Allegro MicroSystems (ALGM) Boosts Portfolio With ACS37220

Allegro MicroSystems ALGM recently launched a high-power current sensor, the ACS37220. The latest product, the ACS37220, is the smallest leaded magnetic current sensor, which has been rolled out as an improvement over the discrete shunt resistors and op-amps used currently.

The product is expected to replace the traditional discrete shunt resistors and high-power sense resistors that have a larger footprint on electronics boards, have thermal issues and need multiple components.

The new ACS37220 is a single-package sensor designed to perform the functions of multiple components with increased reliability, efficiency and less space consumption. The ACS37220 sensor is designed to be used in high-current monitoring applications, which is why it can be used in a wide range of current sensing devices.

Allegro, being a fabless semiconductor company with a main focus on innovation, has consistently launched more than 30 new products in fiscal 2024. Its new product launches include AHV85000 and AHV85040 isolated gate-driver ICs, and ACS37030 and ACS37032 ICs with their application in clean energy and data center applications.

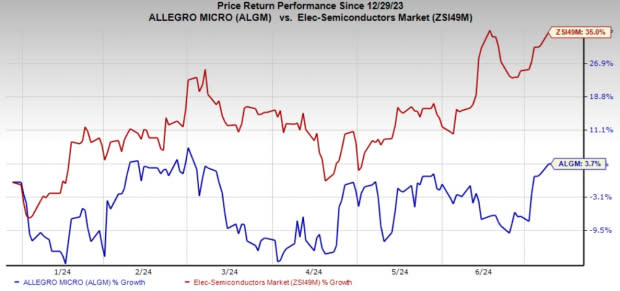

Through these innovations, ALGM is thriving in the extremely competitive chip manufacturing market. The company has returned 3.7% in the year-to-date period, underperforming the Zacks Electronics-Semiconductor industry’s growth of 35%.

Image Source: Zacks Investment Research

Near-Term Headwinds

A large part of Allegro’s revenues come from selling these magnetic sensors and power ICs to the automotive sector, especially the electronic vehicle space. Allegro’s 2024 automotive segment revenues accounted for 72.4% of total revenues, making it highly dependent on the automotive market.

In the automotive market, Allegro MicroSystems mainly operates in the electrification of vehicles, hybrid electric vehicles and electric vehicles (“EV”) powertrains and advanced safety-related driver assistance systems. However, a report by Goldman Sachs highlights the fact that the global EV market is experiencing a slow growth rate. This does not bode well for Allegro Microsystems.

Additionally, Allegro operates in an intensely competitive industry, which remains a major concern. The company faces stiff competition from Analog Devices ADI, Monolithic Power Systems MPWR and Texas Instruments TXN in both its magnetic sensor and power IC segments. In Europe and Asia, other international companies, including Melexis, Infineon and TDK Micronas, also compete with it in both magnetic sensors and power ICs.

Analog Devices’ portfolio contains ADA4570-2 and ADA4571 magnetic sensors and ADP5070 and ADP5071 power ICs. Texas Instruments offers magnetic sensors like DRV5053 and DRV425 and power ICs like TPS65251 and TPS65261. Monolithic offers magnetic sensors, including MPX5700 and MPXH6300, and power ICs like MPQ4569 and MPQ4572.

Conclusion

Allegro MicroSystems is continuously rolling out innovative products to get a competitive advantage in the chip manufacturing space. However, the pessimistic outlook of the EV sector's growth on which ALGM mainly relies does not bode well for this Zacks Rank #4 (Sell) company’s near-term prospects.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Allegro’s earnings for the current quarter have been reduced from 18 cents to 2 cents in the past 60 days. Estimates for ALGM’s earnings for fiscal 2025 have been reduced from 94 cents to 43 cents in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

Allegro MicroSystems, Inc. (ALGM) : Free Stock Analysis Report