Amazon (AMZN) Expands Its AWS Offerings With IoT FleetWise

Amazon's AMZN cloud computing arm — Amazon Web Services ("AWS") — continues to strengthen its service offerings in a bid to sustain its cloud dominance.

The move to make AWS IoT FleetWise generally available is a testament to the same. The new service aids in the seamless collection and transfer of data from millions of vehicles to the cloud in real-time cost-efficiently.

The service is equipped with intelligent data-collection capabilities, which enables developers to reduce the amount of data transferred to the cloud by selecting the exact data that is needed for their use cases.

The service enables automotive companies to access, structure and standardize proprietary vehicle data seamlessly without developing custom data-collection systems.

Customer Base to Expand

We believe that the underlined service will help AWS gain strong momentum among automakers, suppliers, fleet operators and technology solution vendors in the automotive industry.

Notably, customers like Bridgestone, Hyundai Motor Group, LG CNS and Renesas Electronics have already shown interest in AWS IoT FleetWise.

We believe that the growing customer momentum will continue to drive AWS's top line. Strengthening clientele will continue to aid its dominance and competitive edge against its strong peers like Microsoft MSFT and Alphabet's GOOGL Google.

Apart from customer interest in the new service, AWS was picked by Pick n Pay, the strategic cloud provider. Pick n Pay leverages AWS services to bring advancement in the supply-chain network of its stores, develop digital customer experiences in omni-channel grocery and streamline its operations.

It was revealed that CEAT LTD is leveraging AWS cloud capabilities such as the Internet of Things, analytics, business intelligence and machine learning to invent intelligent tires and carry out its smart manufacturing process seamlessly.

AWS was selected by Delta Air Lines as the preferred cloud provider. Additionally, AWS was chosen by Prasar Bharati News Services in India.

We believe that the expanding customer base will continue to drive AWS’s top line. In second-quarter 2022, AWS generated revenues of $19.7 billion (16% of Amazon’s net sales), which rose 33% year over year.

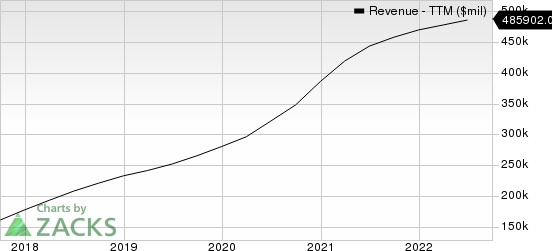

Amazon.com, Inc. Revenue (TTM)

Amazon.com, Inc. revenue-ttm | Amazon.com, Inc. Quote

Bottom Line

We believe that AWS’s strengthening clientele across the world will continue to aid Amazon in gaining a competitive edge against the above-mentioned peers.

Microsoft Azure has become the key growth driver for Microsoft. The company is currently riding on the robust adoption of Azure cloud offerings. Azure's increasing number of availability zones and regions globally, along with strength in its consumption-based business, is likely to continue driving Microsoft's cloud momentum in the near term.

Similarly, Google Cloud is contributing substantial growth to the total revenues of Alphabet. Expanding data centers, availability zones and cloud regions are expected to keep boosting Alphabet's cloud position.

Nevertheless, AWS’s growing efforts toward strengthening its portfolio offerings are likely to keep it ahead of the above-mentioned peers.

Apart from AWS IoT FleetWise, the company made its managed wide area network (WAN) service, namely AWS Cloud WAN, generally available. The service aids in the seamless development, management, operation and monitoring of a global network with the help of a central dashboard.

It also announced the general availability of three new serverless analytics options for Amazon EMR, Amazon MSK and Amazon Redshift.

We believe that portfolio strength will continue to drive AWS’ customer momentum, which, in turn, will aid Amazon in sustaining its cloud dominance. This will instill investor optimism in the stock in the days ahead.

Notably, Amazon has lost 29.2% on a year-to-date basis.

According to the latest Canalys report, AWS accounted for 31% of the global cloud spending in second-quarter 2022, maintaining its leading position in the booming cloud market.

Microsoft’s Azure, the second-largest cloud-service provider, accounted for 24% of worldwide cloud spending. Alphabet’s Google Cloud represented 8% of the cloud spending, marking it the third-largest cloud provider.

Zacks Rank & Stocks to Consider

Currently, Amazon carries a Zacks Rank #3 (Hold).

A better-ranked stock in the retail-wholesale sector is The Kroger KR, which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kroger has gained 0.4% on a year-to-date basis. The long-term earnings growth rate for the KR stock is currently projected at 11.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research