5 Reasons to Buy TravelCenters of America (TA) Shares

Ohio-based TravelCenters of America TA operates 276 travel centers under the TravelCenters of America, TA, TA Express, Petro Stopping Centers, and Petro brand names in 44 U.S. states and in the Ontario province of Canada; three truck service facilities operated under the TA Truck Service brand name; and one restaurant.

The company has these really huge locations that serve as a one-stop shop mainly for trucking fleets and independent truck drivers, but are equally convenient for local motorists and casual diners. That’s because they offer not only some of the largest parking spaces (under the Reserve-It brand), diesel, gasoline, diesel exhaust fluids (DEF), and maintenance and repair services, but also general merchandise, convenience products, grocery items, snacks, freshly brewed coffee, cold fountain drinks, and gifts and regional souvenirs.

They also house a number of full and quick service restaurants under popular brands like the Iron Skillet, Country Pride, IHOP, Black Bear Diner, Fuddruckers, Bob Evans, Popeye's Chicken & Biscuits, Subway, Burger King, Taco Bell, Pizza Hut, Dunkin' and Starbuck's Coffee.

The location size and breadth of offerings have allowed TravelCenters to build a distinguished brand that is attracting some of the largest fleet owners and the most reputed organizations. Cleveland Clinic for example, has recently entered into a deal for healthy meals for its drivers at the company’s full service restaurants. Known brands gravitating to its locations will help to further build the TravelCenters brand. At the same time, TA also has a special program for small fleets that management says is gathering momentum.

Acquisitions are an important way that any store expands. That is particularly true for the kind of deal TravelCenters offers. The greater the geography it covers, the more it is likely to attract top brands. Additional locations also increase overall footfall and become profit centers for the company. In the first nine months of 2022, TA has acquired five travel centers and two truck service locations and are in talks to acquire several more. It has earmarked $75-120 million a year for the purpose.

TravelCenters also expects to open 30 travel centers a year under the franchisee model (the effect of which should be evident next year, although supply chain and labor issues can play spoilsport). These outlets will not only expand its geographical presence but also significantly improve its profitability while reducing the risk that comes from operation.

The company is a beneficiary of the increase in fuel cost since it sells the thing. While there is some concern about the availability of diesel that would be a hit to volumes, the company seems to be well positioned, having both short and long-term deals that tend to ensure availability. However, a certain amount of uncertainty remains. The offsetting factor could come next year if there is a recession because supply may get closer to demand in that case. In the foreseeable future though, the current dynamics are expected to remain in play, which will be good for pricing and therefore, margins.

TravelCenters has benefited from the great reopening because its restaurants suffered a big blow during the pandemic when most were shut down. It is now in the process of revamping its full service restaurants, especially with respect to technology investments. It is also building AI for fuel pricing, which can then be expanded to include other parts of the business including the stores and restaurants. These investments should help lift the overall performance of the company.

Final Words

TravelCenters obviously doesn’t function in a vacuum. Therefore, it is not immune to the broader uncertainties of inflation, an imminent recession, supply chain issues, input and labor cost issues, etc. However, as explained above, there is reason to believe that it can do better than other players in the segment. Analysts also support this view, as they’ve taken its 2022 estimate up 11.8% in the last 30 days. Similarly, the 2023 estimate is up 13.9%. Although revenue and earnings are expected to decline next year, the upward revision in estimates indicates positive surprises are a possibility.

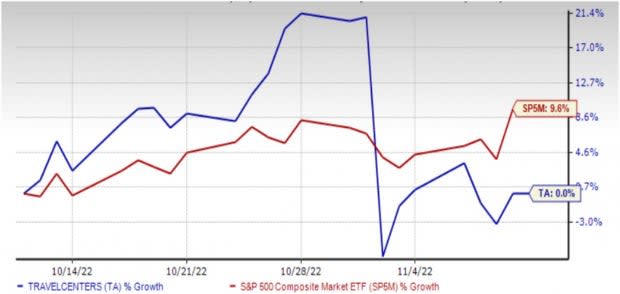

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TravelCenters of America LLC (TA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research