Alphabet (GOOGL) Q2 Earnings Miss Estimates, Revenues Rise Y/Y

Alphabet’s GOOGL second-quarter 2022 earnings of $1.21 per share missed the Zacks Consensus Estimate by 4.7%. The figure declined 11% year over year.

Revenues of $69.69 billion increased 13% year over year (16% at constant currency).

Net revenues, excluding total traffic acquisition costs or TAC (TAC is the portion of revenues shared with Google’s partners, and amounts paid to distribution partners and others, who direct traffic to the Google website), were $57.47 billion, which lagged the consensus mark of $57.55 billion. The figure rose 12.8% from the year-ago quarter.

TAC of $12.2 billion was up 11.8% year over year.

Top-line growth was driven by the solid momentum across the company’s search and cloud businesses.

The strong performance of Google Advertising contributed well.

Shares of Alphabet gained 5% in the after-market trading, owing to the company’s resiliency in its advertisement business amid sluggishness in advertisement spending.

However, the company witnessed sluggishness in its Other Bets segment in the reported quarter. Mounting expenses were also concerning.

On a year-to-date basis, Alphabet has lost 25.8% compared with the industry’s decline of 28.6%.

Nevertheless, Alphabet’s growing investments in AI and the expanding cloud services portfolio, which are expected to yield huge returns in the days ahead, remain major positives. This, in turn, is expected to instill investors’ optimism in the stock in the days ahead.

On Jul 15, Alphabet implemented a stock split in a 20:1 ratio.

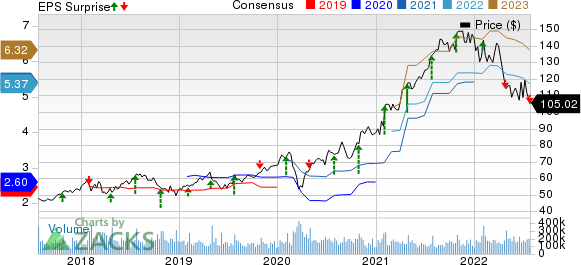

Alphabet Inc. Price, Consensus and EPS Surprise

Alphabet Inc. price-consensus-eps-surprise-chart | Alphabet Inc. Quote

Segments in Detail

The company reports revenues under Google Services, Google Cloud and Other Bets.

Google Services:

Revenues from the Google services business increased 10.1% year over year to $62.8 billion, accounting for 90.2% of the total revenues.

Under the services business, search revenues from Google-owned sites increased 13.5% year over year to $40.7 billion.

YouTube’s advertising revenues grew 4.8% year over year to $7.3 billion, while Network advertising revenues increased 8.7% to $8.3 billion.

Total Google advertising revenues grew 11.6% year over year to $56.3 billion and accounted for 80.8% of the total revenues.

Google’s Other revenues, consisting of Google Play and YouTube non-advertising revenues, were $6.6 billion for the second quarter, down 1.1% year over year.

Google Cloud:

Google Cloud revenues rose 35.6% year over year to $6.3 billion, accounting for 9% of the quarterly revenues.

Other Bets:

Other Bets’ revenues were $193 million, up 0.5% year over year, accounting for 0.3% of the total second-quarter revenues.

Regional Details

EMEA (29.5% of total revenues): The company generated $20.5 billion of revenues from the region, rising 8% year over year.

APAC (16.8% of total revenues): The region generated $11.7 billion in revenues, increasing 4% from the year-ago quarter.

Other Americas (6.3% of total revenues): The region generated $4.3 billion in revenues, growing 29% on a year-over-year basis.

United States (47% of total revenues): The company generated $32.7 billion of revenues from the region, which increased 16% from the prior-year quarter.

Operating Details

Costs and operating expenses were $50.2 billion, up 18.1% year over year. As a percentage of revenues, the figure expanded 340 basis points (bps) from the year-ago quarter.

The operating margin was 27.9%, which contracted 340 bps year over year. Segment-wise, Google Services’ operating margin of 36.2% contracted 300 bps from the prior-year quarter.

Google Cloud reported a loss of $858 million compared to a loss of $591 million in the year-ago quarter.

Other Bets reported a loss of $1.7 billion compared to a loss of $1.4 billion in the prior-year quarter.

Balance Sheet

As of Jun 30, 2022, cash and cash equivalents, and marketable securities were $124.9 billion, down from $133.9 billion as of Mar 31, 2022.

Long-term debt was $14.7 billion at the end of the reported quarter compared with $14.8 billion at the end of the previous quarter.

The company generated $19.4 billion in cash from operations in second-quarter 2022 compared with $25.1 billion in first-quarter 2022.

It spent $6.8 billion on capex, netting a free cash flow of $12.6 billion in the reported quarter.

Zacks Rank & Stocks to Consider

Currently, Alphabet carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Aspen Technology AZPN, Keysight Technologies KEYS and Asure Software ASUR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aspen technology has returned 18.7% in the year-to-date period. The long-term earnings growth rate for AZPN is currently projected at 16.3%.

Keysight Technologies has lost 26.8% in the year-to-date period. The long-term earnings growth rate for KEYS is currently projected at 9.1%.

Asure Software has lost 26.8% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research