ABSD Singapore Rates (2024): Additional Buyer’s Stamp Duty Guide for 2nd Property, PRs and Foreigners

In the Singapore real estate industry, ABSD stands for Additional Buyer’s Stamp Duty. If you’re new to this term, read on to learn more about what this tax is, who is liable to pay ABSD and for ABSD remissions, what the current ABSD rates are (we’ve put it in an ABSD table below!) and more.

Singapore ABSD Table Overview | Singapore ABSD Rates (2024) |

ABSD for 2nd property, Singapore Citizen | 20% |

ABSD for 3rd and subsequent properties, Singapore Citizen | 30% |

ABSD for PR, first property | 5% |

ABSD for PR, 2nd property | 30% |

ABSD for PR, 3rd and subsequent properties | 35% |

ABSD for foreigners, any and all properties | 60% |

When you buy a property in Singapore, you’re subjected to Buyer’s Stamp Duty (BSD). And, depending on certain criteria (e.g. your residency status, the number of properties you own), you may have to pay another type of tax, known as Additional Buyer’s Stamp Duty (ABSD).

The April 2023 property cooling measures saw ABSD rates adjusted again. Most notably, the ABSD rate for foreigners buying any property in Singapore doubled from 30% to 60%. This marks the third round of property cooling measures since December 2021.

For locals who want to invest in property, this ABSD rate revision is ‘bad news’ too. Singaporeans and PRs now have to pay a higher tax to own their 2nd property (and subsequent properties) in Singapore. For some, purchasing an overseas property could be an alternative to expanding their real estate portfolio without having to incur ABSD.

However, there is relief for senior singles. Following the Singapore Budget 2024 statement, they will now be eligible to receive ABSD refunds as they rightsize from a higher to lower-value private property.

Watch Our Video on Additional Buyer’s Stamp Duty (ABSD) in Singapore

What Is Additional Buyer’s Stamp Duty (ABSD) in Singapore?

ABSD in Singapore is a tax that’s levied on top of BSD. It’s computed based on the valuation or the selling price of the property, whichever is higher.

ABSD Table (2024): What Are the Current Additional Buyer’s Stamp Duty Rates in Singapore?

Buyer profile | ABSD amount (rates on/after 27 April 2023) |

SCs buying their first property | 0% |

SCs buying their second property | 20% |

SCs buying their third and subsequent properties | 30% |

SPRs buying their first property | 5% |

SPRs buying their second property | 30% |

SPRs buying their third and subsequent properties | 35% |

Foreigners buying any property | 60% |

Entities (companies or associations) buying any property | 65% |

Trustees for any residential property | 65% |

Housing developers for any residential property | 35% (additional 5%; non-remittable) |

The April 2023 property cooling measures saw a significant ABSD rate hike for Singaporeans and PRs buying their 2nd property, as well as foreigners buying property in Singapore. The ABSD rates shown in the tables above will apply to the property’s purchase price or market value, whichever is higher.

[ProductCTA]{ “title”: “Find a Property Agent”, “description”: “Browse PropertyGuru’s directory of experienced property agents for your home selling, buying, and/or renting needs. “, “link”: “https://www.propertyguru.com.sg/property-agent-directory”, “buttonText”: “Search now”, “image”: “buying” } [/ProductCTA]

How Are ABSD Rates Calculated?

For instance, say a property is valued at $1 million but the selling price is $1.1 million. Assuming that you’re a Singapore Citizen, and you’re buying your 2nd property, you are subjected to an ABSD rate of 20%. So, the ABSD amount that you’ll need to pay is $1.1 million x 20% = $220,000.

If a property is purchased by buyers of different profiles (e.g. one Singapore Citizen and one foreigner, or first-time property owner and 2nd property owner), then the ABSD will be calculated based on the buyer profile with the highest ABSD rate.

How ABSD Works: What If I’m Buying a Property With Someone Else?

When you’re buying a property with someone else of a different profile, different ABSD rates might apply to both of you. If this is the case, then the higher ABSD rate will be used. An example shown below demonstrates how it works:

Your properties | Your spouse’s properties |

No property | Two condo units (sole owner) |

Terrace house (joint owner) | Terrace house (joint owner) |

Let’s say you and your spouse are Singaporean. You have no property while your spouse currently owns two properties. You are both intending to purchase a terrace house together.

With the co-purchase of this new terrace house unit, your spouse will own a total of three properties. The ABSD rate applied for them will be 30%. On the other hand, you will only own one property after the joint purchase. Even though this is your first property, the ABSD payable is based on your spouse’s profile. So, there will be an ABSD rate of 30% will apply. If you are confused, read IRAS’ explanation of ABSD rates and ABSD remission criteria for married couples.

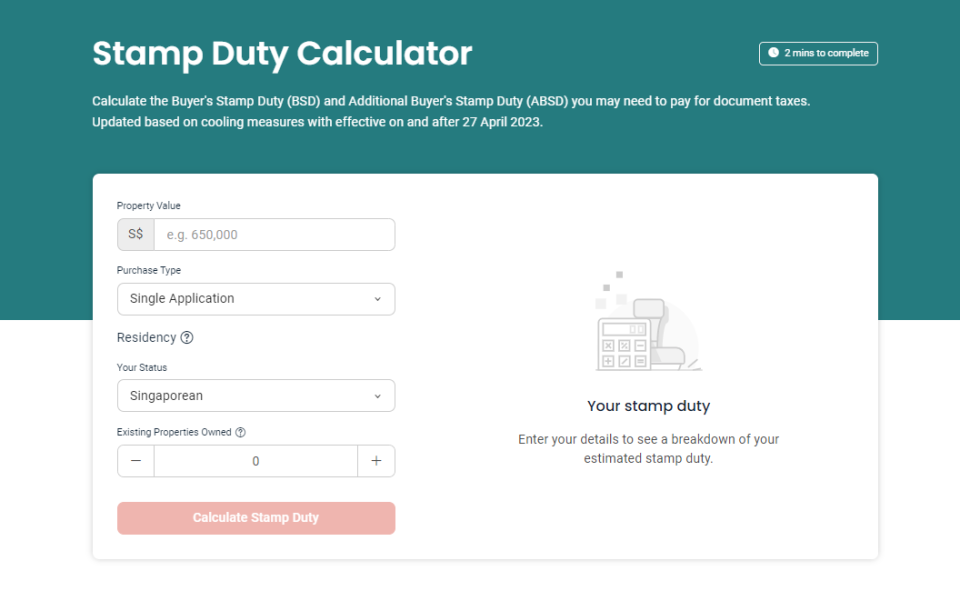

To save yourself from any price shock when buying your property, it would be good to accurately calculate your ABSD amount prior. PropertyGuru Finance has an easy-to-use stamp duty calculator that gives you a breakdown of how much stamp duty you’ll need to pay, on top of your actual housing price.

Why Was Additional Buyer’s Stamp Duty Introduced in Singapore?

ABSD Rate and History Timeline:

December 2011: ABSD was introduced to manage the surge in demand for property

January 2013: ABSD rates were increased, and more buyer profiles were included to be liable for the tax

July 2018: ABSD rates increased again

December 2021: ABSD rates were increased for second and subsequent purchases, for foreigners and entities

April 2023: ABSD rates were increased again for second and subsequent purchases, foreigners, entities, and trustees. ABSD rates remained unchanged for housing developers

ASBD was first introduced in December 2011 as a property cooling measure to discourage foreigners and entities from purchasing residential properties, especially multiple properties. In other words, it was introduced to manage demand for residential properties and to promote a sustainable housing market.

ABSD rates were increased further in January 2013, along with introducing new buyer profiles that would be liable for ABSD. Property speculation dropped after ABSD was implemented, and foreign buyers who were interested in investing in Singapore’s property market were deterred by the high ABSD rates.

Then in July 2018, both the BSD and ABSD increased again, and additional cooling measures like the Total Debt Servicing Ratio (TDSR) and Seller’s Stamp Duty (SSD) saw the volume of property transactions drop rather significantly.

On 16 December 2021, another round of cooling measures was announced. Among them, ABSD rates increased. The latest round of property cooling measures took effect on 27 April 2023, with ABSD rates being adjusted upwards again.

The three rounds of property cooling measures announced since December 2021 reaffirm the Singapore government’s commitment towards prioritising housing for owner-occupation. Dr Lee Nai Jia, Head of Real Estate Intelligence, Data and Software Solutions, PropertyGuru Group, notes that first-time Singaporean buyers remain unaffected and PRs buying their first property did not see an adjustment to the existing 5% ABSD tax.

“Foreign investors are most affected by the April 2023 property cooling measures and will be deterred from buying property as they are the worst hit. The previous December 2021 ABSD adjustment of 30% was already considered to be high for foreign investors, and the latest hike will probably push these buyers to recalibrate their positions.

That said, most foreign buyers purchase property in Singapore for wealth preservation with a longer investment horizon in mind. Buyers with deep pockets may still enter the market, but they will put downward pressure on asking prices.”

In light of these changes, he also postulates that smaller units and the Core Central Region (CCR) market could see slower sales and conversions. But after an initial knee jerk reaction, little impact is likely to be observed on home purchases in the range of $1.8 million to $4 million in the Rest of Central Region (RCR) and Outside Central Region (OCR). This is due to the still-robust demand from HDB upgraders as well as households being in a stronger position than before (in terms of cash liquidity) due to intergenerational wealth transfers.

ABSD Definition of ‘Residential Property’ in Singapore

Let’s understand what’s defined as ‘Residential Property’ for ABSD rates in Singapore. Residential properties are those used as homes. The most obvious examples would include HDB flats, condominiums, bungalows, and terrace houses (and similar types).

Shophouses with living quarters, as well as HDB void deck shops that have an upper floor designated for residential use, will also be considered residential property. Regarding overseas property purchases, these properties are not included in the property count for ABSD rate calculation purposes.

[ProductCTA]{ “title”: “Sell your property confidently”, “description”: “Receive a free valuation report on your property, get access to resources, and find an experienced property agent to help you sell your home.”, “link”: “https://www.propertyguru.com.sg/home-sellers”, “buttonText”: “Learn more”, “image”: “affordabilitycalculator” } [/ProductCTA]

ABSD Definition of ‘Entity’ in Singapore

For ABSD rate calculations, an entity would refer to someone who isn’t an individual, and is defined by the following criteria:

An unincorporated association

A trustee for a collective investment scheme when acting in that capacity

A trustee-manager for a business trust when acting in that capacity

The partners of the partnership whether or not any of them is an individual, where the property conveyed, transferred, or assigned is to be held as partnership property

ABSD Remission and Exemptions in Singapore

There are some situations in which you won’t need to pay ABSD in Singapore. You may find the complete, exhaustive list on IRAS’ website, but here are the more common cases for ABSD remission:

Aborted Sale and Purchase Agreements

Transfer of a property resulting from matrimonial proceedings (divorce)

For married couples – the new property is disposed of within six months of purchasing the new property

For HDB upgraders – when buying a new executive condominium and disposing of previous HDB flat

Foreign citizens that are from countries eligible under Free Trade Agreements

Aside from Free Trade Agreements, there are barely any actual ABSD exemptions. However, there are a couple of ‘gray areas’ that may confuse potential property buyers. Here are some examples.

Downgrading from a private property to an HDB resale flat

Dual-key condos that are consider a single property, but feature with two livable ‘homes’ (one main unit and one sub-unit)

Some also consider decoupling, which is when co-owners ‘split up’ and transfer ownership of the shared home to one half of the couple.

Decoupling to Avoid ABSD in Singapore – Is it illegal?

Some married couples also consider decoupling, which is when co-owners ‘split up’ and transfer ownership of the shared home to one half of the couple. But while decoupling is not illegal, doing so for tax evasion is. Recently, IRAS has announced it will conduct regular audits to prevent the occurrence of “contrived or artificial” arrangements and will reward whistle-blowers who call out private property buyers who exploit the “99-to-1” scheme to evade ABSD tax with up to $100,000.

Additionally, under the respective Free Trade Agreements (FTAs), Nationals and Permanent Residents of Iceland, Liechtenstein, Norway, Switzerland and the United States of America will be treated the same as SCs. In other words, you won’t need to pay ABSD for your first property purchase. Your legal representative can e-Stamp via the e-Stamping portal on IRAS’s website to apply for remission.

Additional Buyer’s Stamp Duty Remission for Foreigners Married to Singaporeans

Now, although we’ve indicated earlier that ABSD is always levied on foreigners and Permanent Residents, there’s one instance where these individuals won’t need to pay it. If you’re a foreigner or Permanent Resident who’s married to a Singaporean, and you don’t own any residential property, you don’t need to pay ABSD.

You can also get an ABSD refund if you’re moving house as a married couple. To qualify for the refund, the property that you paid ABSD for needs to be sold within six months of you buying the second. You can view the full terms and conditions on IRAS’s website.

How to Pay Additional Buyer’s Stamp Duty in Singapore

You can make payment for your ABSD online through the e-Stamping Portal using NETS, a cheque, or a cashier’s order.

Alternatively, you can also make payment at IRAS Surf Centre e-Terminals, or SingPost Service Bureaus (located in Chinatown, Novena, Raffles Place, and Shenton Way). These stamp duties need to be paid in full, and you won’t be able to pay them via instalments.

You can make use of your CPF to pay ABSD. Once you’ve paid these duties, you can get a reimbursement from your CPF account.

Note that ABSD needs to be paid within 14 days of the sale and purchase agreement being signed. If your sale and purchase agreement was signed overseas, the deadline is 30 days after the agreement was received in Singapore.

Are There Any Penalties for Late Additional Buyer’s Stamp Duty Payment?

Delay in payment | Penalty for late ABSD payment |

Up to three months | $10 or an amount equal to the BSD and ABSD payment, whichever is higher |

Exceeding three months | $25 or an amount equal to four times the BSD and ABSD payable, whichever is higher |

If ABSD is not paid by the deadline, you will get a Demand Note reminding you to make payment. This letter will also inform you of the penalty that you’ve incurred for missing the deadline.

IRAS may appoint your bank, employer, tenant, or lawyer to pay the outstanding stamp duty on your behalf. In serious cases, legal action may be taken to recover the outstanding amount.

Read more about what happens when you miss your stamp duty deadlines on IRAS’ website.

Should You Try to Avoid Additional Buyer’s Stamp Duty?

Most Singaporeans tend to view owning property as a good investment move. Seen either as a way to earn passive income through collecting rent or as a way to park wealth in a ‘safe haven’, owning multiple properties is a goal many have to financially secure themselves. This attitude towards owning multiple properties comes as no surprise, considering how property prices have remained resilient over the years.

Currently, property prices are at a high for all property types. With the latest round of April 2023 property cooling measures, we have no doubt that the raised ABSD rates will be a hotly debated topic among property buyers and investors. Not many are fans of the measure, and unsurprisingly so: it is, after all, an extra tax meant to discourage buyers by increasing the cost of property in Singapore and foreigners and entities for speculating.

This is why many property buyers look for exemptions and ‘loopholes’ to avoid paying the extra tax. These could very well work, but in most cases, it may be easier and cheaper to simply pay the ABSD. Not to mention, while you may find legal ways to ‘avoid’ paying ABSD by exploiting ‘loopholes’, tax evasion is still illegal.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help financing your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.