Air Products (APD) Gains on Project Investments, Productivity

Air Products and Chemicals, Inc. APD is benefiting from investments in high-return projects, new business deals, acquisitions and productivity initiatives. However, the industrial gases giant faces headwinds from energy cost inflation.

The company’s shares are up 5% over a year, compared with a 6.2% decline recorded by its industry.

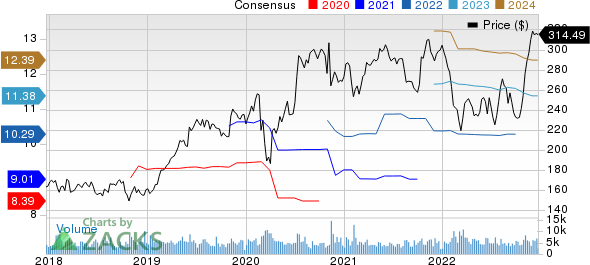

Image Source: Zacks Investment Research

Air Products, a Zacks Rank #3 (Hold) stock, is benefiting from investments in high-return industrial gas projects and productivity measures. It remains committed to its gasification strategy and is executing its growth projects. These projects are expected to be accretive to earnings and cash flows.

The company has a total available capacity to deploy (over fiscal 2018-2027) around $36.5 billion in high-return investments aimed at creating significant shareholder value. It has already spent or committed roughly 73% of the capacity.

The company, in October 2021, completed the asset acquisition and project financing transactions of the $12-billion Jazan project in in Saudi Arabia. It expects to close the Phase Two of this project in 2023.

Last year, it also announced the $4.5 billion world-class clean energy complex in Louisiana. The project, the company’s largest-ever investment, is expected to produce more than 750 million standard cubic feet per day of blue hydrogen for local and global markets by 2026.

Air Products, in Apr 2022, also purchased Air Liquide's industrial gases business in the United Arab Emirates ("UAE"), including liquid bulk, packaged gases and specialty gases. APD also acquired Air Liquide's majority share in MECD, which owns and operates a liquid CO2 manufacturing site in Bahrain. By purchasing these businesses, Air Products broadened its footprint and regional presence in the UAE and Bahrain.

The company is also boosting productivity to improve its cost structure. It is seeing the positive impacts of its productivity actions. Benefits from additional productivity and cost improvement programs are likely to support its margins moving ahead. Air Products also has been benefiting from higher pricing. Higher merchant demand is also driving its volumes.

Air Products also remains committed to maximize returns to shareholders leveraging strong balance sheet and cash flows. The company, earlier this year, increased its quarterly dividend by 8% to $1.62 per share from $1.50 per share. This marked the 40th straight year of dividend increase. The company expects to pay more than $1.4 billion of dividend to shareholders in calendar 2022.

However, Air Products is exposed to challenges from cost inflation. It is witnessing higher power costs in its merchant business. The company is seeing significantly higher energy costs, especially in EMEA due to the considerably high natural gas and electricity costs. It is expected to continue to face headwinds from the power cost inflation moving ahead. As such, higher power costs are likely to weigh on margins over the near term.

The company also faces headwinds from unfavorable currency translation. It witnessed significant currency headwinds in the last reported quarter, especially in Europe. Currency translation, stemming from a stronger U.S. dollar, reduced its sales by around 6% and EBITDA by 5% in the quarter and lowered its earnings by 15 cents per share.

In Europe, all major currencies were weaker vis-à-vis the U.S. dollar by double-digits in the quarter. The company sees continued currency headwinds moving ahead.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Olympic Steel, Inc. ZEUS, Sociedad Quimica y Minera de Chile S.A. SQM and Commercial Metals Company CMC.

Olympic Steel currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 4.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 46% in a year.

Sociedad has a projected earnings growth rate of 540.5% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.5% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 37.4%. SQM has rallied roughly 68% in a year. The company currently carries a Zacks Rank #1.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 8.7% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 42% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report