Atlassian (TEAM) to Report Q2 Earnings: What's in the Cards?

Atlassian TEAM is scheduled to report second-quarter fiscal 2021 results on Jan 28.

Atlassian projects fiscal second-quarter revenues to lie between $460 million and $475 million (mid-point $467.5 million). The Zacks Consensus Estimate for revenues is pegged at $469.7 million, suggesting growth of 14.9% from the year-ago period.

The company anticipates non-IFRS earnings of 30-32 cents per share (mid-point 31 cents). The Zacks Consensus Estimate is pegged at 31 cents per share, 16.2% lower than the 37 cents reported in the year-ago quarter.

Notably, the company’s earnings surpassed estimates in all of the trailing four quarters, the average surprise being 24.5%.

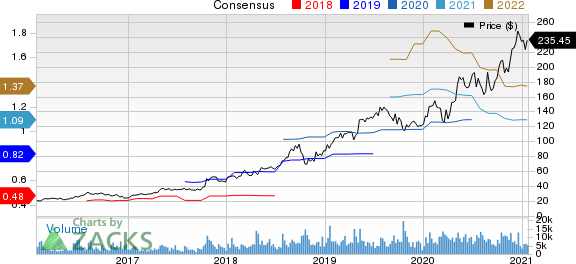

Atlassian Corporation PLC Price and Consensus

Atlassian Corporation PLC price-consensus-chart | Atlassian Corporation PLC Quote

Let’s see how things have shaped up prior to the upcoming announcement.

Factors at Play

Atlassian’s fiscal second-quarter performance is likely to have benefited from the rising demand for remote-working tools amid the COVID-19 pandemic-led work-from-home trend.

The growing adoption of the company’s cloud-based solutions and massive digitalization of work in organizations, big or small, is likely to have driven its quarterly performance. Increasing demand for the company’s cloud products from new customers as well as the existing clients using on-premises products might have been another tailwind.

Healthy demand for core products like Jira and Confluence, coupled with the rising uptake of new products like Jira Service Desk, Jira Ops and Bitbucket, is anticipated to have been a key growth driver during the period in discussion. Improvement in product quality and performance, multiple product launches and increased pricing are anticipated to have boosted quarterly revenues.

Robust growth in subscription revenues, aided by the solid uptake of the company’s cloud-service offerings, will likely reflect on the to-be-reported results as a consistent key catalyst.

What Our Model Says

Our proven model does not predict an earnings beat for Atlassian this season. The combination of a positive Earnings ESP, and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Atlassian currently carries a Zacks Rank of 3 and has an Earnings ESP of 0.00%.

Stocks With Favorable Combinations

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat in their upcoming releases:

Skyworks Solutions, Inc. SWKS has an Earnings ESP of +1.02% and currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Advanced Micro Devices, Inc. AMD has an Earnings ESP of +2.26% and holds a Zacks Rank of 3 currently.

Texas Instruments Incorporated TXN has an Earnings ESP of +1.90% and carries a Zacks Rank #3, at present.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research