'Apple shares won't double again but Samsung's will'

Technology is one the few parts of the economy to have thrived through the pandemic. Working from home, socialising on the internet and having to order our shopping online have sped up the use of countless digital platforms.

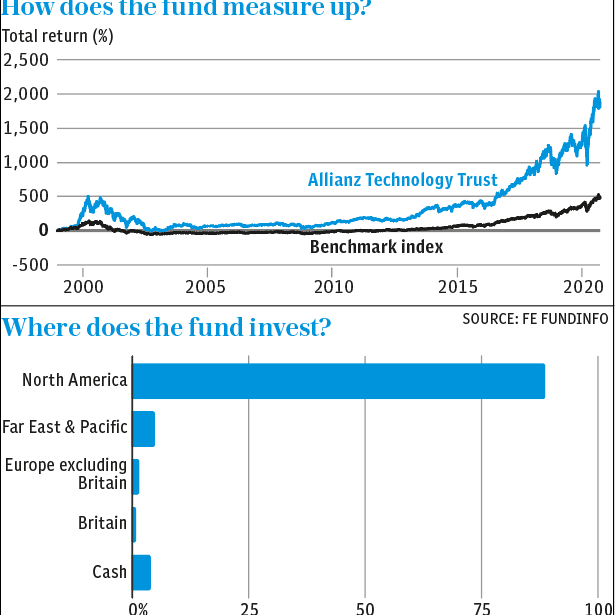

Walter Price has taken full advantage of these trends to drive his £1bn Allianz Technology Trust, which has returned 44.8pc this year so far. He tells Telegraph Money how he spotted the winners of the working from home revolution and how he learned a hard lesson after he was stung in China.

Who is the fund for?

It is for investors who believe that technology investments should be part of their portfolio. Technology is broadening its reach throughout the world and continues to expand into other industries.

How do you define a technology stock?

If technology is driving the company then it is a technology stock as far as we are concerned. It is a broad definition so it allows us to invest in a wide range of companies: in the past we have invested in oil, defence, aerospace and industrial companies.

How do you select stocks?

The first thing we look for is a market subsector of technology that has high growth because either it is a new way to do things or it is a lower-cost way. We then look for a leader in that subsector; we get to know the different companies before we decide which is going to be the leader.

Then we look at management to see how they plan to differentiate their company and make returns for shareholders.

How has the pandemic affected your stocks?

Technology has come through the pandemic pretty well. It is a broad sector so some areas have been really hurt, such as suppliers to the travel industry or companies that provide on-premise computer products.

But in general the pandemic has been good for tech firms. There are obvious winners: the beneficiaries of stay-at-home, such as Netflix or video game companies. A lot of them have been put on the map by the pandemic. It has shown how important it is for companies to complete their digital transformation so they have more flexibility within their business.

Have you made changes to your portfolio?

We made a lot of changes when we first saw the pandemic coming. We saw what it was doing to the economy and businesses in China so we sold some of our vulnerable companies, including some semiconductor makers. We have since started to buy them back again.

We have also been trimming some of the high-growth companies where the market got a little ahead of itself in the past couple of months. About 5pc of the portfolio is in cash. The idea is that if these companies do get hit we want to be able to buy them back at lower prices. We believe in these companies, but in some cases the market has got overly enthusiastic.

Can the tech giants double in value again?

Apple has been great from a valuation standpoint over recent years, but it is unlikely it will double again in price.

For a lot of these companies, we will be counting on earnings growth now to power the stocks forward. So we are focusing on companies that are associated with cloud computing, for example.

The other area we are very enthusiastic about is security. As infrastructure moves online we need to have much more security for individuals, companies and countries.

What have been your best investments?

Tesla has been an extraordinary stock this year for us. We bought it last year and it has clearly been our best performer. We built our investment across 2019 but mostly bought mostly by July at an average price of $60 per share. It is now at $380.

Zoom is another one that has done extremely well. We bought it in April this year at $155 per share and it is now at $500.

And your worst?

It was a Chinese company called Longtop. It is a banking software firm that was overstating its performance through fraud in China. We figured it out and sold the stock before they stopped trading but it is a painful lesson that you have to be careful when you invest in stocks in China. We bought it in 2009 for $34 per share and sold in 2010 at an average of $27.

How are you paid and do you own the fund?

I am paid based on the performance of the fund relative to our benchmark. I do own the fund myself.