Abbott's (ABT) New FDA Approval to Improve Patient Outcome

Abbott Laboratories ABT recently announced the receipt of the FDA’s approval for its latest-generation transcatheter aortic valve implantation (TAVI) system, Navitor, to treat people with severe aortic stenosis who are at high or extreme risk for open-heart surgery. The Navitor TAVI system, the latest addition to the company's comprehensive transcatheter structural heart portfolio, is expected to offer less-invasive treatment options for some of the most common and serious heart diseases.

The latest regulatory clearance is expected to significantly boost Abbott’s structural heart business of the broader Medical Devices segment.

Significance of the Approval

Aortic stenosis, which occurs when the aortic valve's opening narrows, restricts blood flow to the body. If left untreated, it can lead to heart failure and death. For patients with severe aortic stenosis who are at high or extreme surgical risk due to the potential complications stemming from age, frailty, or having multiple other diseases or conditions, physicians may now opt for a minimally-invasive procedure using TAVI therapies, such as the Navitor system.

Navitor’s unique fabric cuff (NaviSeal) is expected to reduce or eliminate the backflow of blood around the valve frame, known as the paravalvular leak. Additionally, the new device is the only self-expanding TAVI system with leaflets within the native valve. This design is expected to aid in improving access to coronary arteries to facilitate future procedures for treating coronary artery disease.

The Navitor device is implanted using Abbott's FlexNav delivery system, which features a slim design to accommodate different patient anatomies and small vessels for stable, predictable and accurate valve delivery and placement.

Per Abbott's management, Navitor is the first TAVI system that is expected to offer optimal hemodynamics (blood flow) in all valve sizes while preserving options for lifetime disease management. This is an important consideration for physicians and patients when selecting a TAVI solution, and receiving this approval will likely improve patients’ lives.

Industry Prospects

Per a report by Allied Market Research, the global TAVI market was valued at $4,559 million in 2020 and is anticipated to reach $16,937 million by 2030 at a CAGR of 14%. Factors like the increase in the prevalence of aortic stenosis, rise in demand for various TAVI procedures and rise in the elderly population are likely to drive the market.

Given the market potential, the latest regulatory clearance is expected to significantly strengthen Abbott's global structural heart business.

Notable Developments in Medical Devices

Last month, Abbott announced that its FreeStyle Libre 3 sensor is now compatible with the mylife Loop solution from partners, Ypsomed and CamDiab, thus creating a smart, automated process to deliver insulin based on real-time glucose data. This automated insulin delivery system solution is now available in Germany and will be available in additional European countries beginning in 2023.

The same month, Abbott announced the receipt of the FDA’s approval of its Eterna spinal cord stimulation system. It is the smallest implantable, rechargeable spinal cord stimulator currently available on the market for the treatment of chronic pain.

In October 2022, Abbott announced its third-quarter 2022 results, where it registered a robust uptick in its total worldwide sales on an organic basis, benefiting from robust organic sales growth across the company’s core Established Pharmaceuticals and Medical Devices segments. The U.S. Medical Devices sales also improved in the third quarter, led by strong double-digit growth in Electrophysiology, Structural Heart and Diabetes Care.

Price Performance

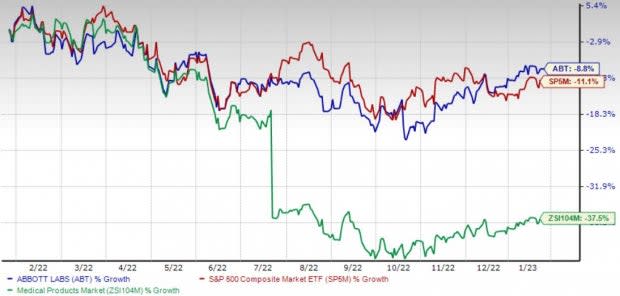

Shares of the company have lost 8.9% in the past year compared with the industry’s 37.5% decline and the S&P 500's 11.1% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Abbott carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 0.8% compared with the industry’s 22.3% decline in the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.7%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 3%.

Cardinal Health has gained 49.2% against the industry’s 1.9% decline over the past year.

Merit Medical, flaunting a Zacks Rank #1 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 22.2% against the industry’s 1.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report