Autoliv (ALV) Q4 Earnings & Sales Top Mark, '21 View Strong

Autoliv, Inc. ALV reported fourth-quarter 2020 adjusted earnings of $2.19 per share, which topped the Zacks Consensus Estimate of $2.05. Higher-than-anticipated revenues from both the segments led to the outperformance. The bottom line was also higher than $1.84 per share recorded in the year-ago quarter. Robust demand of Autoliv’s products and cost-cut efforts resulted in improved year-over-year performance

The company reported net sales of $2,517 million for the quarter, up from the prior-year figure of $2,192 million. Moreover, the figure beat the Zacks Consensus Estimate of $2,453 million.

Autoliv reported adjusted operating income of $311 million, up 28.5% year over year. Adjusted operating margin from continuing operations was 12.4% for the reported quarter, higher than 11.1% in the corresponding period of 2019.

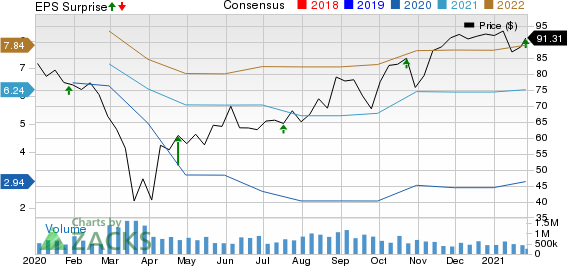

Autoliv, Inc. Price, Consensus and EPS Surprise

Autoliv, Inc. price-consensus-eps-surprise-chart | Autoliv, Inc. Quote

Segmental Performance

Sales in the Airbags and Associated Products segment totaled $1,636.7 million, surpassing the Zacks Consensus Estimate of $1,538 million. Moreover, revenues were higher than the year-ago level of $1,443.6 million. While knee airbags witnessed the highest sales growth on a year-over-year basis, revenues from replacement inflators declined $16 million.

Sales in the Seatbelts and Associated Products segment totaled $880.1 million, up 17.7% from the prior-year quarter. Further, the figure topped the consensus mark of $844 million. Higher revenues from North America, Europe, China and Japan aided the results.

Financial Position

Autoliv had cash and cash equivalents of $1,178.2 million as of Dec 31, 2020. Long-term debt totaled $2,109.6 million, increasing from $2,007.1 million as of Sep 30, 2020. Net capital expenditure decreased to $111.1 million from the year-ago figure of $118 million.

Road Ahead

Per IHS Markit, global light vehicle production (LVP) in 2021 is expected to be lower than the second half of 2020. The firm expects semiconductor shortage to result in LVP production decline at least during the first half of the year, which may in turn lead to lost revenues for Autoliv. Nonetheless, sales are expected to recover in the second half of 2021. As such, Autoliv expects full-year 2021 net sales to rise 25% year over year. Adjusted operating margin is expected to be 10%. Operating cash flow for 2021 is envisioned to be on par with 2020 levels.

Zacks Rank & Key Picks

Autoliv currently holds a Zacks Rank #4 (Sell). Some better-ranked stocks from the auto space include Magna International MGA, Dana Incorporated DAN, and American Axle & Manufacturing AXL, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Dana Incorporated (DAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research