AZUL Incurs Wider-Than-Expected Loss in Q4, Beats on Revenues

Azul AZUL incurred a loss (adjusted) of $1.49 per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of 80 cents. In the year-ago period, the company reported adjusted earnings of 95 cents per share. While air-travel demand is gradually recovering from the coronavirus-led lows, it is still significantly below 2019 levels, as reflected in the fourth-quarter results.

However, total revenues of $331 million outperformed the Zacks Consensus Estimate of $313 million. While the top line jumped more than 100% sequentially, owing to improved travel demand, the same declined more than 45% year over year. Passenger revenues, accounting for 85.7% of the top line, plunged 50.7% year over year due to coronavirus-led suppressed air-travel demand. Cargo and other revenues surged 65.9% year over year primarily due to strong e-commerce growth.

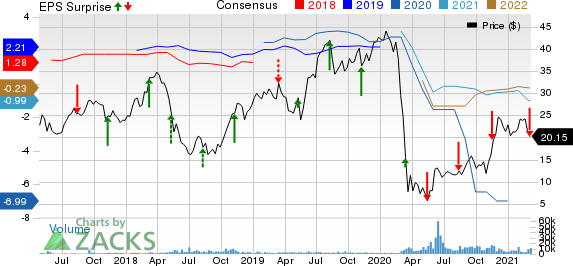

AZUL SA Price, Consensus and EPS Surprise

AZUL SA price-consensus-eps-surprise-chart | AZUL SA Quote

Operational Statistics

Consolidated revenue passenger kilometers ("RPK”), measuring revenues generated per kilometer per passenger, fell 35.5%. The metric declined 20.7% domestically and 82.8% internationally.

Consolidated available seat kilometers (“ASK”), measuring an airline's passenger-carrying capacity, decreased 33.4% year over year. While domestic capacity dropped 19.7%, international capacity contracted 78.6%. At the end of 2020, the airline’s domestic capacity was more than 90% of the 2019 level. Azul expects its first-quarter 2021 capacity to increase from the same in first-quarter 2019.

With traffic declining more than the amount of capacity contraction, consolidated load factor (percentage of seats filled with passengers) deteriorated 260 basis points to 80.8%.

While total revenues per ASK, or RASK, decreased 17.6%, passenger revenues per ASK, or PRASK, fell 25.9%. Meanwhile, cost per ASK (“CASK”) climbed 17.2% on 31.2% devaluation in the Brazilian real against the U.S. dollar. Jet fuel prices declined 16% year over year. CASK, excluding fuel, augmented 35.3%. Average fare increased 17% from the year-ago quarter’s figure.

Azul exited the fourth quarter with total passenger operating fleet of 162 aircraft. The average age of the fleet was 8.3 years. Contractual fleet size was 185.

Liquidity

Azul, carrying a Zacks Rank #3 (Hold), exited the fourth quarter with total liquidity of R$7.86 billion, up 13.2% year over year. Additionally, total debt decreased 4.5% to R$17.2 billion from the September-end figure due to debt repayments made during the quarter and appreciation of the Brazilian real against the U.S. dollar. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Airline Stocks

Ryanair Holdings RYAAY, carrying a Zacks Rank #4 (Sell), incurred a loss (excluding 8 cents from non-recurring items) of $1.62 per share in the third quarter of fiscal 2021 (ended Dec 31, 2020), narrower than the Zacks Consensus Estimate of a loss of $1.95. Quarterly revenues of $406.9 million lagged the Zacks Consensus Estimate of $495 million.

SkyWest SKYW, carrying a Zacks Rank #3, incurred a loss of 93 cents per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of 87 cents. Quarterly revenues of $589.6 million surpassed the Zacks Consensus Estimate of $530 million.

Southwest Airlines LUV, carrying a Zacks Rank #4, incurred a loss of $1.29 per share (excluding 25 cents from non-recurring items) in the fourth quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $1.69. Meanwhile, operating revenues of $2,013 million lagged the Zacks Consensus Estimate of $2,117.5 million.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research