Amazon's (AMZN) AWS Gains Momentum in India With New Client

Amazon AMZN continues to ride on its robust cloud computing arm, Amazon Web Services ("AWS"). Strengthening AWS offerings, which are constantly driving the company's cloud customer momentum globally, remain the key catalysts.

The latest selection of AWS by Prasar Bharati News Services (“PBNS”) in India is a testament to the aforesaid fact. This highlights the efficiency and reliability of AWS's innovative cloud products and services.

With the aid of AWS’s robust portfolio of cloud technologies and infrastructure, PBNS strives to host and scale its digital news website — NewsOnAir — and daily magazine in India and across the world.

By doing this, PBNS will be able to boost audience engagement on its platform by offering them strong and innovative digital formats.

PBNS also runs its News Data Management System platform that categorizes, archives and shares content across regional news units on AWS.

With these, PBNS aims to deliver news seamlessly to more than 894 million viewers and listeners in more than 190 countries.

We note that the latest deal has added strength to the client base of AWS in the booming cloud market of India.

Per the latest IDC report, the public cloud service market of India is likely to hit $13.5 billion by 2026, seeing a CAGR of 24% between 2021 and 2026.

Amazon, which has lost 23.4% on a year-to-date basis, remains well-poised to gain investors’ confidence in the near term on the back of its expanding footprints in this promising market.

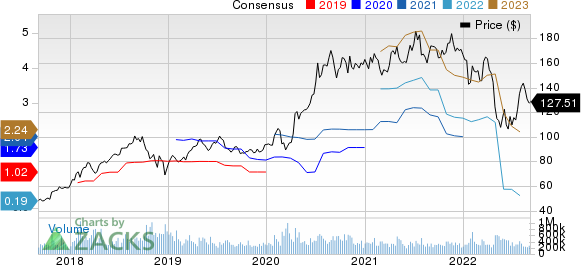

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Expanding Customer Base

We believe that AWS's persistent focus on enhancing its offerings will continue to expand its clientele.

Apart from PBNS, it was recently announced that CEAT LTD is leveraging AWS cloud capabilities such as the Internet of Things, analytics, business intelligence and machine learning to invent intelligent tires and carry out its smart manufacturing process seamlessly.

Additionally, Pick n Pay selected AWS as its strategic cloud provider in a bid to bring advancement in the supply-chain network of its stores, develop digital customer experiences in omnichannel grocery, and streamline its operations.

We believe that the expanding customer base will continue to drive AWS’s top line. In second-quarter 2022, AWS generated revenues of $19.7 billion (16% of Amazon’s net sales), which rose 33% year over year.

To Conclude

We believe that AWS’s strengthening clientele across the world on the back of its expanding portfolio, data centers and cloud regions will continue to aid Amazon in gaining a competitive edge against its peers, namely Microsoft MSFT and Alphabet’s GOOGL Google.

Microsoft Azure has become the key growth driver for Microsoft. The company is currently riding on the robust adoption of Azure cloud offerings. Azure's increasing number of availability zones and regions globally, along with strength in its consumption-based business, is likely to continue driving Microsoft's cloud momentum in the near term.

Similarly, Google Cloud is contributing substantial growth to the total revenues of Alphabet. Expanding data centers, availability zones and cloud regions are expected to keep boosting Alphabet's cloud position.

Nevertheless, AWS, with solid customer momentum, continues to maintain its dominant position in the cloud market.

According to the latest Canalys report, AWS accounted for 31% of the global cloud spending in second-quarter 2022, maintaining its leading position in the booming cloud market.

Microsoft’s Azure, the second-largest cloud-service provider, accounted for 24% of worldwide cloud spending. Alphabet’s Google Cloud represented 8% of the cloud spending, marking it the third-largest cloud provider.

Zacks Rank & Stock to Consider

Currently, Amazon carries a Zacks Rank #3 (Hold).

A better-ranked stock in the retail-wholesale sector is The Kroger KR, which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kroger has gained 7% over a year. The long-term earnings growth rate for the KR stock is currently projected at 11.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research