Albertsons (ACI) to Report Q1 Earnings: What's in Store?

Albertsons Companies, Inc. ACI is likely to register an increase in the top line when it reports first-quarter fiscal 2022 results on Jul 26, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $22,599 million, indicating growth of 6.3% from the prior-year reported figure.

The bottom line of this food and drug retailer in the United States is expected to be flat year over year. The Zacks Consensus Estimate for earnings per share for the quarter under discussion has been stable at 89 cents over the past 30 days.

Albertsons Companies has a trailing four-quarter earnings surprise of 30.6%, on average. In the last reported quarter, this Boise, ID-based company surpassed the Zacks Consensus Estimate by 15.4%.

Key Factors to Note

Albertsons Companies' focus on providing efficient in-store services, enhancing digital and omni-channel capabilities, and increasing productivity has been contributing to its top-line performance. The company has been enhancing digital payment facilities alongside expanding the availability of online assortments.

Efforts to bolster assortments, especially in the fresh and Own Brands categories, continue to elevate the customer experience. The company's right assortment in each local market, loyalty program, and ease of checkout through frictionless and contactless payments have been aiding in attracting customers. As part of its digital endeavors, the company has been expanding Drive Up & Go curbside pickup service and sharpening home delivery capabilities.

Clearly, the aforementioned factors instill optimism regarding the outcome of the results. However, margins still remain an area to watch. The impact of costs associated with digital fulfillment, supply chain and COVID-19-related expenses cannot be ruled out. Product cost inflation, tight labor market and supply chain bottlenecks are some of the challenges Albertsons Companies is currently facing.

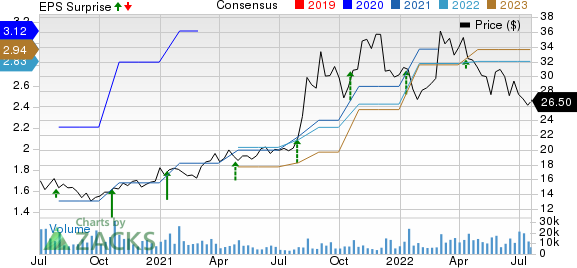

Albertsons Companies, Inc. Price, Consensus and EPS Surprise

Albertsons Companies, Inc. price-consensus-eps-surprise-chart | Albertsons Companies, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Albertsons Companies this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter. You can see the complete list of today's Zacks #1 Rank stocks here.

Albertsons Companies has a Zacks Rank #3 but an Earnings ESP of 0.00%.

3 Stocks With Favorable Combination

Here are three companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Grocery Outlet GO currently has an Earnings ESP of +5.62% and a Zacks Rank #1. The company is likely to register bottom-line improvement when it reports second-quarter 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 24 cents suggests a marginal improvement from 23 cents reported in the year-ago quarter.

Grocery Outlet's top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $859.6 million, which indicates an improvement of 10.8% from the figure reported in the prior-year quarter. GO has a trailing four-quarter earnings surprise of 4.8%, on average.

Lamb Weston LW currently has an Earnings ESP of +0.99% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 51 cents suggests an increase of 15.9% from the year-ago reported number.

Lamb Weston's top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.07 billion, which suggests an increase of 6% from the prior-year quarter. LW has a trailing four-quarter earnings surprise of 18.1%, on average.

Archer-Daniels-Midland Company ADM currently has an Earnings ESP of +2.59% and a Zacks Rank #3. The company is expected to register bottom-line growth when it reports second-quarter 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.74 cents suggests an increase of 30.8% from the year-ago quarter.

Archer-Daniels-Midland Company's top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $25.27 billion, indicating an increase of 10.2% from the figure reported in the year-ago quarter. ADM has a trailing four-quarter earnings surprise of 22.3%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research