Aspen's (AZPN) Artificial IoT Solutions Used by Birla Carbon

Aspen Technology, Inc. AZPN has announced that India-based Birla Carbon is leveraging AspenTech’s Artificial Internet of Things (AIoT) solutions, including Aspen InfoPlus.21 and aspenONE Process Explorer, to scale enterprise visibility across nine manufacturing sites globally.

Birla Carbon is a manufacturer and supplier of carbon black additives, which has 16 manufacturing facilities spread across 12 countries, with a total yearly production capacity of over two million tonnes, per company report.

Aspen Technology, Inc. Price and Consensus

Aspen Technology, Inc. price-consensus-chart | Aspen Technology, Inc. Quote

Birla Carbon plans to tap the industrial data by leveraging AspenTech’s AIoT solutions to speed up enterprise visibility by using an integrated approach to manage Industrial Artificial Intelligence (AI) applications.

This will allow the company to reduce the total cost of ownership and complexity as well as provide its employees with the optimal technology tool for improved productivity.

Aspen Technology provides asset optimization software solutions that assist in optimizing process manufacturing by supporting real-time decision making, predicting equipment failure, and providing the ability to forecast and simulate potential actions.

Per a report available on Research And Markets, enterprise asset management market is projected to witness a CAGR of 14.2% between 2020 and 2030. This augurs well for Aspen Technology.

Synergies from acquisitions are also aiding Aspen Technology in driving top-line growth. Recently, it concluded the merger with Emerson Electric Co. The merger involves the integration of Emerson's OSI Inc and Geological Simulation Software (“GSS”) businesses with Aspen.

Recently, Aspen Technology inked an agreement to acquire Micromine from Potentia Capital and other sellers for AU$900 million or approximately $623 million in an all-cash deal.

The company recently reported fourth-quarter fiscal 2022 non-GAAP earnings of $2.43 per share, beating the Zacks Consensus Estimate by 13%. The company reported non-GAAP earnings of 38 cents per share in the year-ago quarter.

Revenues of $238.9 million missed the Zacks Consensus Estimate by 19.7%. The company reported revenues of $77.4 million in the year-ago quarter.

However, increasing business acquisitions lead to integration risk. Stiff competition and supply-chain constraints are further concerns.

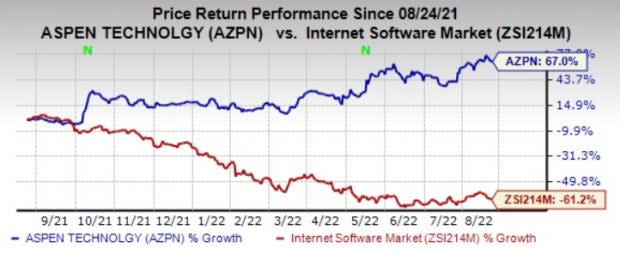

Aspen currently holds a Zacks Rank #3 (Hold). In the past year, shares of the company have returned 67% against the industry’s decline of 61.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Cadence Design Systems CDNS, Badger Meter BMI and Arista Networks ANET. Cadence Design Systems, Badger Meter and Arista Networks each sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have jumped 15.6% in the past year.

The Zacks Consensus Estimate for BMI’s 2022 earnings is pegged at $2.30 per share, up 6% in the past 60 days.

Badger Meter’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, with the average being 12.6%. Shares of BMI have lost 8.5% of their value in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $4.03 per share, increasing 9.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 34.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research