Barnes (B) Teams Up With RTX's P&WC for Engine Component Repair

Barnes Group Inc. B recently finalized a long-term extension of a repair services contract with RTX Corporation’s RTX Pratt & Whitney Canada (“P&WC”). Per the agreement, both companies will collaborate on maintenance, repair and overhaul of highly engineered and complex parts utilized in aero engine cases, rotating components, seals and shrouds.

The recently signed contract extension is a testimony to the longstanding partnership between Barnes and P&WC, which started in the 1970s. The agreement will boost both companies’ partnership in the development of repairs for new and existing aerospace engines.

As noted, B will leverage its strong capabilities and expertise in repair services to offer quality repairs with impressive turn-around-time for P&WC. This will help P&WC to keep its robust fleet of engines in flight and maintain an appropriate turn-around-time for the engines, which are under maintenance.

It’s worth noting that Barnes’ repair facilities are certified by the U.S. Federal Aviation Administration, European Aviation Safety Agency, as well as other regulatory bodies.

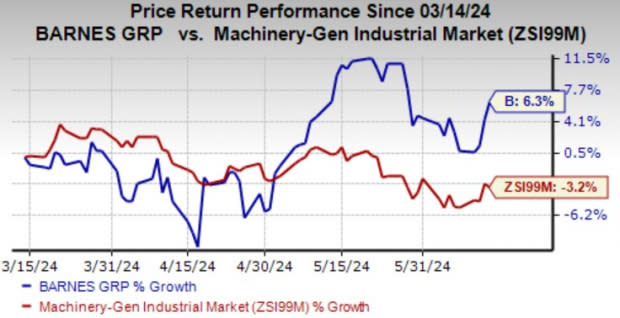

Zacks Rank & Price Performance

Barnes, with a $2 billion market capitalization, currently carries a Zacks Rank #3 (Hold). The company is likely to benefit from strength in the Aerospace segment, driven by solid demand across aerospace aftermarket and aerospace Original Equipment Manufacturing businesses. However, rising costs and expenses due to high raw material costs remain concerning.

Image Source: Zacks Investment Research

B’s shares have increased 6.3% against the industry’s decline of 3.2% in the past three months.

The Zacks Consensus Estimate for B’s current-year earnings has improved 1.2% over the last 60 days.

Key Picks

A couple of better-ranked companies from the same space are discussed below.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter average earnings surprise of 8.2%. The consensus estimate for AIT’s fiscal 2024 earnings has improved 1.4% in the past 60 days.

Ingersoll Rand Inc. IR presently carries a Zacks Rank #2 (Buy) and has a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for IR’s 2024 earnings has grown 1.9% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report