Alphabet (GOOGL) to Strengthen YouTube With Search Engine

Alphabet’s GOOGL division Google is consistently adding features to its online video-streaming service, YouTube.

Google is gearing up to equip YouTube with a search engine capability. This serves as a testament to the abovementioned fact.

With the help of the search engine, YouTube users will be able to find a specific content in YouTube videos.

Currently, Google is testing the new feature in the Unites States and India.

On the back of this capability, Google aims to provide an enhanced experience to users. This is expected to increase the adoption rate of YouTube in the days ahead.

This is expected to aid the performance of the Google Services segment, which contributes the most to Alphabet’s top line.

Revenues from the Google services business increased 2.5% year over year to $61.4 billion, accounting for 88.8% of the total third-quarter revenues.

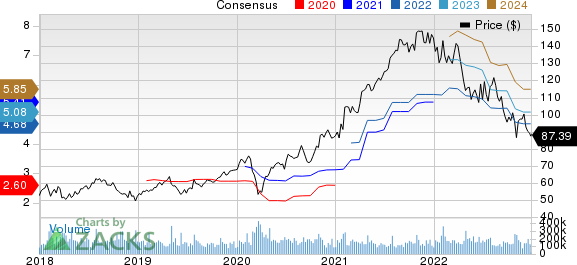

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Growing YouTube Initiatives

Apart from the recent move, Alphabet is gearing up for bringing a redesigned YouTube video screen to aid users with an improved video-streaming experience.

Alphabet announced two updates on its YouTube Partner Program to allow users to easily join YouTube and make money from the platform, mainly from YouTube Shorts. Alphabet also introduced a Creator Music catalog for adding tracks to videos.

GOOGL introduced handles for YouTube channels to support creators in establishing their distinct presence and brand on YouTube.

With consistent efforts, Alphabet remains well-poised to rapidly penetrate the booming global video-streaming market.

Per a Precedence Research report, the underlined market is expected to reach $1.7 trillion by 2030, seeing a CAGR of 18.5% between 2022 and 2030.

Competitive Scenario

In this upbeat scenario, Alphabet faces intense competitive pressure from the likes of Amazon AMZN, Apple AAPL and Netflix NFLX, who are making strong efforts to expand their market share in the video-streaming space.

Amazon, which has lost 29.1% in the year-to-date period, is gaining traction among customers on the back of its video on-demand service, Prime Video. On AMZN’s video platform, viewers can watch movies, TV series and exclusive Amazon Originals.

Apple is witnessing solid momentum across its video-streaming platform, Apple TV. Apple’s growing original and regional content portfolio is helping it expand its user base. AAPL’s growing interest in sports streaming remains a major positive. Shares of Apple have moved down 37.6% in the year-to-date period.

Netflix is benefiting from its diversified content portfolio, attributable to heavy investments in the production and distribution of localized and foreign-language content. Netflix has moved 53.5% south on the year-to-date basis.

We believe that Apple, Amazon and Netflix’s growing initiatives in this potential market will be a threat to Alphabet’s market position.

Shares of GOOGL have moved down 40.4% in the year-to-date period, outperforming the Computer and Technology sector’s decline of 37.6%.

Currently, Alphabet carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report