Barclays (BCS) to Trim Trading, IB and Retail Banking Workforce

Barclays PLC BCS is slashing jobs. Per a Bloomberg report, the company intends to eliminate hundreds of jobs across its trading and investment bank (IB) divisions, while separately, Reuters reported that BCS is considering trimming approximately 400 jobs in its retail banking business as part of its broader strategic review.

Persons familiar with the matter noted that Barclays plans to eliminate around 5% of its client-facing employees in the trading business, along with a number of dealmakers globally, and restructure teams within its U.K. consumer-banking business.

This is part of Barclays’ annual evaluation of performance and this round of cuts were unrelated to the one in the retail banking operation. The sources knowing the matter stated that some retail employees could be transferred or made redundant on a voluntary basis.

The performance of the capital markets business has been discouraging since the past year. Even in the first half of 2023, the company's Global Markets income and Investment Banking fees decreased 25% and 11%, respectively, on a year-over-year basis.

On the second-quarter earnings call, C.S. Venkatakrishnan, CEO of Barclays, said, “We have delivered on our cost guidance this quarter and remain committed to driving a lower cost-to-income ratio over time.” Over the medium term, the cost to income ratio is targeted to be below 60%.

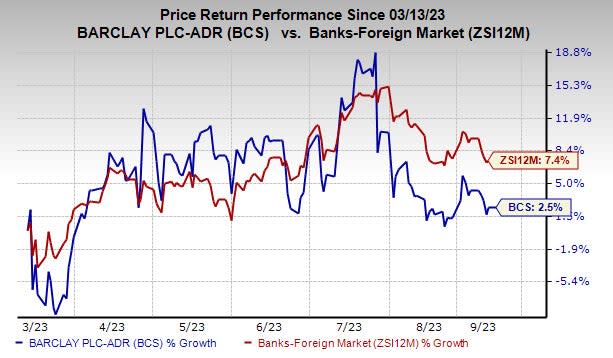

Over the past six months, shares of BCS have gained 2.5% compared with the industry's upside of 7.4%.

Image Source: Zacks Investment Research

Currently, Barclays carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Similar to BCS, The Goldman Sachs Group, Inc. GS and The Charles Schwab Corporation SCHW have been reducing their workforce.

GS is planning another wave of job cuts that could take place as soon as next month, per a Financial Times article. This is part of its yearly practice of letting go of those employees who are deemed to be the lowest performers.

The expected move usually affects between 1-5% of GS’ total staff. The company is aiming to cut jobs at the lower end of the range, primarily in its main business divisions like IB and trading.

Last month, SCHW announced a business streamlining plan as part of its cost-saving measures. Per the filing with the Securities and Exchange Commission, the company will slash jobs and close or downsize its corporate offices with an aim to achieve at least $500 million in annual cost savings.

In addition to the cost efficiencies associated with the integration of TD Ameritrade (acquired by Schwab in October 2020), the above-mentioned action is a step taken to simplify its business to better prepare for the post-integration period.

While Schwab did not mention the count of positions that will be impacted by this move, it stated that in the coming months, jobs mostly in non-client-facing areas will be eliminated.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report