5 Top Alcohol Stocks to Watch As Innovation Drives the Industry

Despite the pandemic-led disruptions, companies in the Zacks Beverages – Alcohol industry have managed to maintain strong sales, with an increased focus on shift supplies to off-premise. Further, the companies stand to gain from the ongoing digital transformation (e-premise channels) as consumers adopt online shopping options and make the most of increased at-home consumption occasions.

Furthermore, the industry players have been steadfastly investing in product innovations to include non-or-low alcoholic beverage variations to its portfolio. These investments in the product portfolio, particularly the fast-growing hard seltzer category, bode well for players like Diageo Plc (DEO), Brown-Forman Corporation (BF.B), Constellation Brands Inc. (STZ), The Boston Beer Company Inc. (SAM) and Molson Coors Beverage Co. (TAP).

About the Industry

Companies producing, importing, exporting, marketing and selling alcoholic beverages like beer, craft beer, draft beer, ciders, wine, rums, whiskey, liqueurs, vodka, tequila, champagnes, brandy, amaretto, ready-to-drink cocktails and malt mainly constitute the Zacks Beverages – Alcohol industry. However, some of the industry players engage in the production and sale of non-alcoholic beverages like carbonated soft drinks, sparkling waters, bottled water, energy drinks, powdered and natural juices and ready-to-drink teas.

These companies, mostly brewers (beer makers), sell products through a network of wholesalers as well as retailers like supermarkets, warehouse clubs, grocery stores, convenience stores, package stores, drug stores and other retail outlets. These also sell beer directly to consumers in cans and bottles at restaurants, pubs, bars and liquor stores. Additionally, some brewers operate brewpubs or taste rooms at breweries offering consumers the freshest beers.

What’s Shaping the Future of Beverages – Alcohol Industry

Shift in Trends to Off-Premise & E-commerce, At-Home Occasions: The alcohol industry has been witnessing a gradual shift in consumption trends from on-premise to off-premise. In this scenario, alcohol companies have been quickly shifting focus and resources to off-premise, including retail stores and other channels that are likely to stay in the near term. With the shelter-in-place orders and shutdown of on-premise channel due to COVID-19, the e-commerce platform has been gaining traction as consumers shift to e-commerce for buying alcoholic beverages as well. Notably, e-commerce for beverage alcohol has expanded significantly, increasing three to seven times in volume from the prior year. Moreover, consumers plan to continue their e-commerce purchases even in the post-COVID situation. Additionally, the stay-at-home trend has increased more at-home drinking occasions, which has encouraged people to make simple cocktails at home. This has given rise to the demand for drinks with low alcohol content. To capitalize on these trends, beverage companies have ventured out with some interesting product launches, putting the focus on the health of consumers.

Hard Seltzer Beverage Market Gains Prominence: The alcohol companies have been scrambling for opportunities to grab a share of the lucrative hard-seltzer market, which took the alcohol-drinking American population by storm. Product innovation and increased brand launches played a crucial role in the growing penetration of hard seltzer. Further, hard seltzers are expected to continue gaining popularity owing to its low alcohol content, preferred by the millennials in developed economies like the United States, Canada and Australia. According to Grand View Research Inc., the global hard seltzer market size was $4.36 billion in 2019 and is expected to reach $4.51 billion in 2020. Moreover, the hard seltzer market is projected to touch $14.5 billion by 2027, witnessing a CAGR of 16.2%. The hard seltzer beverage industry is dominated by the privately held White Claw and Boston Beer’s Truly brand. Per Bank of America, Truly and White Claw together held nearly 80% of the hard seltzer market at the end of 2019. Bud Light Seltzer from Anheuser-Busch InBev (BUD), which was launched earlier this year, is another prime stakeholder garnering market share in the hard seltzer category.

Higher Costs & Shut-down of On-Premise & Travel Retail: With restaurants, bars and cinemas closing down due to the pandemic, on-premise sales, which form the majority of revenues of beverage companies, have taken a hit. Moreover, travel restrictions dealt a huge blow to the Travel Retail business. While these channels are gradually opening, the trends are likely to remain soft for the next several months. Additionally, escalation in input costs and higher packaging costs due to a larger proportion of variety packs in the product mix has been a major concern for the industry. These along with higher advertising and promotional expenses as well as increased SG&A costs are weighing on margins. To top it all, the global pandemic and the resulting effect on the global economy are likely to push up costs, which may hurt the margins of alcohol companies.

Zacks Industry Rank Indicates Strong Prospects

The Zacks Beverages – Alcohol industry is a 15-stock group within the broader Zacks Consumer Staples sector. The industry currently carries a Zacks Industry Rank #77. This rank places it at the top 30% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. In the past six months, the industry’s earnings estimate for the current year has declined 6.7%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags S&P 500 and Sector

The Zacks Beverages – Alcohol industry has underperformed the S&P 500 and its own sector over the past year.

While the stocks in this industry have collectively declined 23.3%, the Zacks S&P 500 composite has rallied 16.1% and Zacks Consumer Staples sector has declined 1.9%.

One-Year Price Performance

Beverages – Alcohol Industry’s Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing Consumer Staples stocks, the industry is currently trading at 24.96X compared with the S&P 500’s 22.52X and the sector’s 19.93X.

Over the last five years, the industry has traded as high as 27.51X, as low as 18.78X and at the median of 23.63X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Alcohol Beverages Stocks to Keep a Close Eye on

We have one stock in the Zacks Beverages – Alcohol universe that currently sports a Zacks Rank #1 (Strong Buy) and one stock with a Zacks Rank #2 (Buy). We also highlight three stocks with a Zacks Rank #3 (Hold) from the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s have a look at them.

The Boston Beer Company Inc.: The Zacks Rank #1 craft brewer in the United States is on track to catch up with the latest trend of shifting to non- or low-alcoholic beer category owing to a change in consumer preference. This Boston, MA-based company has been particularly making a fortune in recent times through growth in the hard seltzer, cider, tea and kombucha categories while it significantly lost share of its Samuel Adams lager beer in recent years. Recent growth at the company’s Truly is led by the Truly Hard Lemonade, which is witnessing solid trends with the upside likely to stay. The company expects to continue investing heavily in the Truly brand to enhance the brand’s position in the hard seltzer category as competition stiffens.

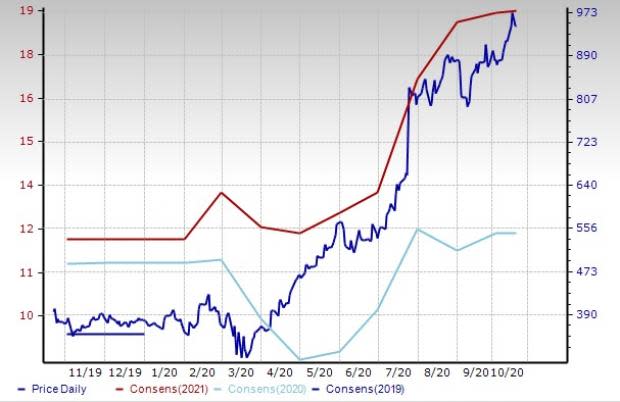

It is optimistic about the new Truly advertising campaign that showcases colors, variety and joy to hard seltzer drinkers through four different commercials. Management foresees increased brand investments in the second half of 2020 compared to the first half and expects accelerated distribution and volume growth for the Truly, Twisted Tea and Dogfish Head brands. The Zacks Consensus Estimate for current financial year earnings has moved up 4.6% in the past 30 days. The stock has declined 139.4% in the past year.

Price and Consensus: SAM

Brown-Forman Corporation: The stock of this Louisville, KY-based leading alcoholic beverages company has risen 18.6% in the past year. The company is capitalizing on the shift in consumption to at-home occasions, with increased investments in the off-premise and e-premise channels as well as accelerated growth in spirits and RTDs. The closure of bars has given rise to a trend of making cocktails and margaritas at home, which is primarily aiding the company’s spirits and tequila portfolios. Additionally, it is aiding the sale of spirits in the off-premise, which is likely to continue.

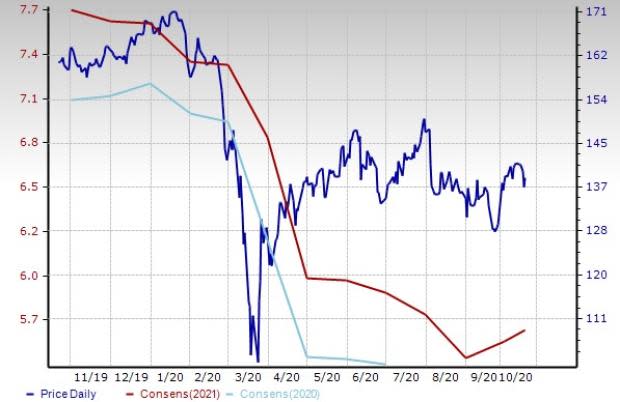

Moreover, there has been increased demand for the company’s ready-to-drink (RTDs) cocktails during the pandemic. This has led to increased sales for its Jack Daniels RTDs globally as well as the tequila-based New Mix RTDs in Mexico. The accelerated demand trends are likely to be a key growth driver for the company in the coming months. The company has reported positive earnings surprise of 8.2%, on average, in the trailing four quarters. The company’s consensus 2020 EPS estimate has moved south by a penny in the past seven days. It carries a Zacks Rank #2.

Price and Consensus: BF.B

Diageo Plc: The largest alcoholic beverage company, based in London, is leaving no stone unturned to adapt to this shift in sales trends by reallocating resources to online channels to compensate for the closure of the on-trade channels. It has been using consumer insights and marketing effectiveness equipment to make prudent investments in the areas of innovation, e-commerce and new opportunities like at-home occasions, including wanting to enjoy bar-quality drinks at home.

The company has inspired consumers with cocktail recipes, new serves and ways to enjoy its brands with food. It also rapidly responded to increased demand for home delivery. In the United States and Latin America, it reached customers with new “cocktail to go” programs. In East Africa, the company explored new ways to get products delivered at consumers’ homes, through partnerships with motorbike delivery companies, known as boda-bodas. The Zacks Rank #3 stock has declined 13.9% in the past year. The Zacks Consensus Estimate for its current-year earnings has declined 0.5% in the past seven days.

Price and Consensus: DEO

Constellation Brands Inc: The consensus fiscal 2021 EPS estimate for this Victor, NY-based company, which is the third-largest beer company and a leading, high-end wine company in the United States, has moved north by 1.7% in the past 30 days. Constellation Brands’ constant focus on brand building and initiatives to include new products bode well. It is anticipated to have benefited from growth in the hard seltzer category as it recently launched the Corona hard seltzer.

Also, it is benefiting from consumers’ shift to e-commerce for buying alcoholic beverages. The digital business has been gaining share through platforms like Instacart, Drizly and other retailer online sites as consumers look for the convenience offered by these channels, which is likely to continue. The company has an expected long-term earnings growth rate of 6.1%. It carries a Zacks Rank #2.

Price and Consensus: STZ

Molson Coors Beverage Company: This Denver, CO-based company is on track to tap the growing demand for health drinks as consumers become health conscious amid the pandemic, through the launch of four innovative non-alcoholic brands. As part of its plan to expand beyond beer, the company plans to launch four innovative non-alcoholic brands from its emerging growth division on the lines of health, wellness and social responsibility, in partnership with L.A. Libations. The first of these brands to be launched is HUZZAH in the seltzer category this fall.

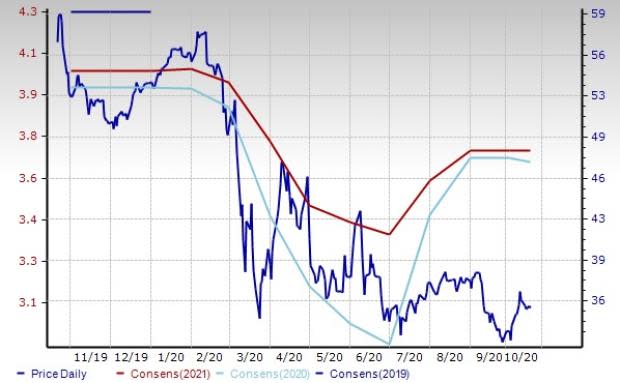

Moreover, it earlier launched non-alcoholic, cannabis-infused beverages through its joint venture with the HEXO Corp., for the Canada and Colorado markets. These launches demonstrate the company’s focus on gaining share in the non-alcoholic beverage space. Additionally, its Vizzy hard seltzer contains anti-oxidant vitamin C, which differentiates it from other sparkling seltzers. Molson Coors currently carries a Zacks Rank #3. The stock has risen 1.2% in the past three months. The company’s consensus 2020 EPS estimate has moved up by a penny in the past seven days. It has an expected long-term earnings growth rate of 6%.

Price and Consensus: TAP

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

AnheuserBusch InBev SANV (BUD) : Free Stock Analysis Report

BrownForman Corporation (BF.B) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research