Adobe (ADBE) Q2 Earnings to Gain From Digital Media Strength

Adobe’s ADBE second-quarter fiscal 2024 results, scheduled to be released on Jun 13, are likely to reflect its Digital Media segment’s strength.

Digital Media has been the key driver behind the company’s growth on the back of its Creative family of products and Document Services products.

With its robust Digital Media solutions, ADBE helps content creators, app and game developers, and creative professionals, such as graphic designers, photographers and video editors, to generate, publish and promote their content anywhere.

We believe that the company’s persistent efforts toward strengthening its content management capabilities will continue driving growth in the Digital Media segment.

The segment under discussion generated revenues of $3.82 billion in first-quarter fiscal 2024, which improved 12% on a year-over-year basis.

For second-quarter fiscal 2024, Adobe expects Digital Media revenues between $3.87 billion and $3.90 billion. The Zacks Consensus Estimate for the same is pegged at $3.89 billion, indicating year-over-year growth of 10.7%.

Click here to know how the company’s overall fiscal second-quarter results are likely to be.

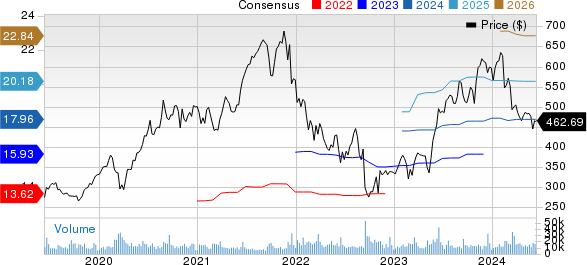

Adobe Inc. Price and Consensus

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Factors to Consider

Solid momentum across Adobe Creative Cloud and Document Cloud is expected to have driven top-line growth for the Digital Media segment in the to-be-reported quarter.

Strong momentum in Adobe Firefly is likely to have continued strengthening Adobe's prospects in the booming generative AI space. The integration of Firefly into Photoshop and Illustrator is anticipated to have contributed well to top-line growth in the Digital Media segment.

The increasing adoption of Firefly-powered tools in Photoshop, Generative Fill and Generative Expand across desktop, web and iPad is likely to have been a positive. Also, the growing traction among various enterprises on the back of Firefly Services is expected to have contributed well.

Frame.io’s integration into creative software like Adobe Photoshop, Adobe Premier Pro and After Effects is likely to have benefited the segment further.

Apart from this, the monthly growing active user base of Creative Cloud Express and the new AI-powered innovations in Premiere Pro are expected to have accelerated growth in Creative revenues in the quarter under review. Strength in Adobe Stock and product-led growth motions is also likely to have benefited the Stock business in the to-be-reported quarter.

The Zacks Consensus Estimate for fiscal second-quarter Creative Cloud revenues is pegged at $3.115 billion, suggesting an improvement of 9.2% from the year-ago quarter’s reported figure.

Coming to Document Cloud, strength across web, mobile and embedded third-party app ecosystems is anticipated to have contributed well to growth in the monthly active user base. Solid momentum across the Acrobat ecosystem is likely to have been a positive. Strong momentum in Acrobat PDF on mobile is expected to have been beneficial.

The growing adoption of Acrobat and Acrobat Sign is expected to have been a plus. Enhanced PDF workflows across Acrobat and Express are likely to have continued to drive customer momentum.

Positive contributions from Microsoft Edge and Google Chrome integrations are anticipated to have continued driving Adobe’s user momentum.

All these factors are expected to have contributed well to Document Cloud revenues.

The Zacks Consensus Estimate for fiscal second-quarter Document Cloud revenues are pegged at $774 million, indicating an improvement of 17.4% from the year-ago quarter’s reported figure.

Zacks Rank & Stocks to Consider

Currently, Adobe carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 30.6% in the year-to-date period. The long-term earnings growth rate for ANET is pegged at 15.68%.

Badger Meter’s shares have gained 27% in the year-to-date period. The long-term earnings growth rate for BMI is projected at 15.57%.

Shares of Dropbox have declined 22.6% in the year-to-date period. The long-term earnings growth rate for DBX is expected to be 11.44%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report