Alphabet (GOOGL) Boosts YouTube Capabilities With Cast Redesign

Alphabet’s GOOGL shares have rallied 23.5% in the year-to-date period, outperforming the Zacks Computer & Technology sector’s growth of 15.6%. The company is continuously benefitting from its growing YouTube capabilities on the back of new feature updates.

This is evident from the company’s latest Cast menu redesign of the YouTube app.

The updated Cast icon now features a floating bottom sheet with rounded corners, allowing users to control volume and voice search, and also provides remote control options for televisions.

Alphabet is expected to expand YouTube’s user base on the back of its latest Cast menu redesign.

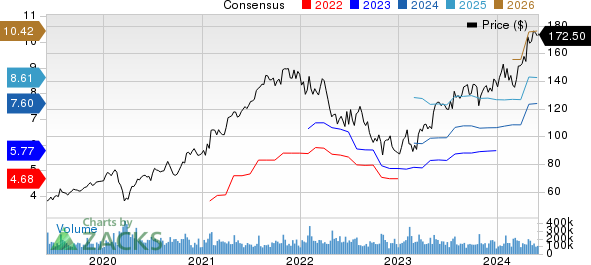

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Growing YouTube Capabilities

Per a Grand View Research report, the global video streaming market is expected to witness a CAGR of 21.5% between 2024 and 2030.

Google remains well-positioned to capitalize on growth opportunities present in the video streaming space on the back of its growing YouTube capabilities.

Recently, the company enhanced YouTube’s user interface for Android TV with an animated comment count feature in the info pill section. This new feature addition aims to make full-screen viewing easier and less intrusive and enhance interaction with videos on displays.

Alphabet also expanded its YouTube Create video editing app for Android to 13 more countries, including Australia, Brazil, Spain, and the United States. The app simplifies short-form video creation for creators from various regions, eliminating the need for high-end computers and file transfers.

Google also redesigned the channel pages on YouTube for all Creators. The redesign features a larger background, subscriber count, an About description, and video carousels, aiming to improve the viewing experience for connected devices.

Conclusion

All the above-mentioned endeavors will continue expanding YouTube’s subscriber base. This, in turn, will continue aiding Alphabet’s Google Services segment, which remains the key growth driver of the company.

In the first quarter of 2024, the Google Services segment increased 13.6% year over year to $70.4 billion, which accounted for 87.4% of the total revenues.

The strengthening Google Services segment is expected to aid Alphabet’s overall financial performance in the near term.

The Zacks Consensus Estimate for 2024 total revenues stands at $295.53 billion, indicating year-over-year growth of 15.2%.

The consensus mark for 2024 earnings is pegged at $7.60 per share, indicating a 31.03% rise from the year-ago figure. The figure has been revised upward by 0.4% in the past 30 days.

Zacks Rank & Other Stocks to Consider

Currently, Alphabet sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 26.4% in the year-to-date period. The long-term earnings growth rate for ANET is 15.68%.

Badger Meter’s shares have gained 25.4% in the year-to-date period. The long-term earnings growth rate for BMI is currently projected at 15.57%.

Shares of Dropbox have declined 23.6% in the year-to-date period. The long-term earnings growth rate for DBX is 11.44%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report