50 Property Investment Terms For Understanding Investment Better!

Property investment is a popular choice in Malaysia. But with an industry as complex as this, you’ll need help getting in-line with the lingo and on top of the investment jargon.

Do you know your rental yields from your REITs? Here’s your guide to understanding investment, with 50 property investment terms you can’t live without.

1) Annualised Return

Annualised return is an investment term used to describe the expected return over a year, using a standard timeframe of actual returns.

This can be used to measure what your ‘average’ annual return was, for example, over a three-year period. It could also be used to understand what the total annual return would be expected, given an actual return over a shorter period.

Say, for example, your property provides a profit of RM15,000 over three years. The annualised return would be 15,000 divided by 3 = RM5,000 annualised return.

2) Appraisal

Appraisal is an alternative term used to refer to property valuation. That means it’s an important measure to understand investment value for property.

Appraisal is the process of evaluating a property or piece of land to determine its worth, and the price which might be considered fair and accurate to place it on the market for sale.

3) Bank Valuation

The bank valuation is the estimated value of a given property as analysed by the valuation professional of a particular financial institution.

The bank valuation is important, as it sets the limit of potential lending which could be given out by the bank for the property.

Essentially, it’s what they think a particular property is worth, and thus the limit to how much they will lend you to purchase it.

4) Base Lending Rate (BLR)

The Base Lending Rate (BLR) is a reference lending rate set by Bank Negara Malaysia, based on the cost to lend money between financial institutions.

Up until 2015, it was used as the reference guide for lending rates, impacting loan products such as house loans.

5) Base Rate

The Base Rate (BR) is an interest rate that banks refer to, in order to determine the rates for products such as house loans.

If you’re borrowing money to invest in property, the BR can have a big impact on how those interest rates look!

BR replaced BLR as the standard reference rate in 2015. It takes into account the cost of lending money for banks, and the minimum interest rate set by Bank Negara Malaysia.

6) Bumi Lot

A Bumi lot is one of the four main types of land for sale in Malaysia. Properties built in these areas may be sold or leased only to Bumiputera citizens.

That makes them a much more limited option for investment, and one which only Bumiputera citizens can technically even consider.

An application can be made to release a property from these restrictions, although it is challenging to succeed.

7) Capital Return

Capital return is a term which relates to the difference between the value of property at a point of sale, compared to the point of purchase.

It’s the difference between what you paid for a property, and what you end up selling it for. That means as an investment consideration it doesn’t take into account certain factors such as rental return.

Profit from capital return is an important part of property investment, but should be balanced against things like inflation rates which can devalue the ‘real’ value of profit, and the amount of money you’ve spent in owning and maintaining the property.

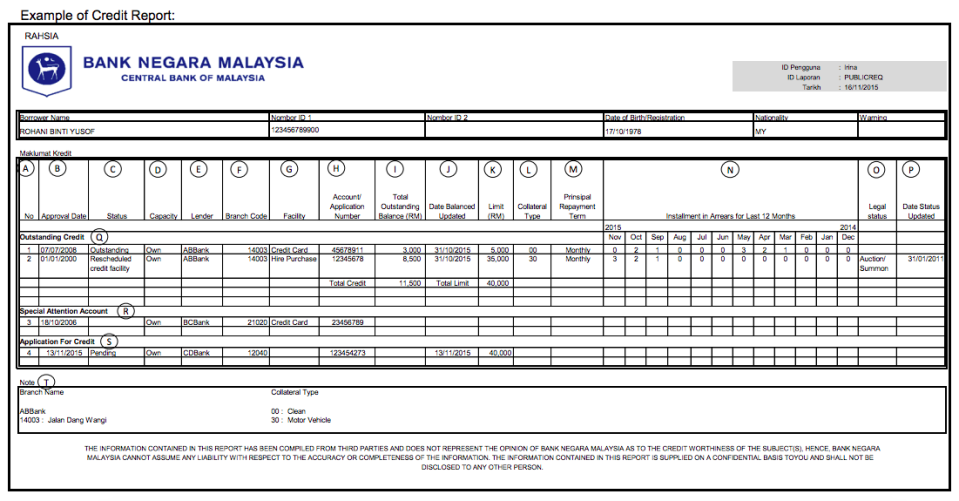

8) CCRIS Report

A Central Credit Reference Information System (CCRIS) report is a system implemented by Bank Negara Malaysia (BNM) to act as a centralised and standardised credit report system for potential borrowers in Malaysia.

When it comes to borrowing money for things such as property investment and housing loans, a CCRIS report will be requested by financial institutions to check your ‘credit worthiness’. It’s basically a score card saying how reliable you might be in paying back any loan!

9) Certificate of Completion and Compliance (CCC)

The Certificate of Completion and Compliance (CCC) is an important document that relates to the transfer of ownership when buying or selling property.

A CCC is issued when a newly built property is signed off as complete and fit for habitation, as assessed and submitted by a professional known as a Principal Submitting Person.

10) Covenants

A covenant is a condition or agreement recorded in a property deed such as a Sale and Purchase Agreement (SPA), which commits the owner to certain conditions.

This could include elements such as a restriction on how and when you can sell the property. It’s important as an investor to understand the covenants, as they may limit the value you can generate from a property if they limit development or restrict resale.

11) CTOS Score

A CTOS score is similar to a CCRIS report. It is an analysis undertaken by the CTOS credit rating agency to assess your financial history, and is often used by banks and institutions to check the credit worthiness of a lender such as an individual applying for a home loan.

12) Debt Service Ratio (DSR)

A Debt Service Ratio (DSR) is a method used by banks to assess your ability to make payments on a debt, and is another important part of being granted a loan.

It combines an assessment of your monthly net income against total fixed debts you pay to understand your financial circumstances.

To put it simply: It's a calculation used by banks to determine the amount of home loan which you might have the financial ability to repay.

13) Deed of Assignment (DOA)

The Deed of Assignment (DOA) is a document used to transfer ownership of property between parties.

It confirms that the assignor (who owns the property currently) is transferring ownership to the assignee (who is acquiring the property).

This legal document of transfer is used in cases where a Memorandum of Transfer (MOT) cannot be used, due to the current status of the property title.

14) Freehold

Freehold is one of the four main types of land in Malaysia. This is a type of land where the ownership has no end date, and belongs to the owner in perpetuity.

In investment terms that means there’s no reduction in potential value directly related to a reducing term of ownership. Freehold land can be subject to forced acquisition by the government, but this is rare.

15) House Loan

A house loan or home loan is a loan taken from a bank or financial institution to assist you in purchase of a property. It is subject to a variety of credit checks and assessments to ensure your ability to pay.

The total amount you can borrow is capped at 90% of the bank-assessed property valuation for your first home, although this is reduced for subsequent home purchases.

16) House Flippers

House flipper is a term used to describe investors whose strategy is to buy an older or rundown house at a lower price, then remodel, restore, or renovate it to improve it and sell it for a higher price.

Essentially they buy low, work on it to upgrade/beautify, and then hope to sell it at a profit a (relatively) short time later!

17) Individual Title

An Individual Title is a title deed document issued for property with a single owner of a whole piece of land, with no shared ownership responsibilities.

This typically covers landed properties such as the ever-popular terraced houses, semi-detached houses, and bungalows.

18) Institutional Investors

Institutional investors is a term which refers to large institutions such as banks, bond managers, and pension funds, which often have a large stake in the property market.

These large institutions tend to use pools of money from their own investors, then invest in a wide range of financial instruments, in order to make a return on that investment.

Since property is often seen as a reliable and lucrative asset, institutional investors often have a big role in the real estate industry.

19) Land Title

A Land Title is a legal document which defines ownership of a particular parcel or area of land. It is an overarching term which covers Individual Title, Strata Title etc.

A copy of all land titles are kept by the Land Office of the relevant state authority. As a property investor, you should be familiar with the process to assess and access Land Titles, as an important part of due diligence on your investments!

20) Leasehold

Leasehold is one of the four main types of land for sale in Malaysia, and defines areas of land which are ‘leased’ from local authorities.

Properties sold under leasehold have a maximum lease period, typically 99 years, after which the ownership reverts to the State Government.

Investors are likely to be more wary of leasehold investment with less than 20 years on the lease. A lease renewal can be pursued to extend this leasing period.

21) Legal Fees

Legal fees refer to all mandatory payments to legal professionals, for professional assistance in the purchase or sale of property.

These fees are legislated by law, and are clearly defined costs as stated in the Solicitor’s Remuneration Order.

The cost of legal fees is one factor that must be included in your overall return on investment as a property investor.

22) Letter of Offer

A Letter of Offer is a written commitment by a buyer to an owner or developer of a property, stating an intention to purchase that property.

It is usually accompanied with a 1%-2% earnest deposit. It can sometimes be called a Letter of Intent to Purchase.

23) Loan Agreement

The Loan Agreement is the official document between a bank or financial institution (lender) and the home buyer (lendee) defining the terms and conditions of a loan.

It will include elements such as total loan amount, term of loan, repayment conditions, and named individuals responsible for making the payments.

24) Loan Disbursement

Loan disbursement is a term that's used to refer to the approval and handing out of loans in the property market.

The loan disbursement rate of banks is often assessed to understand how accessible home loans are, at any given time.

25) Loan Tenure

Loan tenure defines the term over which a loan is agreed. Essentially, it defines the total number of years you have to repay the loan under the loan agreement.

26) Lock-in Period

The lock-in period is a defined period after the purchase of a property where the owner is prohibited from, or penalised for, selling the property.

This can prohibit short-term investors from flipping a house or quickly reselling it. Home loans often define a financial penalty for the lock-in period, where sellers must pay a penalty fee based on their loan agreement.

Some special property types, such as PR1MA property, exclusively prohibit any sale within a set time period.

27) Long-term Investors

Long-term investors are property investors who operate over more significant investment terms, often multiple years or decades.

Rather than house flippers who wish to purchase and sell as quickly as possible, long-term investors are looking for properties with good capital return over a long period, as well as significant rental potential to ensure on-going income.

28) Margin of Financing

The Margin of Finance, sometimes called the Loan-to-Value (LTV) ratio is an assessment of lending risk undertaken by financial institutions prior to a loan offer.

It will define the total amount offered in your home loan, up to a maximum 90% of the property valuation's amount.

29) Master Title

The Master Title is a property title issued during the construction and development phase of a property development.

It is issued after a developer has been granted permission to develop land, and covers ownership of the entire parcel of land under development.

It also grants the right to sell off individual parcels of this land, under a Strata Title or Individual Title.

30) Memorandum of Transfer (MOT)

The Memorandum of Transfer is a legal document which defines the transfer of ownership of a property.

The signing of the MOT is the legal confirmation of transfer of ownership and generally forms the final step of the transfer process.

31) Mortgage Level Term Assurance (MLTA)

Mortgage Level Term Assurance (MLTA) is a type of life insurance often used to cover the value of a home loan, in the event of death or permanent disability.

The MLTA is a level value of cover, with the total amount insured remaining the same throughout the course of the plan.

At point of claim it is paid to the bank which holds the home loan, with any excess cover paid directly to a beneficiary.

32) Mortgage Level Term Takaful (MLTT)

Mortgage Level Term Takaful (MLTT) is a shariah-compliant, or ‘Takaful’, version of Mortgage Level Term Assurance (MLTA).

Like MLTA, the level value of the cover remains the same throughout the term. In the event of a claim, the outstanding value of a home loan is paid to the financial institution, and the remaining amount paid to a named beneficiary.

33) Mortgage Reducing Term Assurance (MRTA)

Mortgage Reducing Term Assurance (MRTA) is a type of life insurance often used to cover the value of a home loan, in the event of death or permanent disability.

The MRTA will pay out a decreasing amount of cover over time, with the total value of payment at any given point designed to align with the total value outstanding on a home loan.

It is paid out to the bank which holds the home loan, with no additional amount paid to the beneficiary.

34) Mortgage Reducing Term Takaful (MRTT)

Mortgage Reducing Term Takaful (MRTT) is a shariah-compliant, or ‘Takaful’, version of Mortgage Reducing Term Assurance (MRTA).

The value outstanding on MRTT cover reduces over the course of the plan, and is designed to match the total outstanding value of the home loan as it is paid off.

At the point of claim, MRTT cover pays directly to the financial institution which holds the home loan.

35) Overnight Policy Rate (OPR)

The Overnight Policy Rate (OPR) is a key lending rate used by banks. It describes the rate of interest one bank will charge another for overnight lending.

This method is often undertaken to balance the changing level of cash reserves these financial institutions have.

The OPR can play a big role in the ultimate cost of lending money in Malaysia, and thus also have an impact on the interest rates that home buyers or investors might have to pay.

36) Progress Payment

Progress payment is a term which relates to the payment schedule for under-construction property in Malaysia.

As part of the purchase agreement, the buyer of property is responsible for making specific payments at designated points of completion.

It is essentially a gradual payment schedule that covers set points from the signing of the Sales and Purchase Agreement (SPA) through to the 18 months after Vacant Possession (VP) is handed over to the buyer.

37) Property Speculators

Property speculator is an overarching term used to describe people who are investing in the property market with the intention of making profit and financial gains.

It basically means buying a property in the hope of selling it later and making money. Often, the term 'speculator' is used to refer to those who buy currently undervalued properties, with a prediction that the value will increase due to market changes.

Ultimately, this term can be used for any property investor looking to buy and sell for profit.

38) Real Estate Agent (REA)

A Real Estate Agent (REA) is a qualified agent who is licensed to operate in Malaysia’s real estate industry, having completed a two-year course and attained a Diploma in Estate Agency from the Board of Valuers, Appraisers and Estate Agents Malaysia (BOVAEA).

They will then complete their qualification through a two-year practical training, under an existing fully-qualified REA. An REA is legally allowed to open their own real estate agency, and employ up to 50 RENs.

39) Real Estate Investment Trusts (REITs)

Real estate investment trusts (REITs) are a particular type of investment often used by investors seeking to gain access to the property industry without directly purchasing property.

A REIT is a pooled investment where different investors purchase into a fund, with the fund itself used for buying, renting, and operating property for a profit.

This can provide access to valuable investment returns without the direct risk of personal ownership of property, but this does come at the cost of far less control over the investment.

40) Real Estate Negotiator (REN)

A Real Estate Negotiator (REN) is a property market professional with accreditation that enables them to work in Malaysia’s property industry.

They must attend a two-day course known as the 'Negotiators Certificate', and are then qualified to be registered under BOVAEA and find employment under a licensed REA.

41) Real Property Gains Tax (RPGT)

Real Property Gains Tax is a type of tax, which applies to the profit earned from selling a property in Malaysia. RPGT only applies to property sales where the sale price was higher than the original purchase price.

This is an extremely important consideration for investors, as RPGT can undermine the profit from capital returns if not carefully assessed.

The rate of RPGT varies by seller type such as company, individual, or foreign owner, and is rated against the period of ownership of the property.

There are a number of exemptions depending on your circumstances, but most of these relate to one-off sales or transfer for family purposes, and are less applicable to investors with higher volumes of property transactions.

42) Rental Yield

Rental yield is an important term used to describe the return on investment received from a rental property.

This is measured as the income you gain from the property, as a proportion of the total price you paid for it.

If you buy a property for RM100,000 and rent it out at RM5,000 per year, then your rental yield would be 5%. This is not the net profit however, as you also have to take into account the costs of maintaining that property.

43) Return on Investment (ROI)

Return on investment (ROI) is a term of critical importance to serious property investors. It describes the overall profit made on a particular investment.

In the real estate industry, this can be used to describe the total profit made through a house transaction, by comparing the sale price of the property to the original purchase price, as well as any rental earnings during this period.

True ROI should also take into account the cost of inflation over this period, as well as all additional costs associated with house ownership such as maintenance, legal fees, and tax.

44) Sale and Purchase Agreement (SPA)

The Sales and Purchase Agreement (SPA) is an extremely important document which defines the terms of a house sale.

It is a legally binding contract between buyer and seller which confirms mutually agreed conditions such as method of payment, defect liability period, conditions of property, fixtures and fittings, and other relevant clauses.

45) Short-term Investors

Short-term investor refers to investors who purchase a property with the intention of making a relatively rapid return on that investment.

The general concept is to purchase a property for a low price, and then sell it for a higher price in a short period of time. This can include ‘house flippers’, who directly target properties they can quickly renovate and/or improve.

46) Stamp Duty

Stamp duty refers to a fee paid for the ‘stamping’ of legal documents to prove their legitimacy. It’s a mandatory requirement on instruments of transfer in property sales and loan agreements. Stamps are issued by the Inland Revenue Board of Malaysia (LHDNM).

47) Strata Title

A Strata Title is a type of legal document issued for a single property parcel with individual ownership, as part of a larger development that includes areas of shared ownership.

This typically covers strata properties such as apartments and condos in developments with shared ownership areas.

48) Subsale Market

The subsale market refers to the sector of the property market where a buyer is purchasing a property from a current owner who is reselling the property ‘second-hand’.

This is often a lucrative area for property investment, particularly for short-term investors, as it provides the opportunity to purchase an undervalued or rundown house and improve it to sell it for a profit.

49) The Board of Valuers, Appraisers and Estate Agents Malaysia (BOVAEA)

The Board of Valuers, Appraisers and Estate Agents Malaysia (BOVAEA) is the body defined by the Malaysian Ministry of Finance to regulate the professional conduct of people within the property industry such as REAs, RENs, valuers, property managers, and estate agents.

It maintains a range of key market functions such as valuation services, register of accredited valuers, property managers, real estate agencies, and other key professional functions.

50) Vacant Possession (VP)

A Notice of Vacant Possession is a document issued to confirm ownership has been passed to the purchaser of a property from a developer.

It will follow the Certificate of Completion and Compliance, confirming the property is fit for habitation. The VP essentially states that the house is finished and ready for the new owner.

PropertyGuru Tip

<strong>A note of caution!</strong> No investment is truly guaranteed. Property investment is a valuable and often lucrative opportunity, but it comes with its risks. You should always research and understand the full implications if a property investment goes wrong, as well as if it goes right. If you’re at all uncertain about your choices, seek the advice of a qualified professional.

Related Guides: