posted negative EPS. Compared to its industry, IEP has lower historical EPS growth, projected sales growth, net margin, return on equity, and soaring debt.

Image Source: Zacks Investment Research

Conclusion

With equities in a robust bull market, investors have ample opportunities outside Icahn Enterprises. The inflated NAV, poor fundamentals, and negative headlines should be red flags for prospective investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Icahn Enterprises L.P. (IEP) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Clover Health Investments, Corp. (CLOV) : Free Stock Analysis Report