Amazon (AMZN) Boosts AWS Offerings With Cloud WAN Availability

Amazon’s AMZN cloud-computing arm, Amazon Web Services (AWS), made its managed wide area network (WAN) service, namely AWS Cloud WAN, generally available.

The new service aids in the seamless development, management, operation and monitoring of a global network with the help of a central dashboard.

The service enables a robust connection among on-premise data centers, branch offices and cloud resources. It also connects Amazon Virtual Private Clouds across the AWS global network.

AWS Cloud WAN prevents enterprises from configuring and managing different networks individually by allowing them to use simple network policies for the same purpose.

The latest move bodes well for the growing efforts of AWS toward expanding its product and services portfolio.

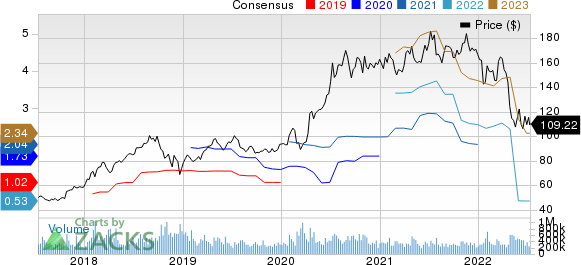

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Customer Base to Expand

We believe that the latest move will help AWS gain strong momentum among customers in this data-driven world.

Customers like Avalara, Cisco, Foundation Medicine, Slalom and VMware are already using AWS Cloud WAN.

We believe that the growing customer momentum will continue to drive AWS’s top line. In first-quarter 2022, AWS revenues (16% of net sales) rose 37% year over year to $18.4 billion.

Apart from the customer interest in the underlined service, AWS was picked by Boeing BA as the strategic cloud provider.

In a bid to bring advancement in aerospace design and manufacturing, Boeing will migrate its applications from on-premise data centers to AWS. Boeing will leverage AWS’s scalable, robust, and high-performing infrastructure and cloud services, including high-performance computing.

In addition, Delta Air Lines recently selected AWS as the preferred cloud provider. With the aid of AWS’s robust portfolio of cloud technologies, Delta strives to streamline the processes from booking to flight experience in order to deliver an enhanced experience to customers.

To Conclude

Strengthening clientele will continue to aid the Zacks Rank #3 (Hold) company’s competitive edge against its strong peers like Microsoft MSFT and Alphabet’s GOOGL Google, which are also leaving no stone unturned to expand their market share.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Microsoft is currently riding on the robust adoption of Azure cloud offerings. Azure's increasing number of availability zones and regions globally, along with strength in its consumption-based business, is likely to continue driving Microsoft's cloud momentum in the near term.

Similarly, Google Cloud is contributing substantial growth to the total revenues of Alphabet. Expanding data centers, availability zones and cloud regions are expected to keep boosting Alphabet's cloud position.

Nevertheless, the improving performance of AWS on the back of a strengthening product portfolio and growing customer momentum is expected to aid Amazon in sustaining its dominant position in the cloud computing market.

According to the latest Canalys report, AWS accounted for 33% of the global cloud spending in first-quarter 2022, maintaining its leading position in the booming cloud market.

Microsoft’s Azure, the second-largest cloud-service provider, accounted for 21% of the worldwide cloud spending. Alphabet’s Google Cloud represented 8% of the cloud spending, marking itself the third-largest cloud provider.

Amazon, which has lost 34.5% on a year-to-date basis, remains well-poised to gain investors’ confidence in the near term on the back of its well-performing AWS and growing cloud prospects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research