Altria (MO) Q3 Earnings Lag Estimates, Revenues Decline Y/Y

Altria Group Inc. MO delivered third-quarter 2022 results, wherein the bottom line missed the Zacks Consensus Estimate, though it advanced year over year on solid pricing. However, revenues declined year over year due to softness in the smokeable products segment and the divestiture of the wine segment.

Quarter in Detail

Adjusted earnings came in at $1.28 per share, which increased 4.9% year over year but fell short of the Zacks Consensus Estimate of $1.31. The year-over-year increase was backed by the increased operating companies income (OCI) and reduced number of shares outstanding.

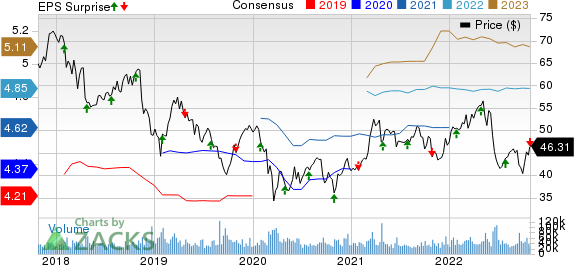

Altria Group, Inc. Price, Consensus and EPS Surprise

Altria Group, Inc. price-consensus-eps-surprise-chart | Altria Group, Inc. Quote

Net revenues fell 3.5% year over year to $6,550 million due to the lack of revenues from the wine segment, which was divested in October 2021, along with reduced revenues from the smokeable products segment. This was partly compensated by increased net revenues in the oral tobacco products segment.

After deducting excise taxes, revenues were down 2.2% to $5,412 million. The Zacks Consensus Estimate for revenues was pegged at $5,620 million.

Segment Details

Smokeable Products: Net revenues in the category dipped 1.6% year over year to $5,882 million due to the reduced shipment volume and increased promotional investments, partly compensated by increased pricing. Revenues, net of excise taxes, climbed 0.4%.

Domestic cigarette shipment volumes were down 9.2% year over year, mainly driven by the industry’s rate of decline and retail share losses, somewhat compensated by trade inventory movements. On adjusting for trade inventory movements and other factors, smokeable products’ domestic cigarette shipment volumes fell an estimated 8%. Altria’s reported cigar shipment volumes rose 3.3%.

Adjusted OCI in the segment increased 1.8% to $2,812 million on higher pricing, partly offset by increased promotional investments, reduced shipment volumes and elevated costs. The adjusted OCI margin increased 0.9 percentage points to 58.9%.

Oral Tobacco Products: Net revenues in the segment jumped 7% from the year-ago quarter’s level to $665 million due to greater pricing, partly offset by increased promotional investments in on!. Revenues, net of excise taxes, rose 7.7%.

Domestic shipment volumes in the segment went up 1.3%, mainly due to trade inventory movements, the industry’s rate of growth and calendar differences, partly countered by retail share losses and other factors. On adjusting for trade inventory movements and calendar differences, oral tobacco products shipment volumes dipped an estimated 2%.

Adjusted OCI ascended by 4.9% to $425 million, backed by increased pricing. However, this was partially negated by elevated costs, increased promotional investments in on!, a mix shift and a greater percentage of on! shipment volume compared to MST. The adjusted OCI margin contracted by 1.8 percentage points to 66.4%.

Financial Updates

Altria ended the quarter with cash and cash equivalents of $2,483 million, long-term debt of $24,848 million and a total stockholders’ deficit of $4,232 million.

In the first nine months of 2022, Altria bought back 29.9 million shares for $1.45 billion. In the third quarter, it repurchased 8.5 million shares for $368 million. As of Sep 30, 2022, Altria had shares worth roughly $375 million remaining under its $3.5-billion share repurchase program, which is anticipated to conclude by Dec 31, 2022.

In the first nine months, MO paid out dividends worth $4.9 billion, including $1.6 billion in the third quarter. In August, management raised its quarterly dividend, taking the annual rate to $3.76 per share. The company maintains a long-term dividend payout ratio goal of about 80% for adjusted earnings per share (EPS).

Full-year capital expenditures in 2022 are likely to be in the $175-$225 million range now compared with the prior range of $200-$250 million.

Other Developments & Guidance

Altria recently announced that a subsidiary entered an agreement with a subsidiary of Philip Morris International related to the IQOS. Per the deal, Altria will receive cash worth around $2.7 billion in exchange for giving exclusive U.S. commercialization rights for the IQOS, from Apr 30, 2024.

In another release, Altria announced a strategic deal with JT Group, alongside unveiling its expanded heated tobacco portfolio.

Altria noted that its tobacco business did not witness any material disruption related to the changing macroeconomic and geopolitical scenario. For 2022, the company now envisions the adjusted EPS in the range of $4.81-$4.89, suggesting growth of 4.5-6% from the $4.61 recorded in 2021.

Earlier, MO projected the adjusted earnings view in the range of $4.79-$4.93 per share, indicating growth of 4-7%. The company continues assessing external environmental factors like increased inflation, higher interest rates, global supply-chain hurdles, and ATC dynamics such as purchasing patterns, the adoption of smoke-free products and disposable income.

The bottom line also considers planned investments associated with costs to improve the digital consumer engagement system, enhanced smoke-free product research, development and regulatory preparation expenses and marketplace activities to support the company’s smoke-free products. The view also includes anticipation of the inflation of Master Settlement Agreement expenses and direct and indirect material costs.

MO does not expect PM USA to have access to the IQOS system in 2022.

Shares of this Zacks Rank #3 (Hold) company have declined 2.5% in the past three months compared with the industry’s drop of 3.9%.

Staple Stocks to Consider

Some better-ranked stocks from the sector are Lamb Weston LW, TreeHouse Foods THS and Lancaster Colony LANC.

Lamb Weston, a frozen potato product company, currently sports a Zacks Rank #1 (Strong Buy). LW has a trailing four-quarter earnings surprise of 47.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 14.6% and 45.7%, respectively, from the year-ago reported numbers.

TreeHouse Foods, which manufactures and distributes private label food and beverages, sports a Zacks Rank #1 at present. TreeHouse Foods has a trailing four-quarter earnings surprise of 45.2%, on average.

The Zacks Consensus Estimate for THS’ current financial-year sales and earnings suggests growth of 16.8% and 15.1%, respectively, from the year-ago reported numbers.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently carries a Zacks Rank of 2 (Buy). LANC delivered an earnings surprise of 170% in the last reported quarter.

The Zacks Consensus Estimate for Lancaster Colony’s current financial-year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research